Last Updated on March 19, 2024 by CreditFred

One of the most common questions I get is “Should I get the Chase Sapphire Preferred or Chase Sapphire Reserve?“. In this post, I’ll break down the pros and cons of each.

[referral link] Chase Sapphire Preferred

UPDATE 8/10/2021: Chase has issued a press release confirming updates to both the Preferred and Reserve cards. In short, the annual fees will be staying the same but Chase added/increased earning categories and added additional perks such as the $50 hotel credit for the Preferred.

The Short Answer

Get the Chase Sapphire Preferred. After one year, you can decide whether to upgrade to Reserve, or downgrade to a no annual fee card like Freedom Flex or Freedom Unlimited.

The basic reasoning is that you are paying a $95 fee in exchange for a welcome bonus worth at least $1250 (based on the 100k offer). If you are eligible to apply and don’t yet have the card, or it has been 4 years since you last got your Sapphire bonus, there really isn’t a reason why you shouldn’t get it!

The Detailed Breakdown

Card Features Overview

- Signup bonus: 100,000 Chase UR points after spending $4k in 3 months*

- Annual Fee: $95 (not waived first year, authorized users are free)

Earning Categories:

- 5x – Travel booked through Chase Travel portal

- 5x – Lyft (until March 2025)

- 3x – Dining

- 3x – Select Streaming

- 3x – Online Groceries

- 2x – Travel

- 1x – Everything Else

(NEW) Additionally, there is an a 10% anniversary bonus on your spend. For example, if you spent $25,000 in the last year, you will receive an additional 2,500 points after you renew your card.

Other Benefits:

- $50 Annual Hotel Credit

- (NEW) $60 Instacart statement credit ($15/quarter)

- 6-months complimentary Instacart+ membership

- No foreign transaction fees

- 1:1 transfer to travel partners (see this post for details)

- 25% more redemption value when redeeming for travel or Pay-Yourself-Back

- Doordash DashPass membership (free deliveries for 1 year!)

- Primary Auto Rental Insurance

- Trip Delay/Cancellation Insurance

- Baggage Delay Insurance / Lost Baggage Reimbursement

- Purchase Protection

- Extended Warranty

- (NEW) 6-month Instacart+ membership (works for existing members too!)

