Last Updated on March 19, 2024 by CreditFred

The Chase Sapphire Reserve (CSR) is usually not the first card I recommend people, as the Chase Sapphire Preferred currently has a higher signup bonus and can be easily upgraded to the higher tier CSR later on when needed. However, if there is one card that offers the best of simplicity, travel benefits, protection/warranty, and of course rewards, then the CSR is hands down the best well-rounded card. For a full list of benefits, click here.

[referral] Chase Sapphire Reserve

Calculation Assumptions

In this analysis, I will break down how much the CSR saved me this year alone. Keep in mind that I have other cards vying for my spend like the Amex Gold that gives me higher return on certain categories during normal times for dining and groceries, so for someone who only has the CSR, the rewards can be even bigger since you are not spreading across many cards with multiple annual fees.

For this analysis, we will use the minimum that Chase points are worth, at 1.5 cents per point (1.5cpp). For example, 1000 points will be equivalent to $15. In reality, you can redeem for significantly higher returns. I will also not include the initial 50,000 points signup bonus, since this is not the first year holding the card, but note that this bonus alone is worth at least $750.

Cost ($525)

The annual fee increased to $550* in 2020, however, due to the pandemic and other factors, existing cardholders were given a $100 credit which results in an effective annual fee of $450. I also added my dad as an authorized user which gives him access to his own Priority Pass card for unlimited lounge access. The total cost of holding this card for me is $525.

*UPDATE: Looks like Chase is delaying the annual fee increase for 2021 renewals according to recent reports, and some are even getting an additional $150-250 credit for keeping the card.

Earnings ($2870)

In case you want the quick summary, here is a breakdown of the benefits I utilized and how much I personally value them at:

$300 Travel Credit

$25 Global Entry / TSA PreCheck

$60 DoorDash Dining Credit

$500 DoorDash DashPass

$120 Lyft Pink

$1400 Claims

$250 Priority Pass Lounge Access

$150 Car Rental Benefits

$65 Limited Time Offerings

In the next section, I will dive deeper into each specifically.

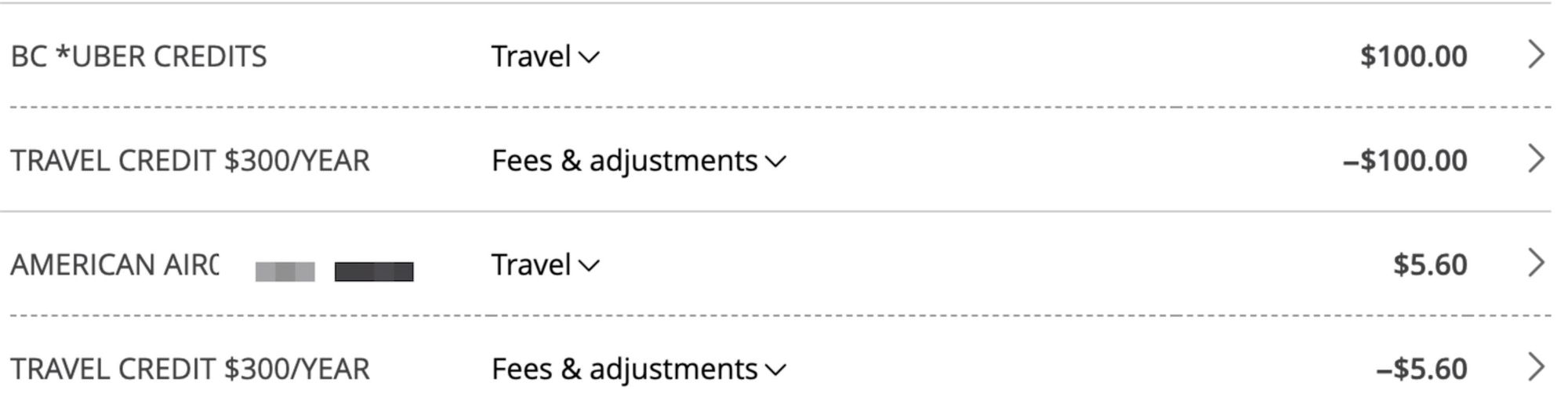

Travel Credit ($300)

This one is super easy to use. Throughout the year, any purchases that are travel-related will automatically credit back. I’d say most people who live in cities and/or travel at least once or twice a year will be able to utilize 100% of the credits. Otherwise, this is definitely not the card for you (it is a travel card after all). Some examples of what qualify:

- Airfare

- Hotels

- Public Transportation (commuter trains, subways, buses, etc.)

- Parking

- Rideshare & Taxis (Lyft, Uber, etc.)

- Airbnb

- Boat/Ferries

*Due to COVID-19, until June 30, 2021, grocery and gas station purchases will also qualify.

We’re currently at:-$525 + $300 = -$225

Global Entry / TSA PreCheck Credit ($25)

The credit is valid for up to $100 reimbursement every 4 years, therefore I’ll assume the per year value of this benefit to be $25. Since Global Entry includes TSA PreCheck, and is only $15 more, always go for Global Entry if you can.

