Last Updated on March 8, 2024 by CreditFred

Maximizing point earnings on a big purchase is nice, but buying the item with a credit card which offers comprehensive warranty and return benefits is arguably even more critical. Here’s my story of how these lesser-known benefits saved me hundreds of dollars in repair costs…

What Happened

I bought a new camera lens a couple months back. I knew going in that putting expensive purchases on premium credit cards like the Amex Platinum, Chase Sapphire Reserve, or Capital One Venture X will offer me the best protection in the event something happens.

Well, life happened and while trying to test my lens with a new tripod, the camera fell off and the front of the lens landed head first onto the ground.

Thankfully, this was at home, on carpet, and fell from relatively low altitude. Fortunately, the damage was limited and it was nothing too serious.

Purchase Protection

Many credit cards offer this benefit that essentially reimburses you for events such as accidental damage, loss, or theft. Check out a previous article on my experience with Chase Purchase Protection. Since the lens was purchased with my Amex Platinum, this is how American Express defines this benefit:

Definition:

Purchase Protection can cover the cost of life’s “uh-oh” moments, so you can be more confident when buying with your Eligible Card. From broken laptops and phones to delivered packages nabbed from the front porch, when you make a Covered Eligible Purchase with your Eligible American Express Card, you can rest easy knowing that you may be protected up to $1,000 per incident (for some Cards you may be protected up to $10,000 per incident) when the unexpected strikes.

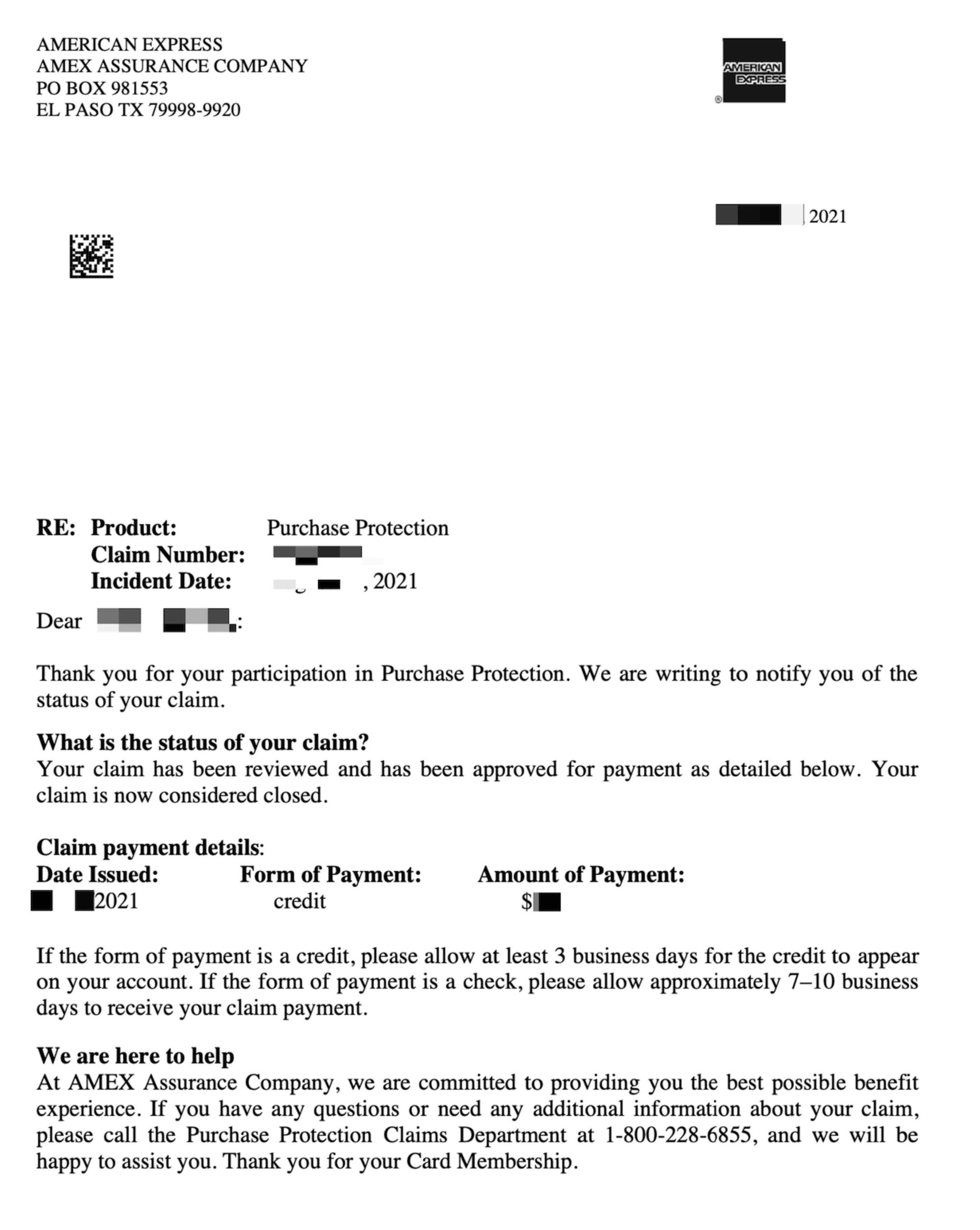

Since this was a minor damage, it wouldn’t have been too bad to pay out of pocket. Still, since this is a covered event I decided to file anyways to see how it goes. Even though it took a few weeks for them to verify the information and issue my credit, I was eventually reimbursed for the cost of a new lens hood!

