Last Updated on March 5, 2024 by CreditFred

UPDATE 8/14/2022: The information provided may not be accurate as the article is no longer being maintained.

This is probably not a good time to have large amounts of cash sitting in your bank account uninvested, as I discussed in this article. However, it is a good idea to keep some of your money liquid as emergency cash or if you have some large upcoming expenses (property purchase, education, medical bill etc.) and don’t want to risk it in stocks or other investments. In this case, your best alternative is to put it into a high yield savings account.

Background

Since the global economy was largely shut down due to COVID-19, the U.S. Federal Reserve has responded with aggressive quantitative easing to increase the money supply and encourage investments. This has led the stock market to record highs and will eventually result in a higher rate of inflation.

The Problem

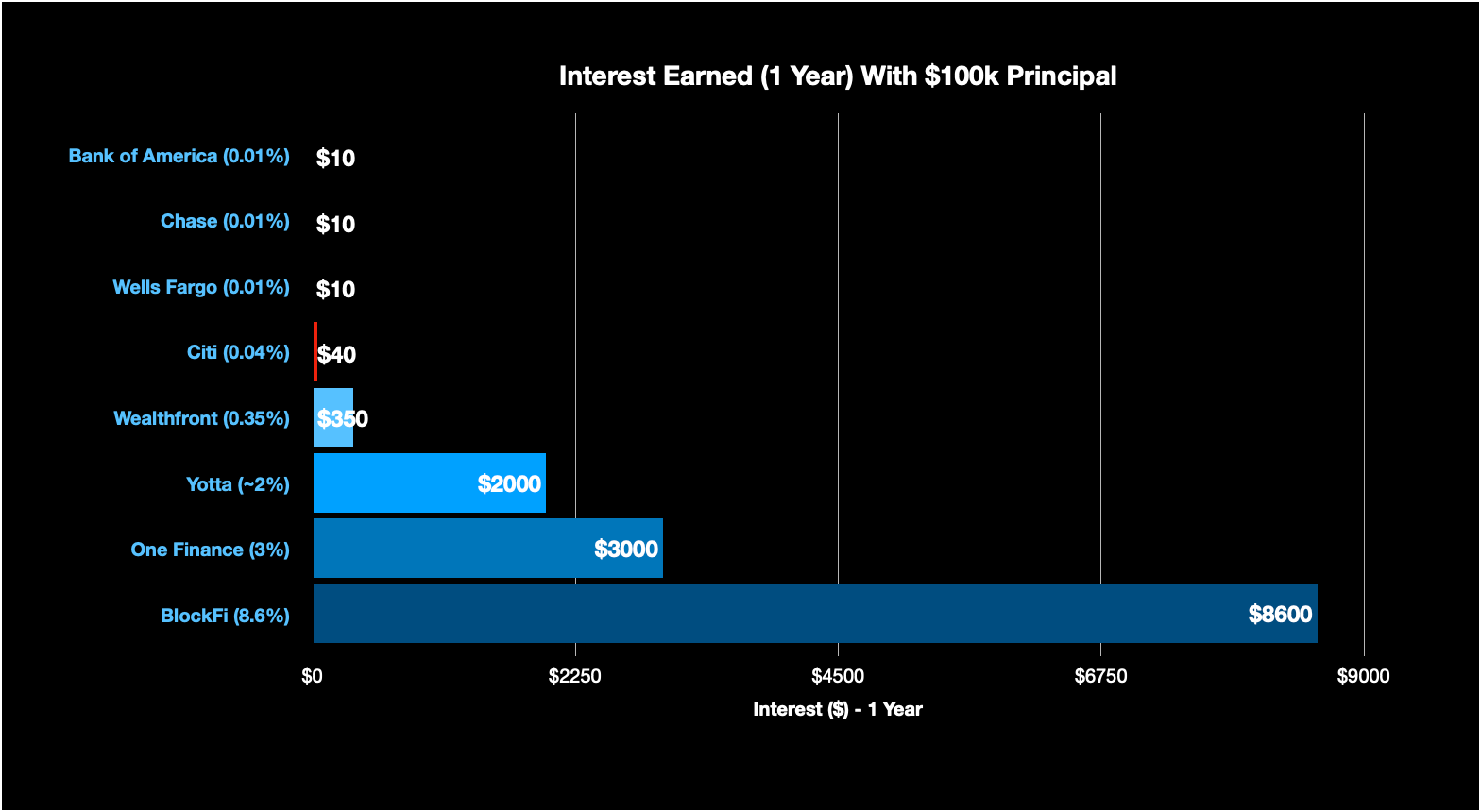

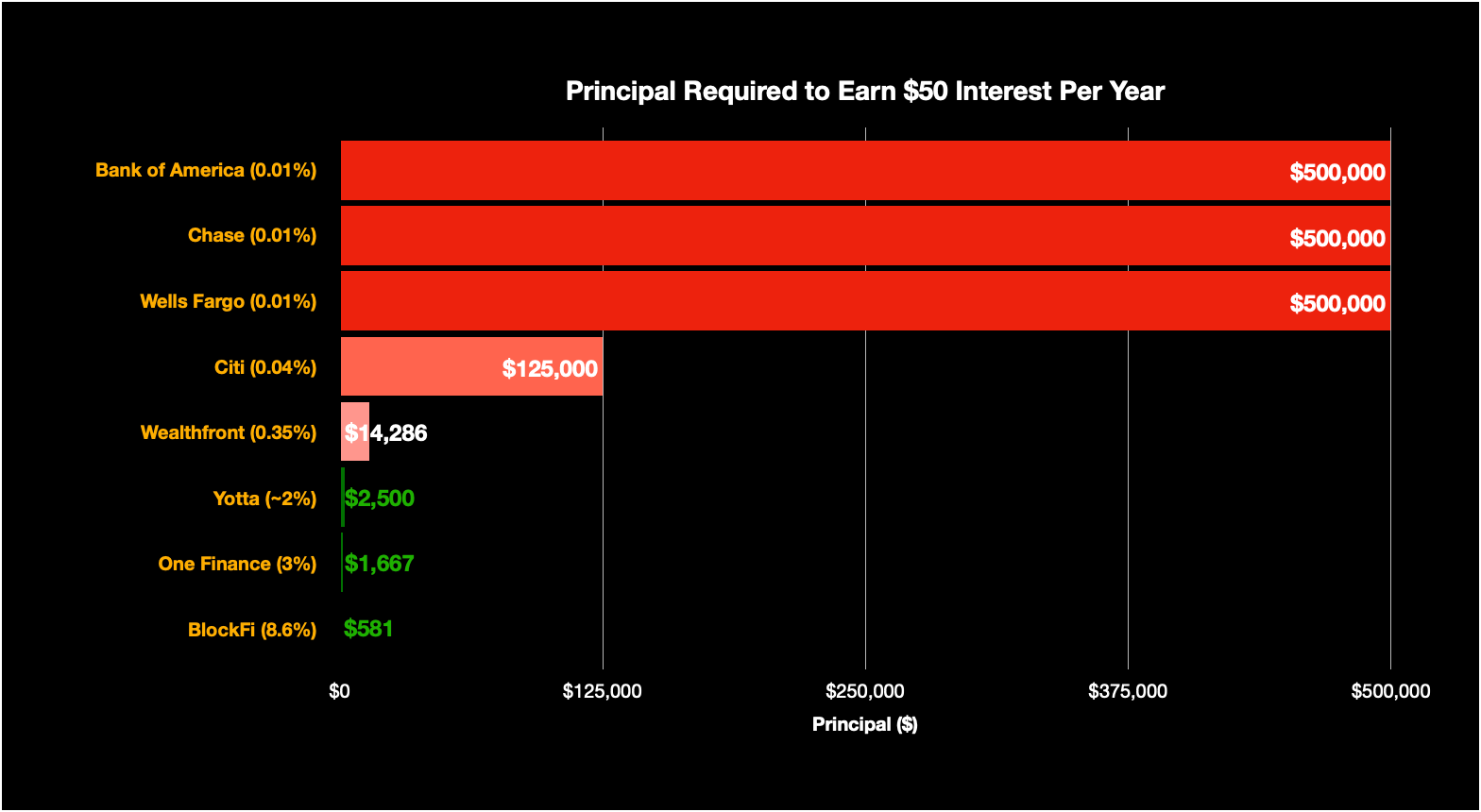

Truth is, most mainstream banks offer REALLY BAD interest rates even if your money is in their so-called “high-yield” savings accounts. By storing your money in the big banks, you are essentially leaving money on the table. Here are some rates that they offer:

Bank of America – 0.01% (standard) ~ 0.05% APY (Platinum, their top tier)*

Citi – 0.04% (basic) ~ 0.15% (CitiGold)*

Chase – 0.01% APY*

Wells Fargo – 0.01% APY*

*Note that interest rates could change at any time. Rates are accurate as of 01/16/2021. Do your own research before making any financial decisions.

I created two illustrations to hopefully simplify this idea:

The Solution

Below are 3 high-yield savings accounts that I use to keep my uninvested money / emergency funds:

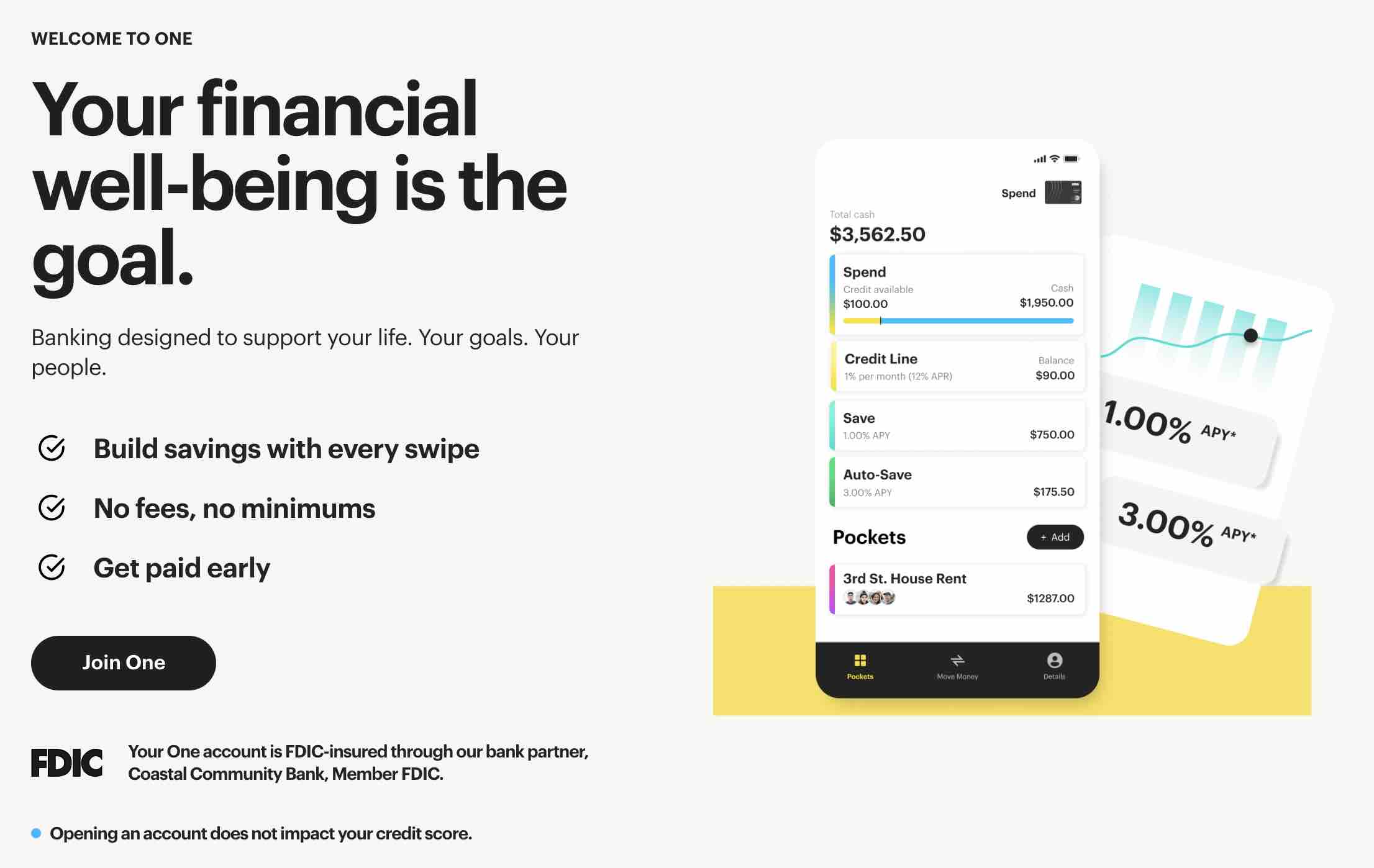

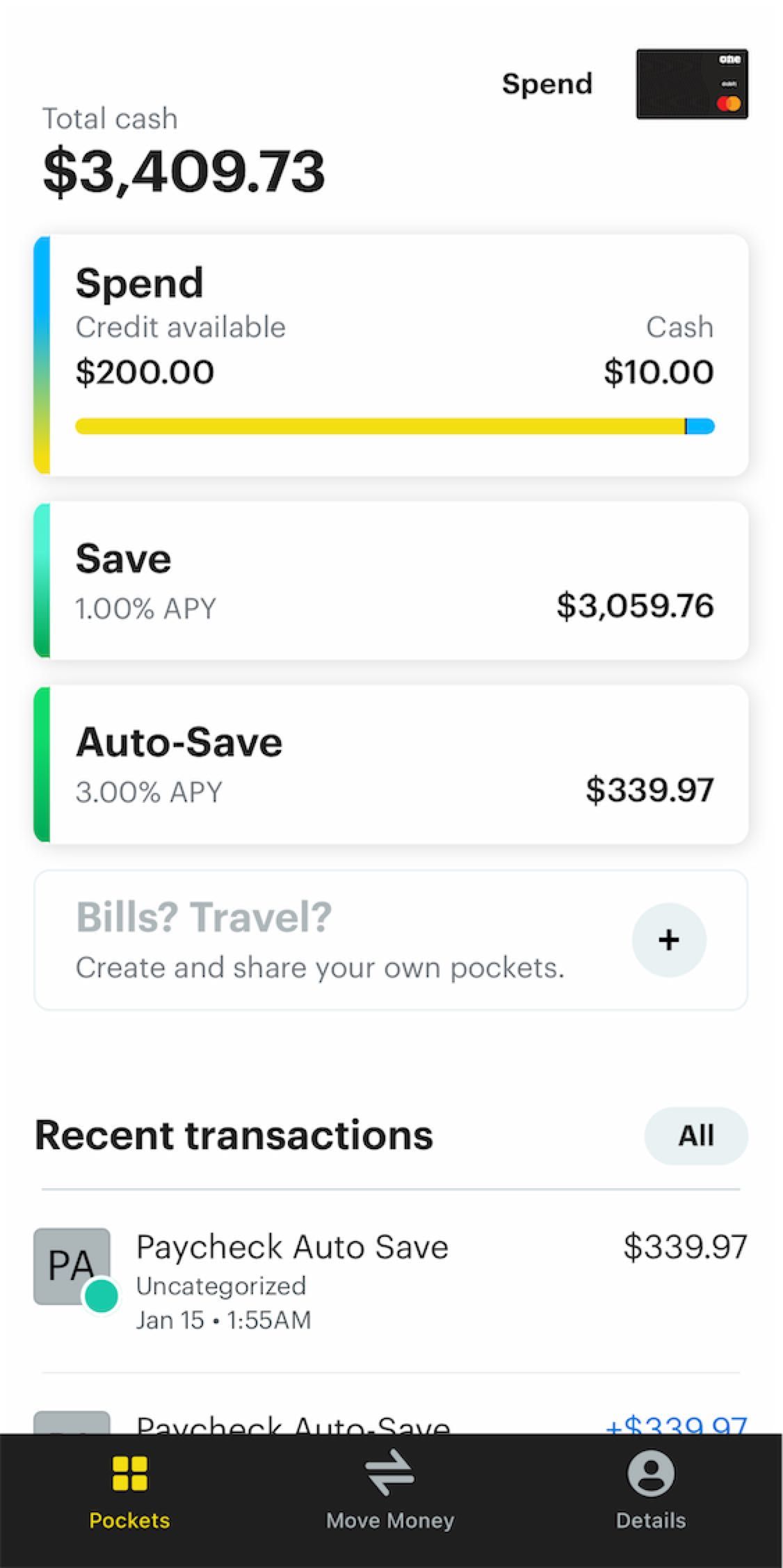

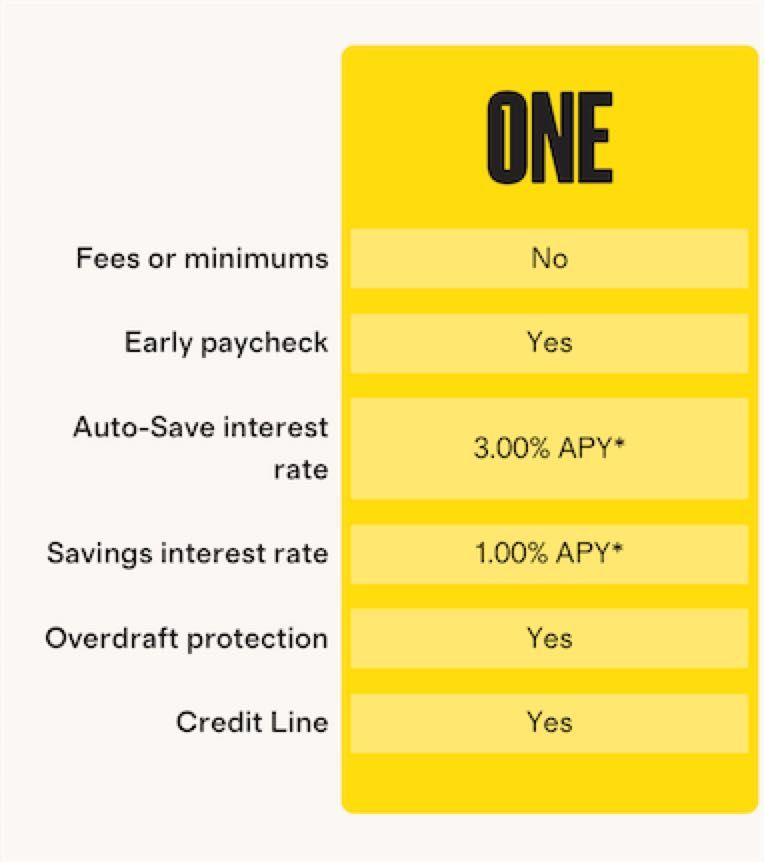

1. One Finance (1.00% – 3.00% APY)

This savings account earns a base rate of 1.00% APY. However, using the Auto-Save feature, you can earn up to 3.00% APY!

Personal Strategy & Experiences:

When you set up direct deposit into One Finance, you can allocate up to 10% of your paycheck to go into the 3% APY Auto-Save account, up to $1000/mo. As your Auto-Save balance grows, so will your interest! I really like this as it encourages you to save at least 10% of your paycheck in your high interest account, since money that is withdrawn from the 3% APY account cannot be put back in. However, if you do find yourself in the event of needing to withdraw, all funds can be withdrawn immediately and there are never penalties or fees.

UPDATE 2/17/2021: One of my paychecks didn’t automatically go to Auto-Save account, so I reached out to Support. They were very responsive and took care of the issue quickly. After a couple months using the app I am really beginning to love it! Great UI, customer service, and of course, their interest rates!

Other Benefits

- $50 Sign-up bonus (see below)!

- FDIC-insured up to $250k

- No fees, no minimums

- Get paid early

- Great mobile app!

- Fee-free access to 55,000 Allpoint ATMs

- Credit Builder – automatically build credit history when you

Pro-Tip: When setting up direct deposit, remember to use the account info from the “Save” account!

Additionally, they recently came out with a new feature that allows everyone to monitor their credit score and see what factors are impacting them. Those with thinner credit profiles can even build credit history by making on-time payments using their existing One Finance debit card!