Global Entry members are able to clear immigration using the automated kiosks upon arrival. This benefit is tied to your citizenship, NOT the airline you are flying with, and only available for US Citizens, Permanent Residents, and citizens from participating countries. Personally, Global Entry has saved me a lot of time and made the arrival process into the U.S. much less stressful (I used to wait 45-60 min on arrival to clear immigration). For example, my friend who was on the same flight as me spent over an hour waiting in immigration at Toronto while it took me all but 5 minutes, and I spent the time before my next flight relaxing and eating at The Plaza Premium Lounge YYZ (separate article coming), a Priority Pass lounge (another benefit of the CSR).

TSA PreCheck is an expedited security screening at US airports. Eligible members can use the dedicated PreCheck lanes and no longer need to remove shoes, belts, laptops, etc., saving time and hassle. Note that this benefit is tied to participating airlines, so check with your airline first before flying. As someone who carries a DSLR camera, multiple lenses, two laptops, and a bunch of other gear, it has made clearing security a breeze. I can’t believe I would ever say this, but I actually look forward to clearing security now!

We’re currently at:-$225 + $25 = -$200

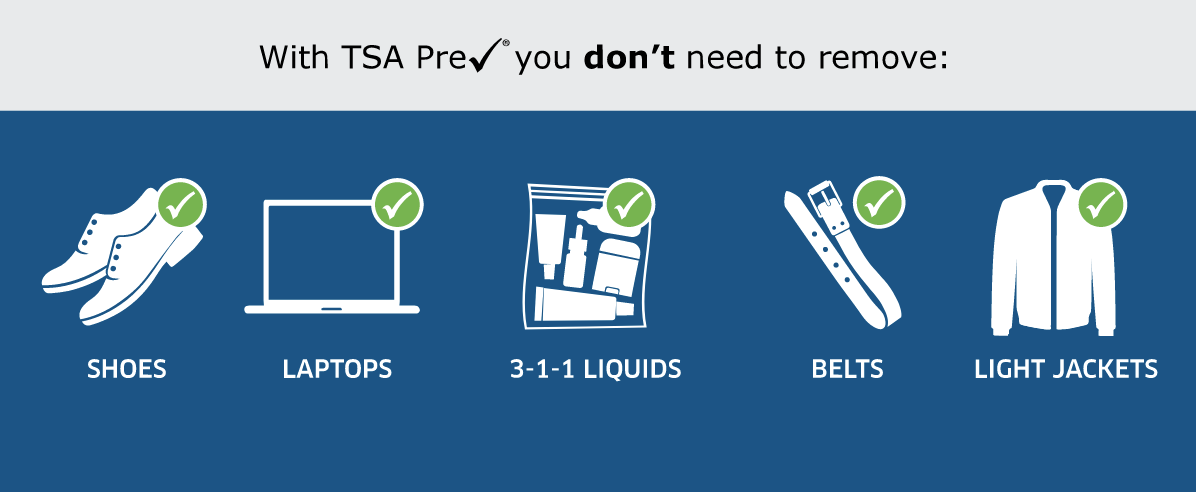

DoorDash Credits ($60)

This one is simple. Purchases on DoorDash’s food delivery app (pickup/delivery) will be reimbursed up to $60/year (so you could potentially get $120 in credits within 1 year of holding the card), but for the purposes of this analysis, I will only count it once. Personally, I utilized this 100% immediately.

