Last Updated on March 9, 2024 by CreditFred

It’s not a secret that the easiest way to earn lots of points fast is to open new cards and get the welcome bonuses.

However, one of the most common comments I get when people are hesitant to open a new card is “I don’t spend that much” or “I can’t meet the minimum spend“. In most cases, you actually can meet the requirements – with a little creativity.

This post will provide some ideas on how to meet that spend requirement. Feel free to leave anything I might’ve left out in the comments below and I’ll be sure to add it to the article!

1. Big Upcoming Purchases

Say you’ve been planning on getting a new laptop or camera, timing that purchase with a new credit card signup can provide many benefits. For example, if you sign up for the Chase Sapphire Preferred 100k offer, you will easily wipe out a substantial amount of the $4k spend requirement. In addition, putting it on a premium card like the Preferred can give you valuable perks such as extended warranty and purchase protection, in case anything happens to your high value item.

2. Rent

Did you know you might be able to pay rent with your credit card with no fees? For details on how to do this without paying fees, check out this post on PayPal Key. I personally have used this hack with my Chase Freedom Unlimited to earn at least 2.25% back on my rent every month (+countless signup bonuses)! Even if you don’t use this method and your apartment charges a credit card fee (e.g. 2% on $4,000 of rent), that would only mean paying a fee of ~$80 to hit your Chase Sapphire Preferred signup bonus worth at least $1,250 – and this is assuming a worst case scenario where you literally don’t have any other spend during the first 3 months.

Update: Paypal Key no longer works, but you can still pay rent with no fees with the Bilt Rewards Credit Card.

3. Tuition

Similar to above, many educational institutions allow tuition payments via credit card (but almost always with a fee). You can do the math to see if it makes sense for you. If you are one of the super rare (LUCKY) people who attends an institution that doesn’t charge ANY fees, you should definitely put the entire tuition spend on your credit card(s) to take advantage of this once-in-a-lifetime perk! Make sure to pay it off in full at the end of the month (or as soon as possible via online banking or the banking app) to avoid getting charged interest.

4. Taxes

Did you know you can pay your taxes with a credit card? If it is tax season or you are pre-paying quarterly taxes, this may make meeting your minimum spend super easy. Refer to the IRS website for more information.

5. Pay for Large Groups Upfront

When eating out or planning a trip with your friends, offer to pay for the expense upfront with your card and have them Venmo you. This can easily be hundreds of dollars just for a single meal if you are with a large group! Additionally, if your card comes with perks such as travel insurance, the whole group will be covered if something goes wrong at the Airbnb. Or with purchase protection, if the new phone your family member bought using your card becomes damaged in the first 90 days, you will be reimbursed! Win-win for everyone!

6. Recurring Expenses

Think about what your recurring expenses are, and if you have the ability to pre-pay for them. Some ideas:

- Utilities (internet, phone, electricity, water bills)

- Subscriptions (gym, Spotify, Netflix, Disney+)

- Insurance (car, home, rental)

- Taxes

- Rent

I especially love pre-paying for my T-Mobile phone bill and PG&E utilities, as they are both expenses I will need to pay in the coming months anyways.

7. Add Authorized Users

If you have friends and/or family that you trust, you can add them as authorized users on your card. Some cards charge an additional fee, but for the Chase Sapphire Preferred, you can add additional users for no fee, and your combined spending will count towards meeting your minimum spend requirement to get that welcome bonus! Cards like the Amex Platinum charges for additional authorized user Platinum cards, but you can add up to 99 Gold card users for free and it will all count towards the signup bonus requirement!

8. Amazon

This is not recommended, but if push comes to shove, you can buy a high value item on Amazon, return it and choose to have it credited to your Amazon gift card balance, instead of back to your credit card. That way, you can hit the minimum spend before the welcome period is up and use your remaining balance over time. You can also top up your Amazon balance directly with a credit card, although I wouldn’t overdo this to avoid triggering any fraud flags.

You may also find yourself in a scenario where you genuinely bought a high value item on Amazon (e.g. a camera or laptop), have a need to return it but do not want to have your bonus clawed back (e.g. your are quickly approaching or past your welcome bonus promo period), choosing to be credited to your Amazon balance instead of refunding back to your card can help you avoid that.

Alternatively, you may also consider buying retailer gift cards on Amazon that you can use up. Some ideas:

- Safeway

- Whole Foods

- Best Buy

- Netflix

- Uber

- Lyft

- Airbnb

- Hotels.com

- Southwest

- Starbucks

- Chipotle

- Nordstrom

- Lowe’s

9. Gift Cards

Many grocery stores and pharmacies sell gift cards. For example, I usually shop at vendors like Apple, Amazon, DoorDash, UberEats, so wouldn’t mind paying for these gift cards upfront to meet my spend requirement as I know I will use these services eventually. Although you can do it, I would advise to stay away from vanilla Visa pre-paid cards, as they make you a target for fraud flagging and may trigger a detailed financial review or disqualify you from your welcome bonus altogether. Amex especially is known to be very sensitive to this (although it is very tempting with the Amex Platinum 10x grocery welcome offer). However, if you mix in organic (normal) grocery spending with 1-2 gift cards every once in a while, you will be just fine.