Return Protection

Due to the earlier incident, I have decided after using the lens for a couple months that it wasn’t the right fit for me. Return Protection is a benefit where the credit card will reimburse an item if you attempt to return the item and the merchant won’t take it back. Based on time of writing, this is the official language from Amex Platinum:

Definition:

If you try to return an eligible item within 90 days from the date of purchase and the merchant won’t take it back, American Express may refund the full purchase price excluding shipping and handling, up to $300 per item, up to a maximum of $1,000 per calendar year per Card account, if you purchased it entirely with your eligible American Express® Card

Since this benefit varies card to card, and also different between banks, make sure to check your official terms to make sure you qualify.

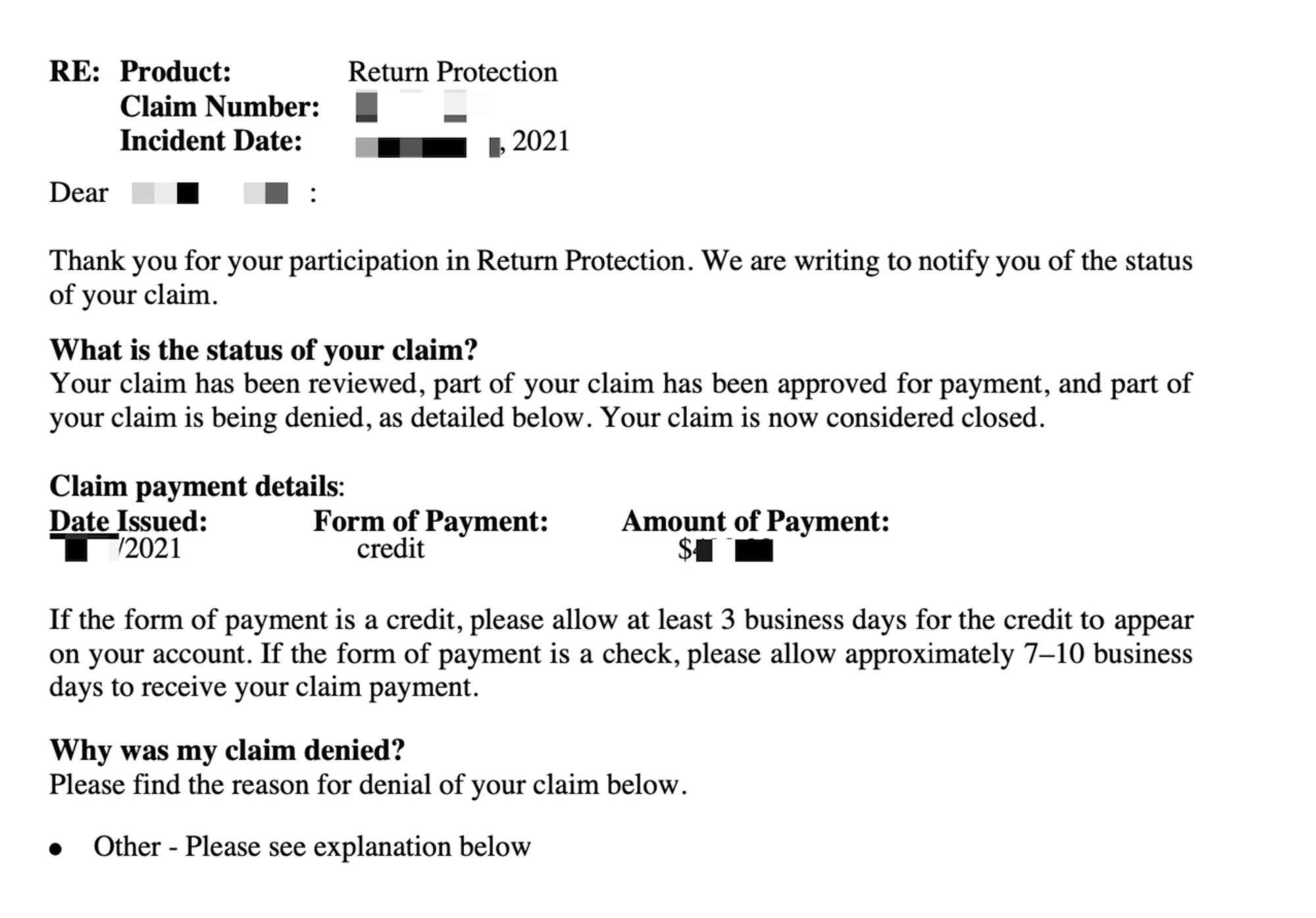

Overall, this process also took a few weeks to be approved. Since the item was more than $300, I did not expect to be fully reimbursed for my purchase. However, I was delighted to see that they actually approved me for a partial credit that was more than the stated official limits, AND didn’t ask for me to return the item!