We’re currently at:-$225 + $60 = -$165

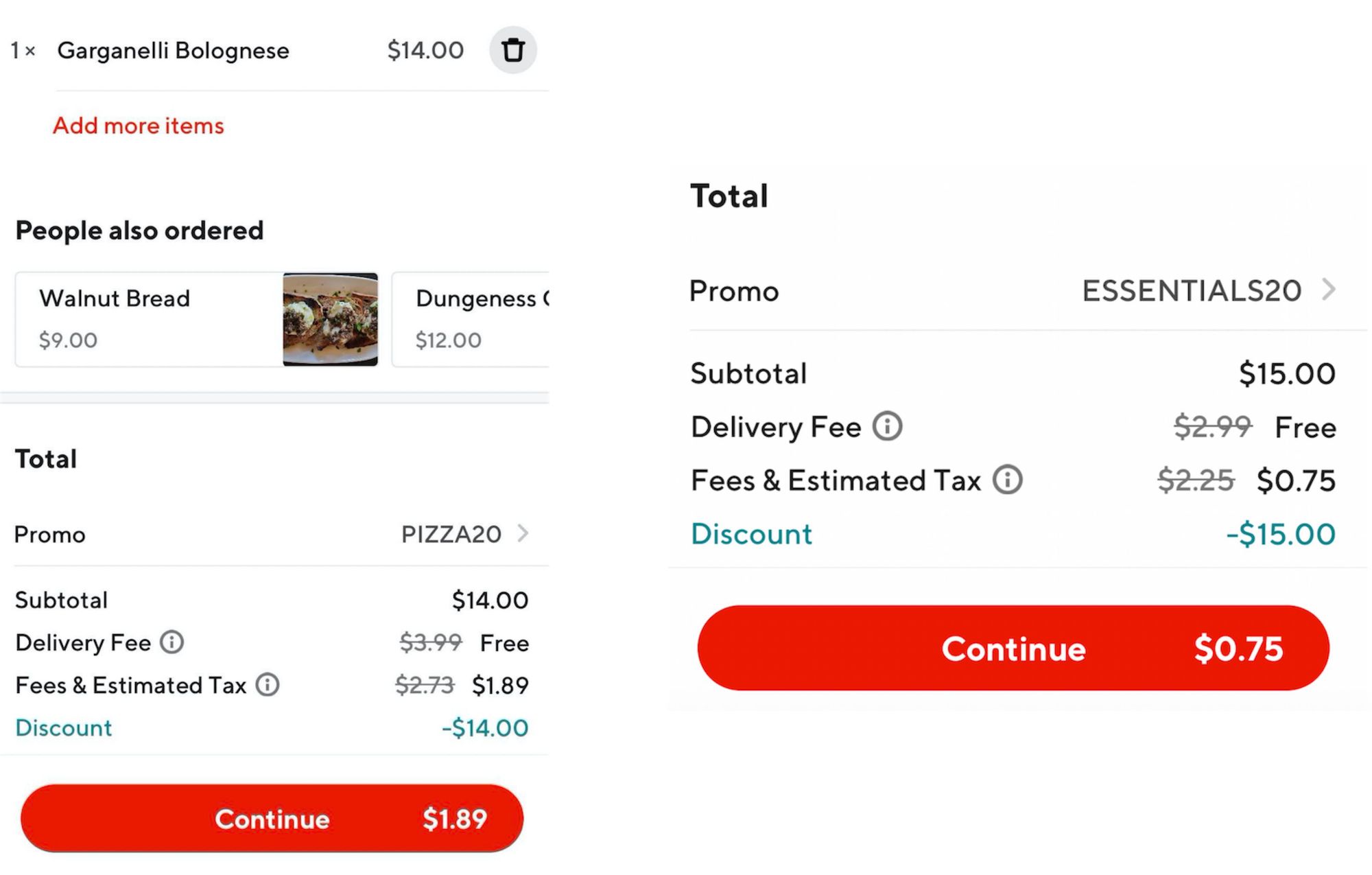

DoorDash DashPass Subscription + Promos (~$500)