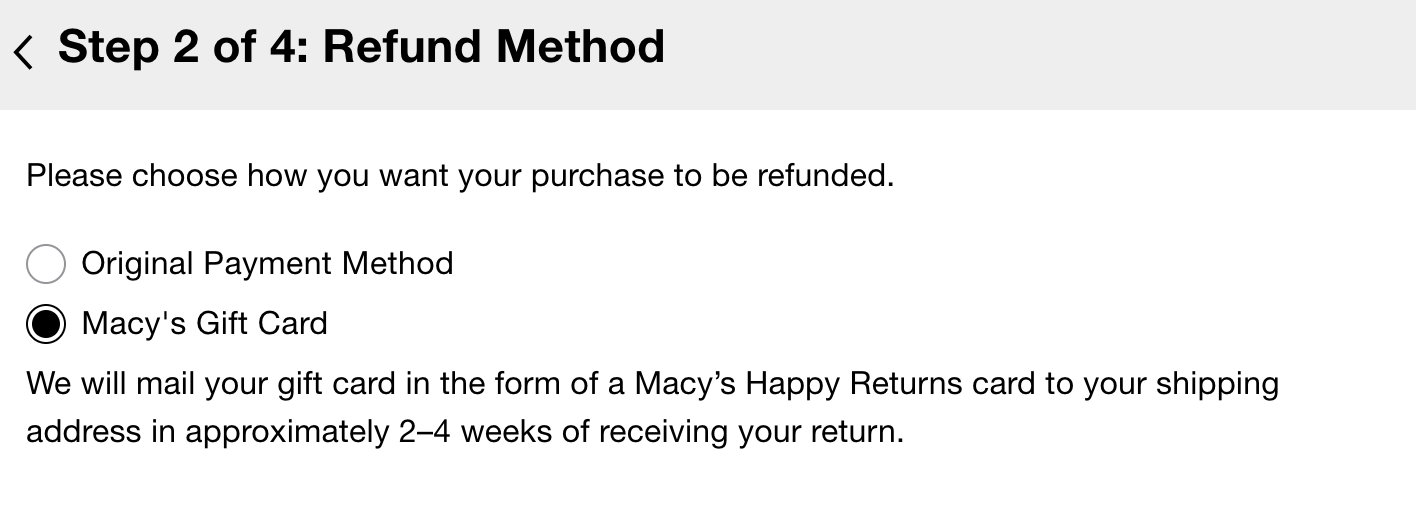

Additionally, many retailers (such as Macy’s) allow the option of processing your return refund as a future store credit instead of reversing the credit card charge. This way, if you need to make a return but want to keep the credit card transaction (+ any additional points you may have earned going through shopping portal on a 10x day), you can do that.

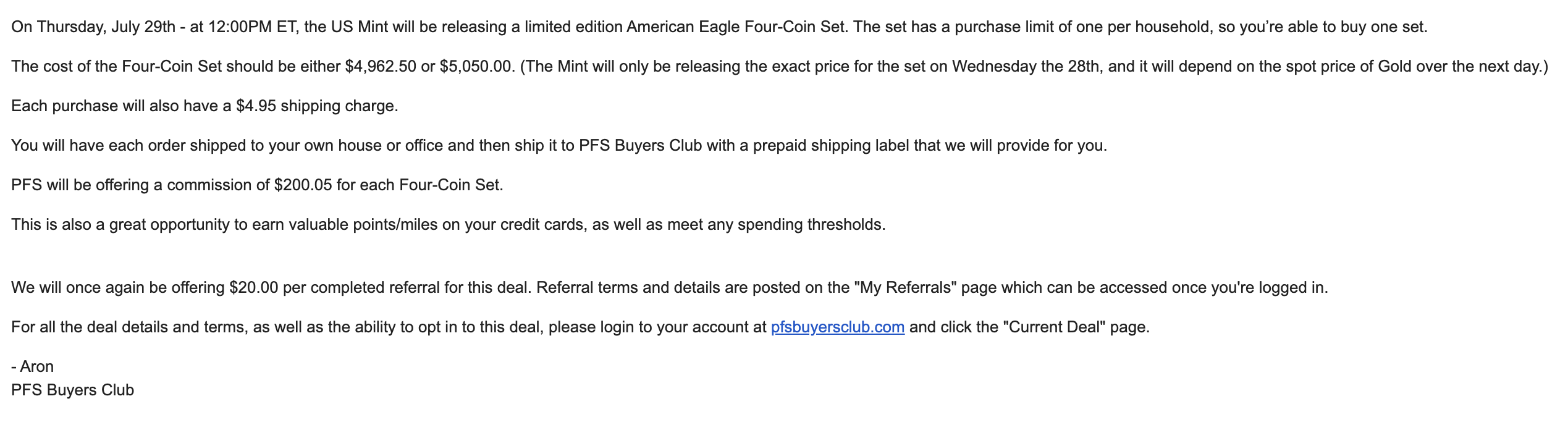

10. PFS Buyer’s Club (US Mint)

Every few months, the US Mint releases limited edition coin sets that PFS Buyers Club is interested in buying for resale. Since the US Mint accepts credit cards, you can either buy and sell yourself directly for a larger margin (but with higher risk and legwork), or if you simply participate in the PFS Buyers club deals, you will be guaranteed a set profit (usually $100-500 range) per order. Since the cost of these coins range from several hundred to a few thousand dollars, it is a TERRIFIC way to meet your minimum spend fast and make some profit on the side!

Of course for those new to this, this may sound a little uncomfortable. Here are a couple links from respected blogs I follow that have covered this for many years, so I find it reputable and safe to do:

However, as with all things finance, please do your own research and proceed at your own risk! Recent reports have also indicated to avoid doing this for Amex cards.

If you want to support this blog, consider signing up using my referral link (at no cost to you!). Thank you!