[referral] Sign up using my link to get $50 after your first qualifying direct deposit of $250 or more! (terms)

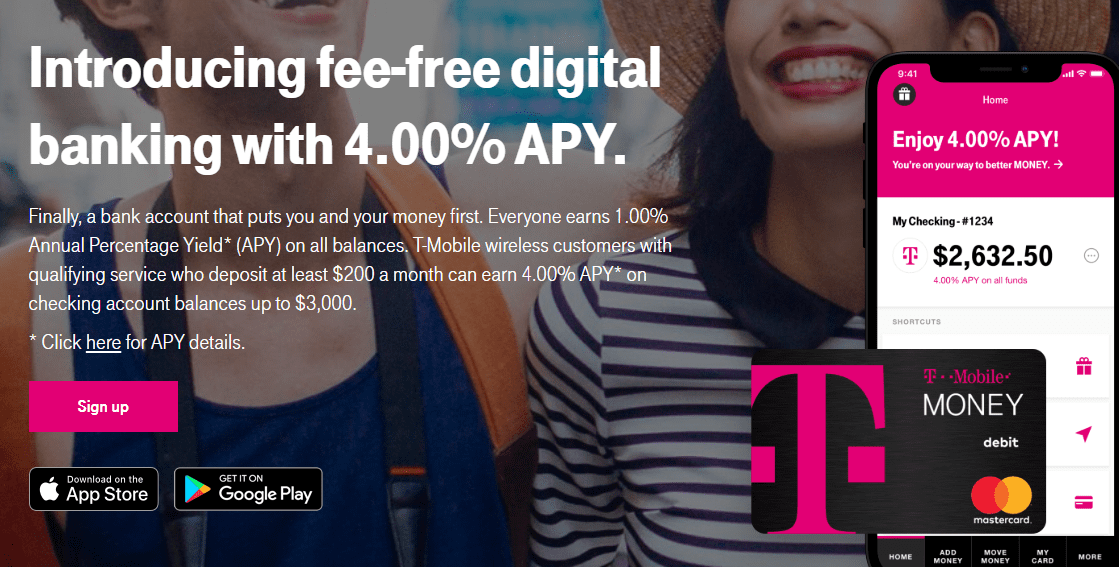

2. T-Mobile Money (1.00% – 4.00% APY)

UPDATE 2/19/2021: T-Mobile announced today that starting 3/31, customers will have to make 10 debit card transactions per month to qualify for 4% APY. IMO this is more restrictive than the previous $200/month deposit requirement, so I will be removing this from my top savings accounts.