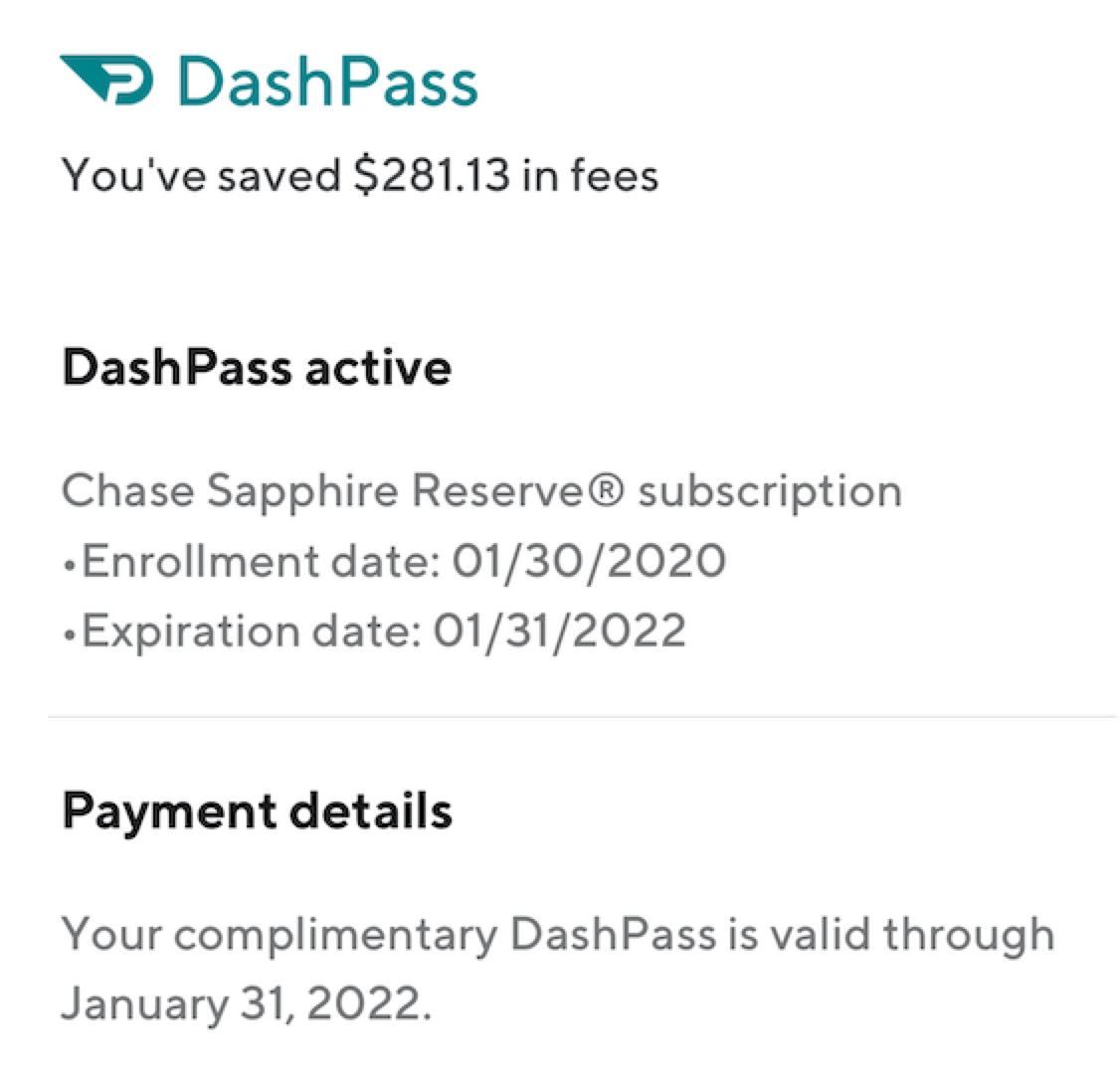

Complimentary access to DashPass, DoorDash’s subscription based delivery service (normally costs ~$9.99/month). Ever since COVID-19, I have not dined at a restaurant, so whenever I feel like eating out, I would order from one of the delivery/pickup apps. If you order at least once or twice a month, this would probably be of value to you. Let me break down the main perks:

Waived Delivery Fees & Reduced Service Fees ($280+) – Not only are deliveries free, but DoorDash also takes a smaller cut in service fees for DashPass members. In other words, the more you order, the more you save in fees. For myself personally, I have saved over $280 in fees using this perk.

Access to seasonal DashPass promotions ($220+) – It’s hard to put a value on this since it varies from time to time. However, given my experience so far, DoorDash has launched countless promotions, especially the Summer of DashPass offer that got me over $100 in free food, though YMMV. In addition, given the fierce competition in the restaurant delivery space, it is not uncommon to see promotions that reduce the cost of ordering by 50%! Personally, I have utilized these promotions countless times and have gained tremendous value from them, so I’d value this at $100 at least. Finally, the 5x back on DoorDash offered earlier this summer earned me over 8000 UR points, which translates to a minimum value of $120.

Overall, I’d say that if you live in urban areas and order deliveries anyways, this is a win for you!

We’re currently at:-$165 + $500 = $335 (PROFIT!!)

