Last Updated on March 19, 2024 by CreditFred

Citi recently announced a brand new credit card called the Citi Custom Cash (public link). In short, this is a card that automatically earns 5% back on your top eligible spending category each billing cycle.

This article will be breaking down the main pros and cons of this card and who I think this card is for.

Card Features Overview

- Signup bonus: $200 cashback / 20,000 Thank You Points after spending $750 within 3 months of account opening. Update: There are reports of $300 welcome offer floating around in-branch and online.

- 5% Categories: Restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, live entertainment.

- Annual Fee: $0

- Foreign Transaction Fee: 3%

Pros:

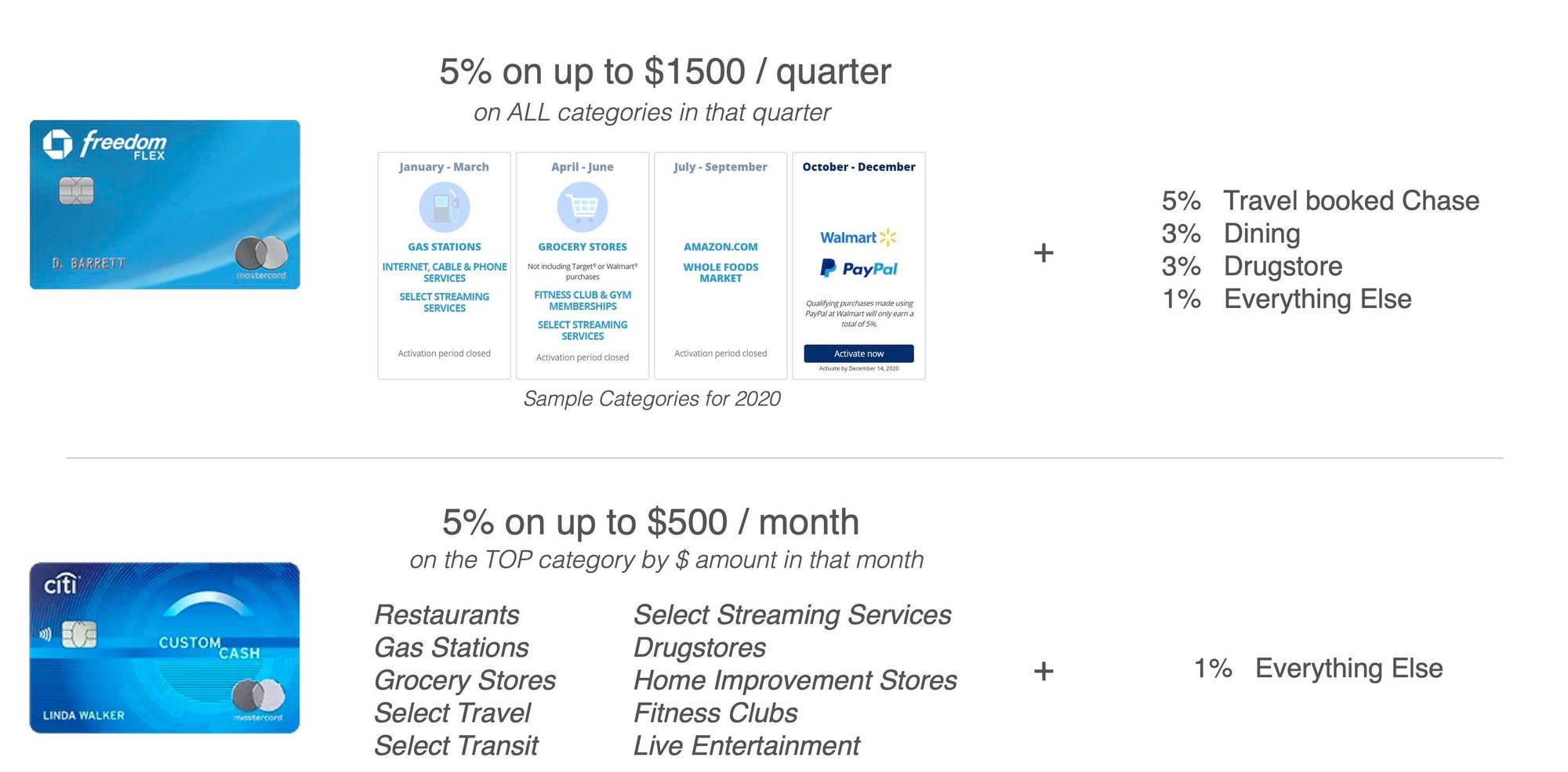

- Automatic – Unlike other 5% cards such as the Chase Freedom Flex, the Citi Custom Cash does not require manual enrollment every quarter to be eligible for the 5%. It all happens automatically.

- Consistent Categories – Most 5% cards on the market are rotating categories, meaning you never really know what to expect next month/quarter. The Citi Custom Cash has set eligible categories so you can choose what works for you and stick with it.