Preferred vs. Reserve

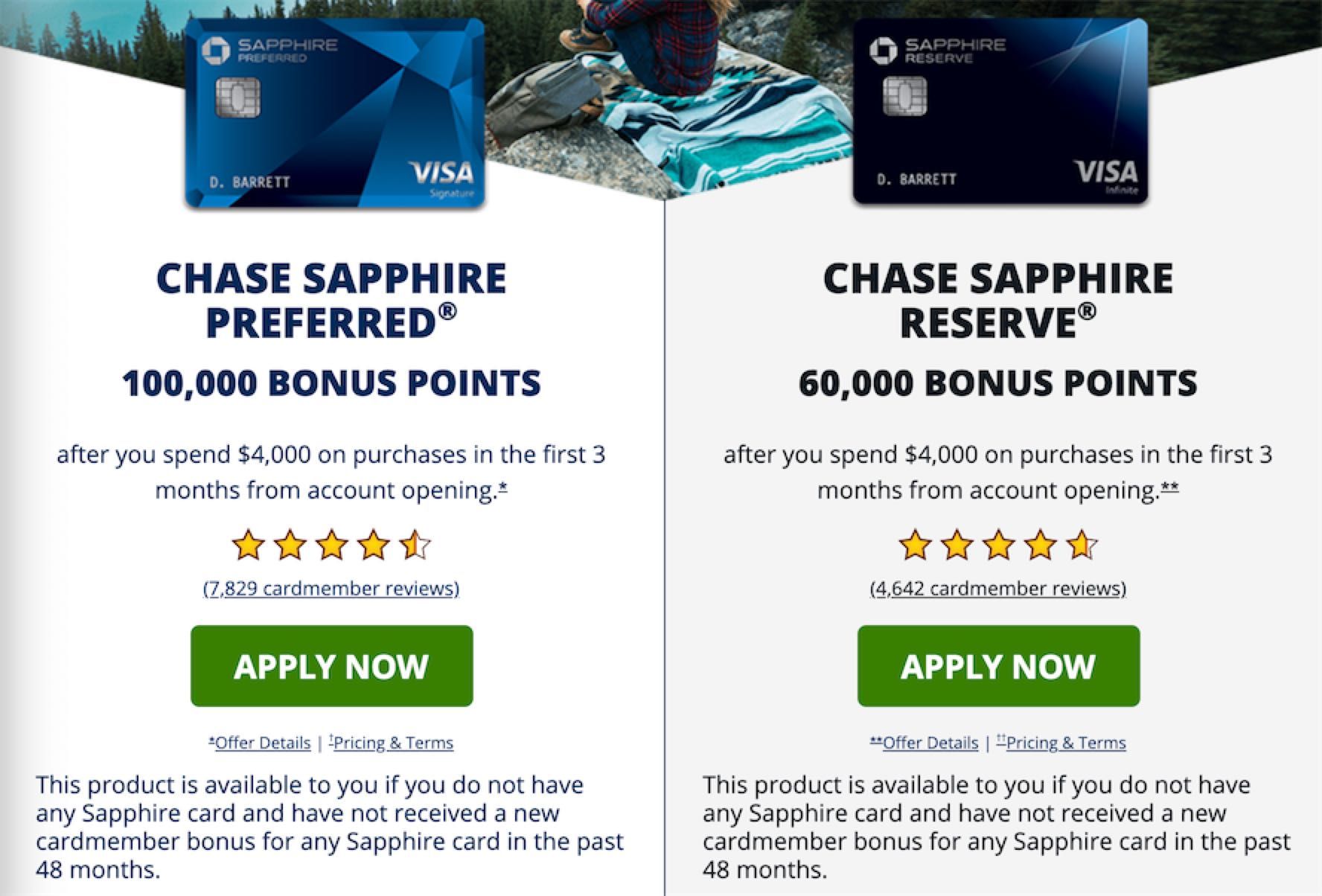

Welcome Bonus: For the same $4000 spend requirement, the Preferred’s 100k bonus* is significantly better than the 60k bonus offered on the Reserve. If you get the Preferred’s 100k bonus* in the first year and upgrade in your second year, the welcome bonus alone will be worth at least $1500, versus the $900 if you went for the Reserve directly. If you’re thinking – “what if I just get both?” – the answer is you can only get one.

Spending Multipliers: The Reserve’s 3x on travel is better than the Preferred’s 2x. However, because of the huge difference in the welcome bonus, one will have to spend an extra $40,000 in these category just to break-even. In your second year, however, the multiplier will be a good factor to consider when deciding whether to upgrade to the Reserve.

Redeeming Your Points: If you plan on transferring to airline/hotel partners like Hyatt or United for award stays and flights, the two cards are equal. They both transfer 1:1 and the Preferred arguably comes out on top since you can add authorized users for free – so you can share the benefits with your loved ones. However, if you plan on redeeming through the Chase Travel Portal, then the Reserve’s 50% bonus is significantly better than the Preferred’s 25% bonus. For example, your 100,000 point balance can be redeemed for $1500 in travel, versus $1250.

Luxury Benefits: The Reserve comes with many additional “perks”, most notably the Priority Pass lounge membership. This allows the primary cardholder access to more than 1100 lounges worldwide, which can come in handy if you travel a lot. Additionally, you also get discounts and status at National, AVIS, and Silvercar. For a limited time, you will also get one year of complimentary Lyft Pink membership. More details about these benefits can be found here.

Purchase Protection and Travel Coverage: Both cards come with important benefits such as Auto Rental Collision Insurance, Trip Cancellation Insurance, Lost/Delayed Baggage Insurance, Extended Warranty Protection, Purchase Protection etc. However, in general, the coverage amount on the Reserve is higher.

Annual Fee: The Preferred has an annual fee of $95, along with the ability to add authorized users for free. This is quickly negated after factoring in the $50 hotel credit + $60 Instacart credit. In comparison, the Reserve has an annual fee of $550 for new cardholders, and each additional authorized user costs $75 (they do get their own Priority Pass membership though!).

For my full review on the Chase Sapphire Reserve, check out this post.

*offers change from time to time, check current offer here.

Am I Eligible?

Chase has several credit card application rules, particularly for the Sapphire cards, so keep these in mind:

- 5/24 rule – if you have opened 5 or more credit card accounts across all issuers (not just with Chase) in the last 2 years, your application will be denied 100%.

- 48 months rule – you are not eligible for new Sapphire bonus if you have received a welcome bonus from the Sapphire Preferred or Reserve in the last 4 years.

- One Sapphire Rule – you cannot have more than one Sapphire card at any one time, so if you currently hold a Sapphire card, you must cancel or downgrade (e.g. to Freedom Flex) before applying for a new Sapphire.

Recommended Strategy

Since the bonus on the Preferred is currently 100k, which is worth at least $1250, vs. the Reserve’s 60k bonus worth ~$900, it makes sense to get the Preferred.

The optimal strategy for those eligible would be to get the Preferred, then after one year, call in to upgrade to the Reserve (since you aren’t eligible for another bonus anyways). This way, you can get the higher signup bonus, and upon upgrade in year 2, will have the ability to redeem those same points at a higher value (50% bonus on Pay-Myself-Back and Chase Travel Portal, so your 100,000 pts are now worth least worth $1500). More details on how to use Chase Ultimate Rewards (UR) points can be found here.

Conclusion

The Preferred is probably the best well-rounded starter travel card I recommend to anyone, especially those just starting out.

Not only does the bonus itself pay for more than a decade of annual fees, but the ability to potentially redeem for much more value in the future makes it a great starting point. Moreover, the incredible travel and shopping protection benefits provide you with an ease of mind when buying high value items like plane tickets or consumer electronics.

For those who don’t want to deal with complicated points and rewards systems, this card covers most food (restaurants, deliveries, cafes, etc.) and travel-related (rideshare, public transit, plane, parking, etc.) expenses. Finally the flexibility of the Chase UR system allows you to easily redeem your points as cash or travel at any time! To accrue even more points, consider my strategy of pooling points across different cards and household members.