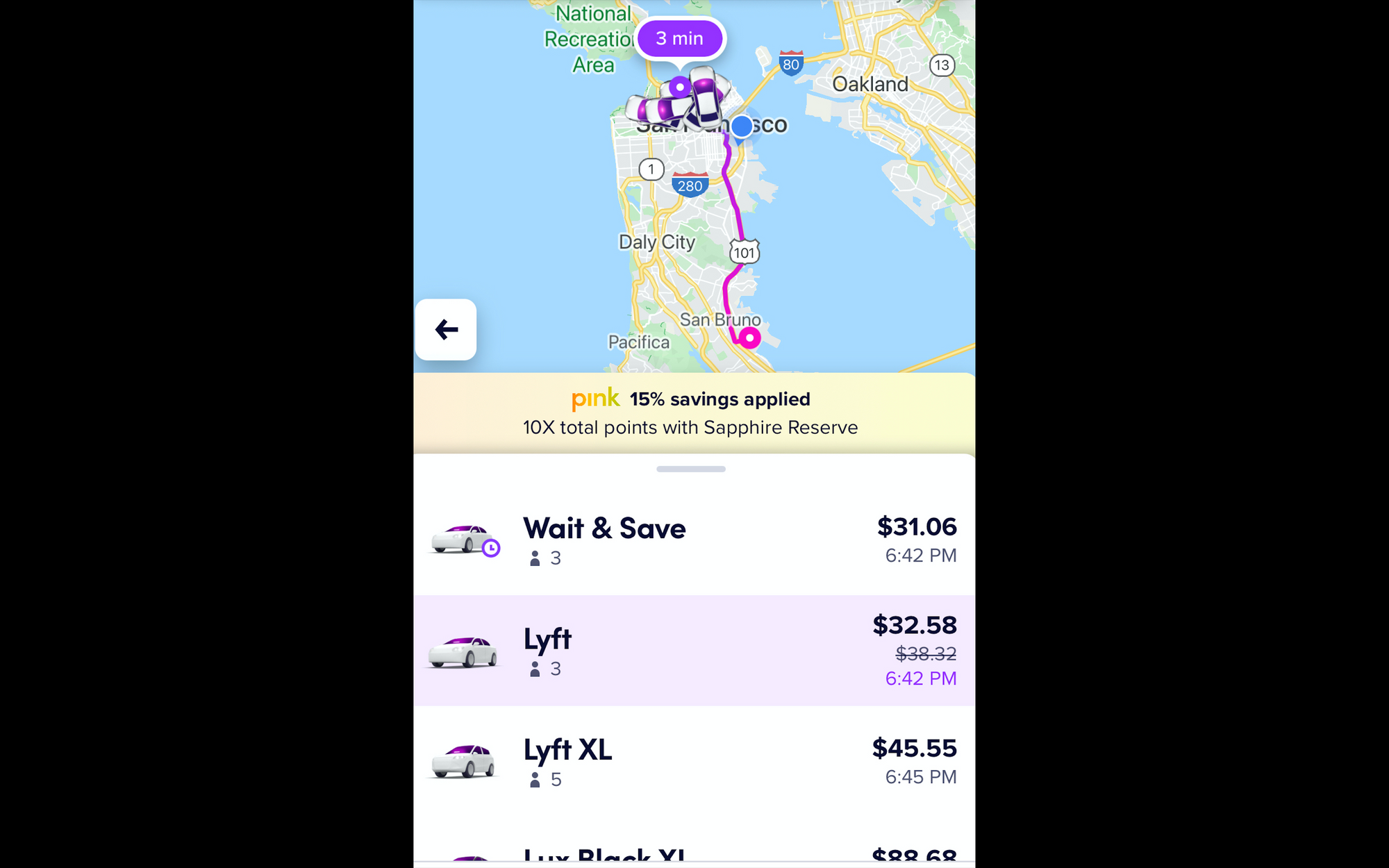

Lyft Pink (~$120)

The CSR also comes with complimentary Lyft Pink (usually $19.99/month) membership, which is Lyft’s premium subscription service, along with 10x back on all Lyft purchases.

In summary, it has the following perks:

- 15% off rides

- 3 free or discounted bike/scooter rides

- Complimentary Grubhub+ membership (usually $9.99/month)

- Relaxed cancellations

- SIXT car upgrades

- Priority airport pickups

- Waived lost and found fees

15% Off Rides (~$60 value)

Overall, I found the 15% off perk to be incredibly useful though I have largely avoided rideshare since the pandemic started. Even taking that into account, I saved over $30 along with an additional 1,800 pts earned, worth at least $30.