- Works well with Citi ecosystem – Similar to how Chase has the Ultimate Rewards ecosystem allowing you to combine points across multiple cards covering various bonus categories, if you have cards like the Citi Double Cash, Citi Premier, or Citi Prestige, adding this card can help you earn Citi Thank You Points in even more categories and pool them together for cashback or travel!

- Solid welcome bonus, no annual fee – For a no annual fee card, the $200 signup bonus is competitive. It is a good starter card that most can keep long term with no downsides. Additionally, it offers 0% Intro APR for the first 15 months (although you should never carry a balance and make purchases you cannot afford…that being said, if you really need it, it is essentially an interest-free loan).

Cons:

- Monthly capped earning – There is a cap on the 5% earning to only the first $500 of spend on your top category every billing cycle. For example, if you spent $1000 on dining in a month, then you will only get 5% on the first $500 ($25 cashback), afterwards, your remaining spend will reward 1% ($5). This is also inferior to the quarterly approach (e.g. 5% on $1500 spend in 3 months on Freedom Flex), as those hoping to make large purchases over $500 on the Citi Custom Cash will not earn the full bonus amount, unless they can split up the payments to not exceed monthly limits.

- Still really a 1% card for all other categories – If you are thinking of using this card as a one-card setup, keep in mind that ONLY the top eligible category earns 5%, everything else will earn 1%. For example, if you spent $400 at restaurants and $350 on gas in a month, you will actually only earn the 5% for restaurant spend, and 1% on the other purchases. Depending on your spending pattern, you may be better off with other cards.

- Higher minimum spend requirement – The $200 welcome bonus isn’t bad, but $750 is considerably higher than other similar offers. For example, both the Chase Freedom Flex and Chase Freedom Unlimited offer $200/20k UR points after spending only $500. In addition, the cashback at Chase can be redeemed at 25-50% more value if you hold the Sapphire Preferred or Sapphire Reserve, giving you even more value.

- Takes up Chase 5/24 slot – If you are eligible for Chase cards, it is generally recommended to get those first due to more restrictive application rules.

- No protections or warranty benefits – Citi removed valuable credit card protection benefits such as Purchase Protection, Extended Warranty, Travel Protection, Cell Phone Protection, etc. Consider the Chase Freedom Flex or Freedom Unlimited, both of which offer these benefits and more.

- Foreign Transaction Fee – Citi Custom Cash charges a 3% fee on foreign purchases. Consider the Chase Amazon Prime card, which has no annual fee and no foreign transaction fees.

Who should get this card?

- Not enough credit history for Chase cards – Chase does have more stringent requirements to be approved, especially for international students new to the U.S. In this case, applying for starter cards at banks such as Citi, BoA, Discover, or Capital One may increase your odds of approval and allow you to build up your credit history.

- Over 5/24 – If you are ineligible for Chase cards due to the 5/24 rule, and don’t want to wait to be under the limit (or you are done getting Chase cards), this is an easy bonus and great long-term card to add to your arsenal.

- Cover new earning category – The Citi Custom Cash offers many unique 5% categories that are not usually covered. Although you can find similar or better returns for categories like restaurants and grocery stores elsewhere, earning 5% on categories such as live entertainment and home improvement on a no annual fee card is pretty much unheard of!

- Adding to your Citi Thank You points strategy – If you are looking to build out your Citi ecosystem, this card nicely complements the Citi Double Cash + Citi Premier/Prestige setup. Furthermore, because you are earning Thank You points, these can be transferred to travel partners such as Avianca LifeMiles, Singapore Airlines, etc. for outsized redemption values such as flying business class for free! Finally, there are overlaps between Amex and Chase travel partners, so you can combine your miles earned from all 3 issuers to book your next travel!

Who shouldn’t get this card?

- Under 5/24 – If you are under 5/24, and are eligible for Chase cards, this simply is not worth getting at this point. You will be sacrificing a sacred 5/24 slot and be spending more for less return.

- Want one-card setups – Although this looks like a good one-card setup with minimal effort at first glance, but in reality because of how the categories are capped and restricted to the top category, you may be better off with other cards.

- Value purchase & travel protections – Since Citi cards have no purchase or travel benefits found in other no annual fee cards, this is not a good card to put your big purchases on should you ever need to dispute or file a claim.

- International Travel – The 3% foreign transaction fee will most likely outweigh all rewards you earn, so avoid using this outside the U.S.

Conclusion

Overall, I think this is a great card for those with limited credit history to get as a starter card, or those that have finished with Chase 5/24 and are looking for additional cards to add to their portfolio. However, for the vast majority of people, I recommend getting the Chase Freedom Flex or Chase Freedom Unlimited. As explained in detail above, you are getting the same or better bonus for less spend, the Chase cards come with valuable purchase and travel protection benefits, and since Chase is more restrictive, it is better to get Chase cards first, then circle back to get Citi cards at a later stage.