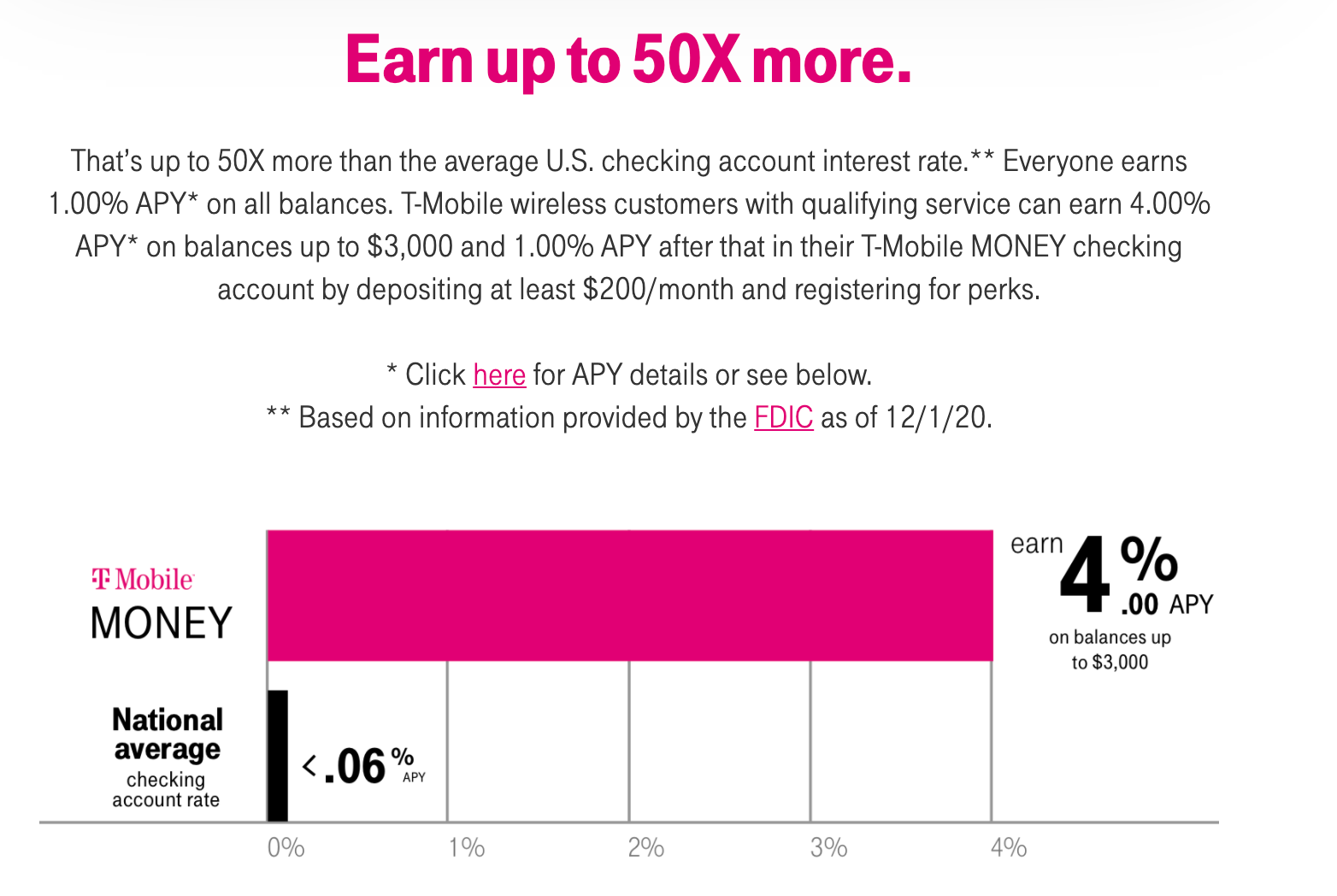

Savings account by T-Mobile. In short, everyone (including non T-Mobile customers) earn 1.00% APY on all balances. If you are a T-Mobile wireless customer with a qualifying service, you can earn 4.00% APY on balances up to $3,000, and 1.00% APY on balances above that threshold.

Personal Strategy & Experience:

I ensure I have $3000 in the account to earn the amazing 4.00% APY. This equates to $10/month in interest, so it’s an easy $120/year simply by having the money in the account. Overall it is a no-brainer because, unlike Yotta, this 4% APY is completely guaranteed. Therefore at the very least, T-Mobile customers should have $3,000 saved in this account.

Other Benefits:

- FDIC-insured

- No account fees

- No ATM fees at over 55k locations

- Get paid up to 2 days early with payroll direct deposit

- Withdraw your money any time

Note: You need to deposit at least $200/month to earn the higher interest rate. You can either do something like transfer $200 out and then back in to qualify or set up direct deposit from your paycheck into the account directly every pay period.

More Info (Official Site): t-mobilemoney.com

2. BlockFi (8.6% APY!)

UPDATE 2/14/2022: U.S. clients are no longer able to sign up for or transfer funds to the BlockFi Interest Account (Official Press Release).

This is technically a crypto-savings account. For more in-depth analysis into pros and cons of BlockFi, see my analysis here.

What makes this a potentially great savings account is you can transfer your money into GUSD stablecoin (which means its value is pegged to the USD 1:1) and earn a whopping 8.60% APY on your savings without the risk of massive fluctuation seen in other cryptocurrencies like Bitcoin!

That being said, be aware that even though the GUSD follows the value of the dollar, it is technically still digital currency and thus not legal tender and is not FDIC insured! As far as crypto platforms go though, it is backed by prominent investors and funds are kept in Gemini Trust for safekeeping (see more details here).

Personal Strategy:

Since the interest rates are so rewarding and the platform in my opinion (please do your own research!) relatively safe for my risk tolerance, I personally will be keeping a sizable but still small percentage of my savings with BlockFi. As an example, this is approximately how much you could earn at BlockFi in one year:

$10,000 * 0.086 = $860

[Referral link or use code 2ecdf12b] Deposit $100 or more into your BlockFi interest account and earn $10 in Bitcoin! Note: You will need to hold your initial deposit for at least 30 days. Referral payments are made on the 15th of every month following fulfillment of a 30-day holding period.