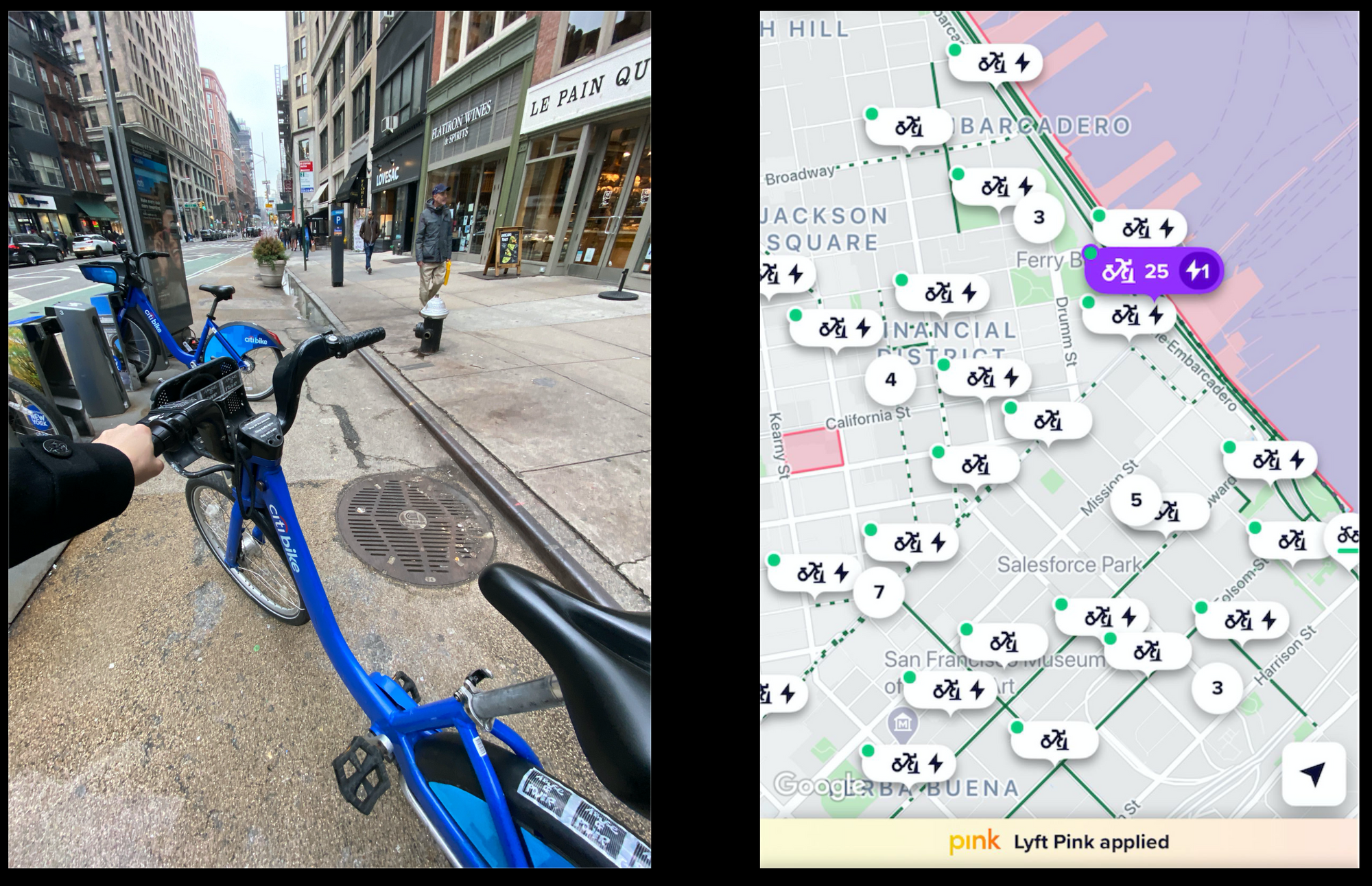

3 Free or Discounted Bike/Scooter Rides (~$30 value)

I used to live in Philadelphia which did not have access to Lyft bikes/scooters, so the 3 free rides benefit went largely unused. However, the few times I made day trips to New York, it gave me an alternative to use CitiBike for free, a nice alternative to walking or taking the subway. Now that I have moved to San Francisco where Lyft bikes are everywhere, the free rides allow me to use this perk for the occasional errand, or when I return my rental car and need to get back to my apartment. I value the free rides at about $6/month, although it went mostly unused for about half of the year, so I would estimate its total annual value at closer to $30 for me, although YMMV greatly depending on your geographic location and lifestyle.

Free Grubhub+ Membership (~$30 value)

The food delivery landscape is extremely competitive. I now have complimentary Doordash DashPass from CSR (with also includes free deliveries on Caviar, since they are now owned by Doordash), UberEats Pass from Amex Gold, and now Grubhub+ from Lyft Pink. I’d say given all the options I have, this perk is only marginally useful for me, but it does open the opportunity to order with reduced fees when promos are available (and they come quite often these days). I’d value it at $30 for the year, although it may be more valuable if you use Grubhub more.

Other Benefits

I haven’t used other benefits like waived ride cancellation fees and didn’t really notice any difference in pickup time at airports with the priority pickup benefit, given that traffic was light both times. Perks like waived lost & found fees may come in handy in the rare circumstance it does occur though. Altogether, I would not factor in additional value for these benefits.

We’re currently at:$335 + $120 = $455

Claims Reimbursements ($1400)

The best (and often overlooked) perks of premium travel credit cards are the automatic insurance coverages you get, such as these:

- Trip Cancellation / Trip Interruption Insurance

- Auto Rental Collision Damage Waiver

- Baggage Delay/Lost Insurance

- Trip Delay Insurance

- Roadside Assistance

- Purchase Protection

- Extended Warranty

- and much more…

I unfortunately experienced issues with my MacBook Pro (which I purchased with my CSR) and delayed baggage from American Airlines this year. For both incidents, I filed claims and was successfully reimbursed for the trouble.

Extended Warranty (~$1300)

I bought my MacBook Pro in 2018 and had been experiencing a series of issues such as random shutdowns, performance lags, etc. I was already officially out of the 1-year AppleCare warranty, and after diagnosing the issue at the Apple Store, they told me since I don’t have any apparent hardware malfunctions, the only solution would be to purchase a new machine. However, after speaking with an agent from the Chase EClaims Hotline, I was able to get my hardware examined at an approved repair center and given a quote on repair. In the end, I was reimbursed ~$1300 (I had purchased the MacBook Pro almost 2 years ago for $1800). This is probably one of the most insane perks, as even Apple’s own $269 AppleCare plan would not have covered my issue. In short, always put your important and high-value purchases on premium cards like the CSR. It’ll pay off in the long run! For more specifics on how I got the reimbursement, check out this post.

Baggage Delay Reimbursement (~$100)

I moved from Philadelphia to San Francisco for my new job this summer. Due to COVID precautions and insane reward rates, we decided to book AA’s domestic first class (more on that in a separate article!) for only 21k AAdvantage miles each (they usually go for 50k pp). With domestic first, my girlfriend and I were able to check in 2 pieces of luggage each, with a per piece weight ceiling of up to 70 lbs / 30kg. Unfortunately, when we arrived, we were told that our luggage (with all our moving necessities!) did not make it on the flight and that the earliest it would arrive would be the next day (sigh… American Airlines). Given that we were moving to an empty apartment and all our necessities were packed in our suitcases, we needed to go out and buy essentials. Luckily, I knew about the Baggage Delay Reimbursement benefit that comes included if any portion of the fare was paid using my CSR (I paid taxes with it), and that whatever amount American Airlines did not reimburse me, I would be covered by Chase. In the end, after AA’s reimbursements, Chase reimbursed me for the remaining ~$100.

For more details on the reimbursement process, check out this post.

We’re currently at:$455 + $1400 = $1855

Priority Pass Lounge Access (~$250)

The CSR comes with complimentary Priority Pass Select membership which grants you free, unlimited access to over 1300+ lounges worldwide, along with the ability to bring 2 guests for free. Without a membership, a single pass can cost $32/person, although I would probably not value it at that if paying out-of-pocket myself. For this analysis, I will use an assumption of $15/visit, which is a reasonable amount to spend to get something like a sandwich and coffee at an airport.

Prior to the pandemic, I was fortunate enough to travel multiple times a year, mostly international, so was able to utilize these benefits. This is also extremely useful before/after a domestic flight since food on-board is usually not free (or good). For long layovers, this can also be a nice escape from the bustling and chaotic terminal area, and you can use this time to grab some free food, freshen up (or take a shower!), and get work done in a more comfortable setting. You can get all these benefits even when flying economy! As my dad travels quite often, it is the primary reason I got him the authorized user card.

Just this year alone (prior to the pandemic), I utilized Priority Pass over 10 times, including at (individual lounge experience articles coming soon!):

- PHL – Minutes Suites

- SFO – Virgin Atlantic

- TPE – Plaza Premium Lounge

- PEK – Air China First Class Lounge

- NRT – Korean Airlines Lounge

- IAH – Landry’s Seafood (Restaurant)

- IAH – KLM Crown Lounge

Furthermore, my parents have utilized these more than a dozen times, which easily pays for the additional card.

We’re currently at:$1855 + $250 = $2105

Rental Car Benefits (~$150)

CSR comes with complimentary rental car privileges, including elite status and discounts. Here is the summary:

- National/Enterprise – Complimentary Executive Level membership and up to 25% off rentals

- AVIS – Avis Preferred, up to 30% off

- Silvercar – 30% off rentals

Personally, I have used Silvercar the most. It is an all-Audi rental service (the company has since been fully acquired by Audi). When first launched, it offered insane discounts that I took advantage of, but lately, the prices have returned to normal and they just closed down all their airport locations. Since I did not utilize Silvercar this year, I’ll be valuing this perk at $0. I’ll also be writing a separate, in-depth review regarding my Silvercar rental experiences, though in general the prices are higher (pre-discount) than other alternatives. On the flip side, you do get guaranteed car type, excellent customer service, and decked out interiors. Stay tuned for the full review!

I’ve also used National/Enterprise a couple of times this year. I don’t think the Emerald Executive perks made any difference but have noticed that I generally get better rates and earn free days much faster. I’ll value this at a $50 savings given my rentals this year.

Furthermore, you can easily save $11-35/day by choosing to decline the Collision Damage Insurance as this is covered by your CSR. I have personally saved ~$100 this year alone by declining Loss Damage. However, make sure to check the specific terms and conditions to make sure it applies!