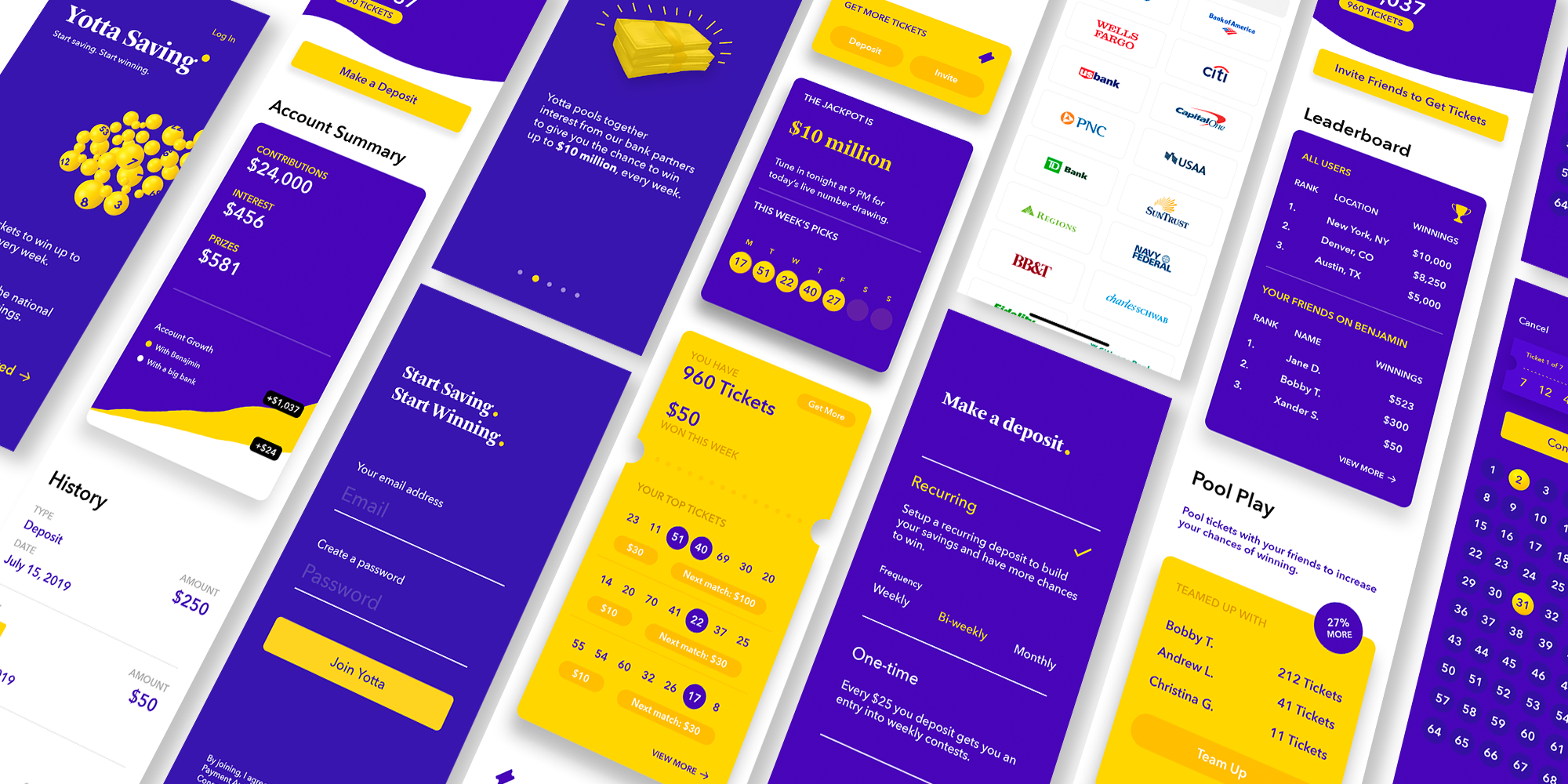

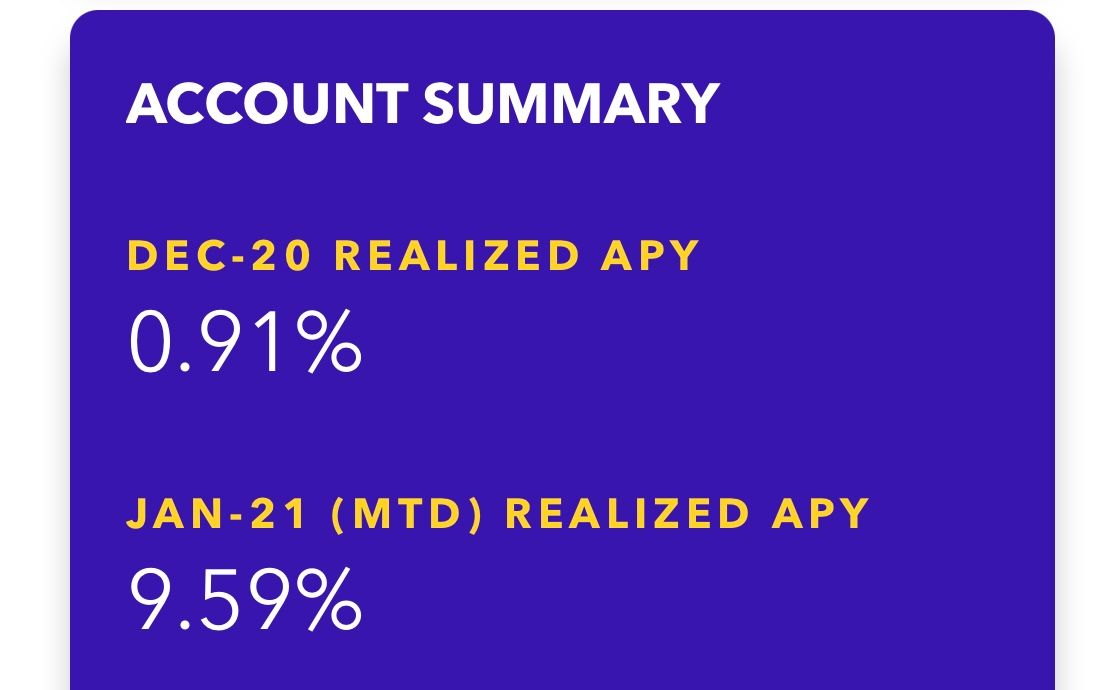

3. Yotta Savings (0.20% + prize = ~1.00-4.00% APY)

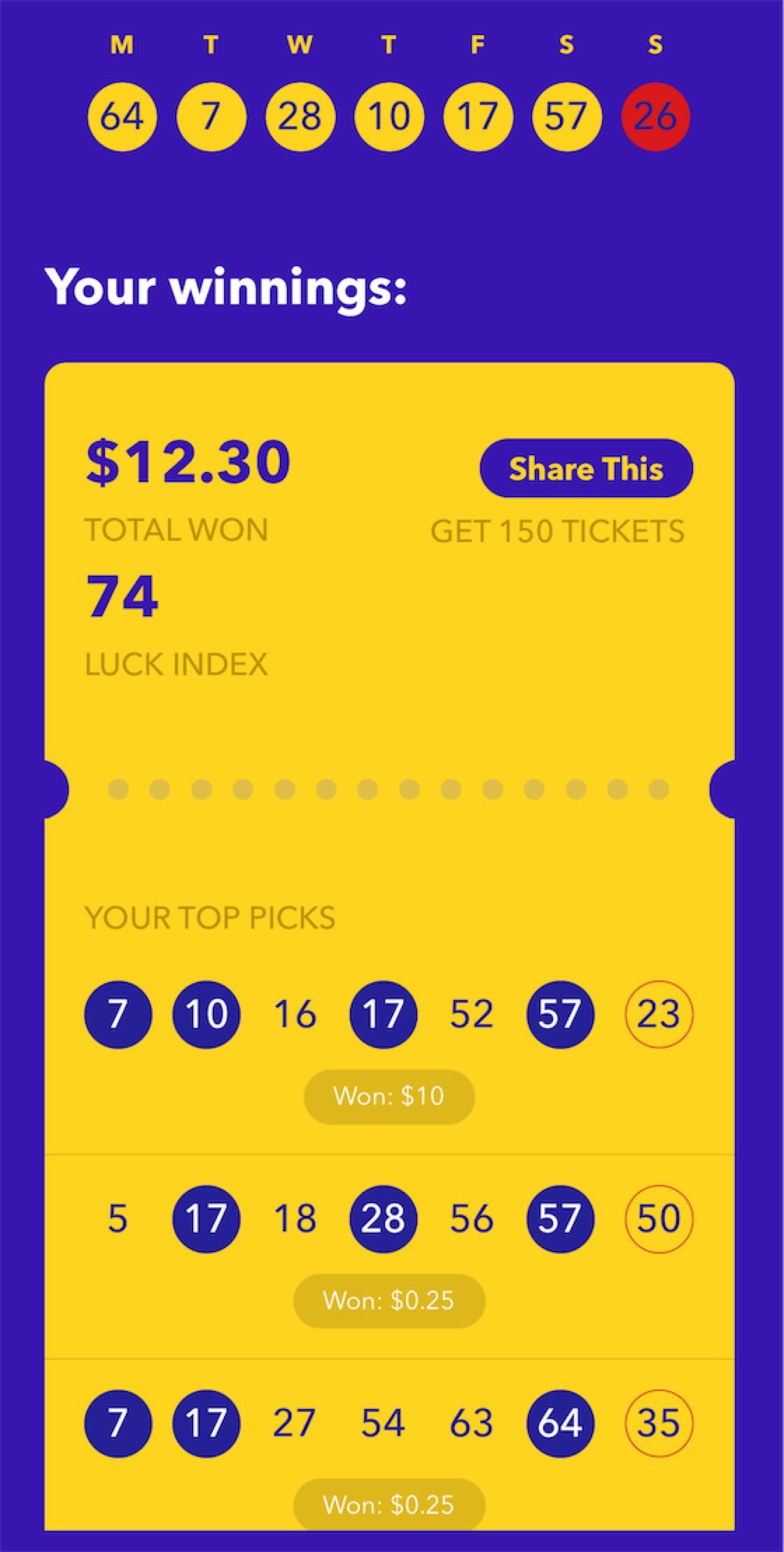

Get paid a guaranteed base rate of 20x what traditional banks offer PLUS, for every $25 deposited into the savings account, you will get a recurring ticket into weekly lottery draws. Essentially throughout the week, your lottery ticket will be matched against “winning numbers.” The more you match, the more your rewards! More on how Yotta works here by AskSebby.

Personal Strategy & Experience:

Since interest rates are at a record low, Yotta’s current offer is extremely competitive. At the very least, you will get 20x the interest you would otherwise get at banks like BoA, Citi, Chase, etc. Furthermore, the lottery results have performed very well, averaging around 2% APY for me. Some weeks I get lucky and earn more interest than I would earn from Citibank all year! In short, at the very worst, you will still earn many times the interest from your big bank and, at the very best, you could win up to $10 million!

Other Benefits:

- FDIC-insured up to $250k

- Backed by world-class investor Y Combinator, finance YouTuber Graham Stephan, and many others. Featured on Bloomberg, TechCrunch, Fast Company, Crunchbase, etc.

- 100% free, no fees

- Withdraw your money any time

[referral] Sign up using my link to get started with 100 free tickets!

My Overall Strategy

This is what has worked best for me. Note that your situation may differ. Please do your own research or reach out below if you want to chat more!

- One Finance – Set up direct deposit so 10% of my paycheck automatically earns 3% APY with the rest earning 1% APY.

T-Mobile Money – Have at least $3000 in the account to earn the 4% APY up to this amount. Any excess will earn the same 1% APY.[NEW] BlockFi – Allocate a small percentage of savings here to bear the risks of no-FDIC insurance but earn 8.6% APY!- Yotta – 1% APY at the other banks is not bad (especially compared to big banks), but I have consistently gotten decent returns with my money through Yotta (1-4% APY) so I have the remainder of my savings in here.