We’re currently at:$2105 + $150 = $2255

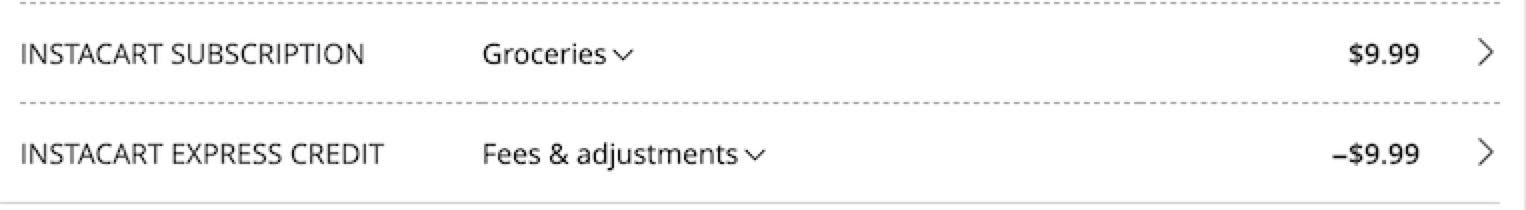

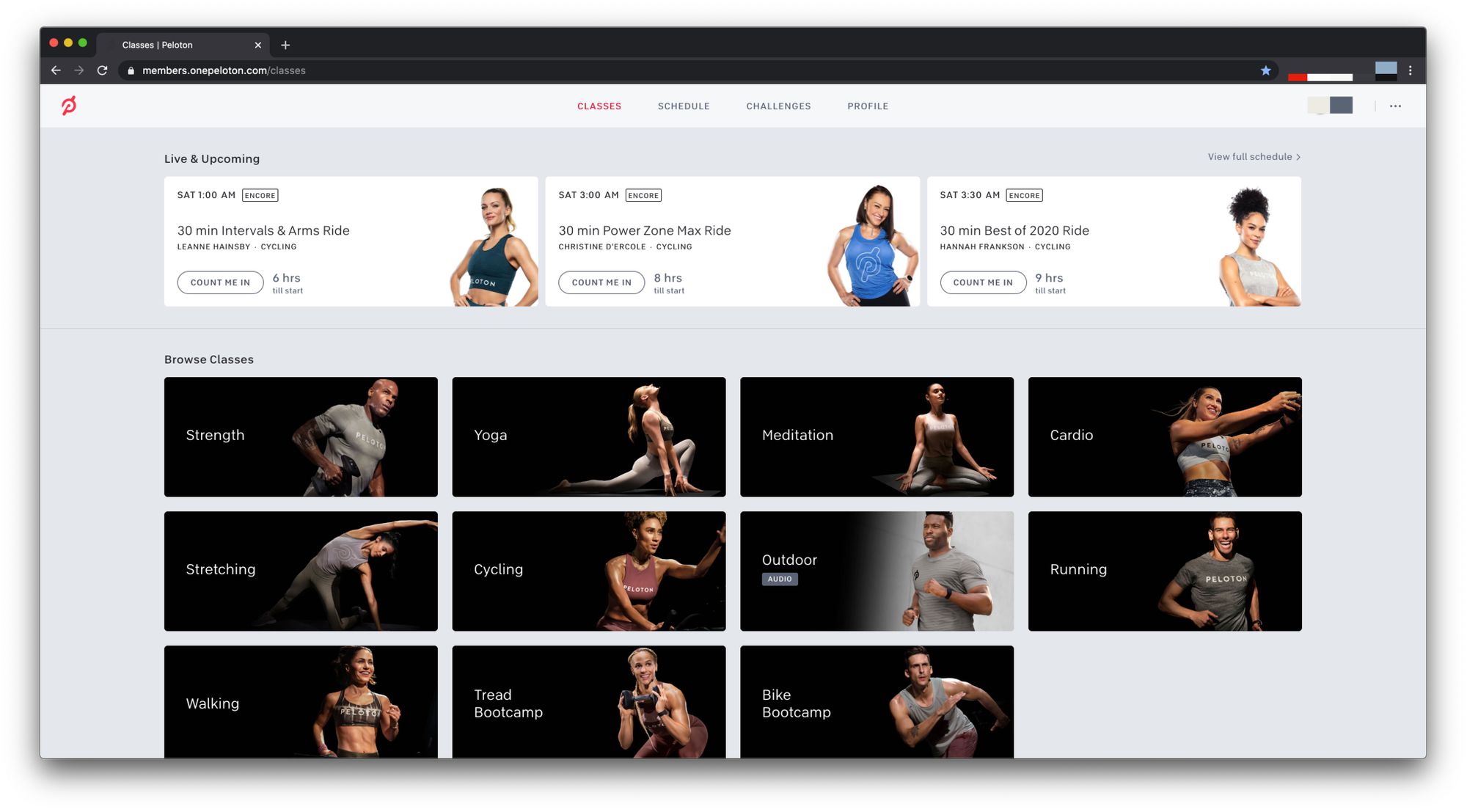

Limited Time Offerings (~$65)

Given this has been a crazy year, Chase (and other banks) have gotten creative to allow us to continue getting outsized value for premium cards like the CSR. Here are a few examples and how much of it I utilized:

- $50/$50 – Instacart Membership credit

- $0/$120 – Peloton Fitness Subscription credit (UPDATE: I tried out their digital subscription, highly recommend but I won’t include it in the value calculation since I’m not sure if I would personally pay for this if it weren’t for the credits)

- $0 – 5x on Gas

- $15 – 10x on Streaming Services (including Apple App Store purchases)

We’re currently at:$2255 + $65 = $2320

Misc. Benefits

Keep in mind that I’ve tried my best to only calculate benefits that I feel generated enough concrete value to discuss, and this does not even account for the massive 50k signup bonus during the first year of holding the card. There are so many other benefits that are core to why this card is a no-brainer for me, such as these:

- 3x on Travel & Dining worldwide

- 10 Airline and Hotel Transfer Partners such as Hyatt, United (to other Star Alliance), Emirates, Virgin, etc..

- Shop Through Chase (cashback portal, article coming!)

- Pay Yourself Back (cash out at 1cpp, article coming soon!)

- Purchase Protection and other automatic safeguards that give me peace of mind when making big purchases like camera equipment, laptops, bikes, etc.

Personally, I feel like Chase has been on top of its game in continuing to make the CSR incredibly valuable even when there is not much demand for travel. The new Pay Yourself Back feature allows me the flexibility to essentially cash out my points at 1.5cpp, which I did using ~120,000 UR points for about $1800 (which I then put into stocks :P). Although I value Chase UR and Amex MR points to be about the same, the flexibility of Chase’s system and ease of liquidating my points into cash when needed make Chase Ultimate Rewards the best program to recommend for beginners to advanced credit carders alike!

Summary

Based on my purchase and travel behavior, the CSR is an insanely great card that provided me with tremendous value, even when travel is more or less non-existent given the pandemic. After subtracting the annual fee, we are left with $2320 in profits, and that is even before factoring points I earned for my regular card spend.

However, given that many benefits I outlined are somewhat not useful for the foreseeable future, I would recommend those that already have this card to review their spending pattern and lifestyle to decide if the CSR is worth keeping and for those interested in applying for the CSR to consider the Chase Sapphire Preferred. The $95 annual fee makes it a very affordable travel card, offering much of the same protections on purchases and travel like the Reserve but at slightly lower amounts. Furthermore, since you can only get one of the Sapphires, I recommend going for the Preferred to get the higher 60,000 UR point signup bonus and then evaluate whether to upgrade during your second year of card membership.