How to File

Overall, the process was very simple and much smoother than my experience with Chase. The whole claim can be completed online and without any direct human interaction (you can, however, choose to call if you want clarifying information). Here are the steps:

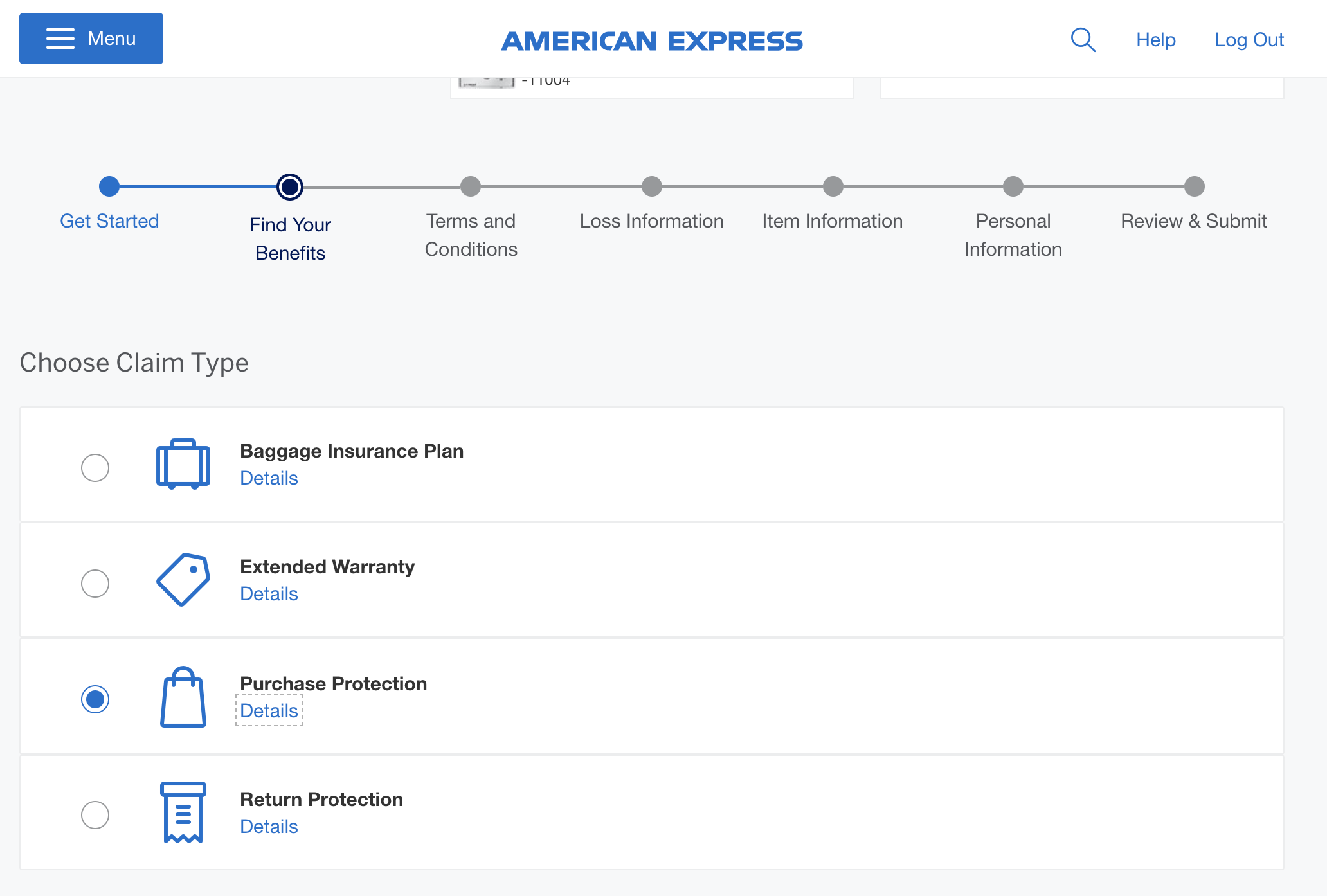

- Head over to the official Amex Claims website to start a claim (requires login)

- Choose the type of claim you wish to file

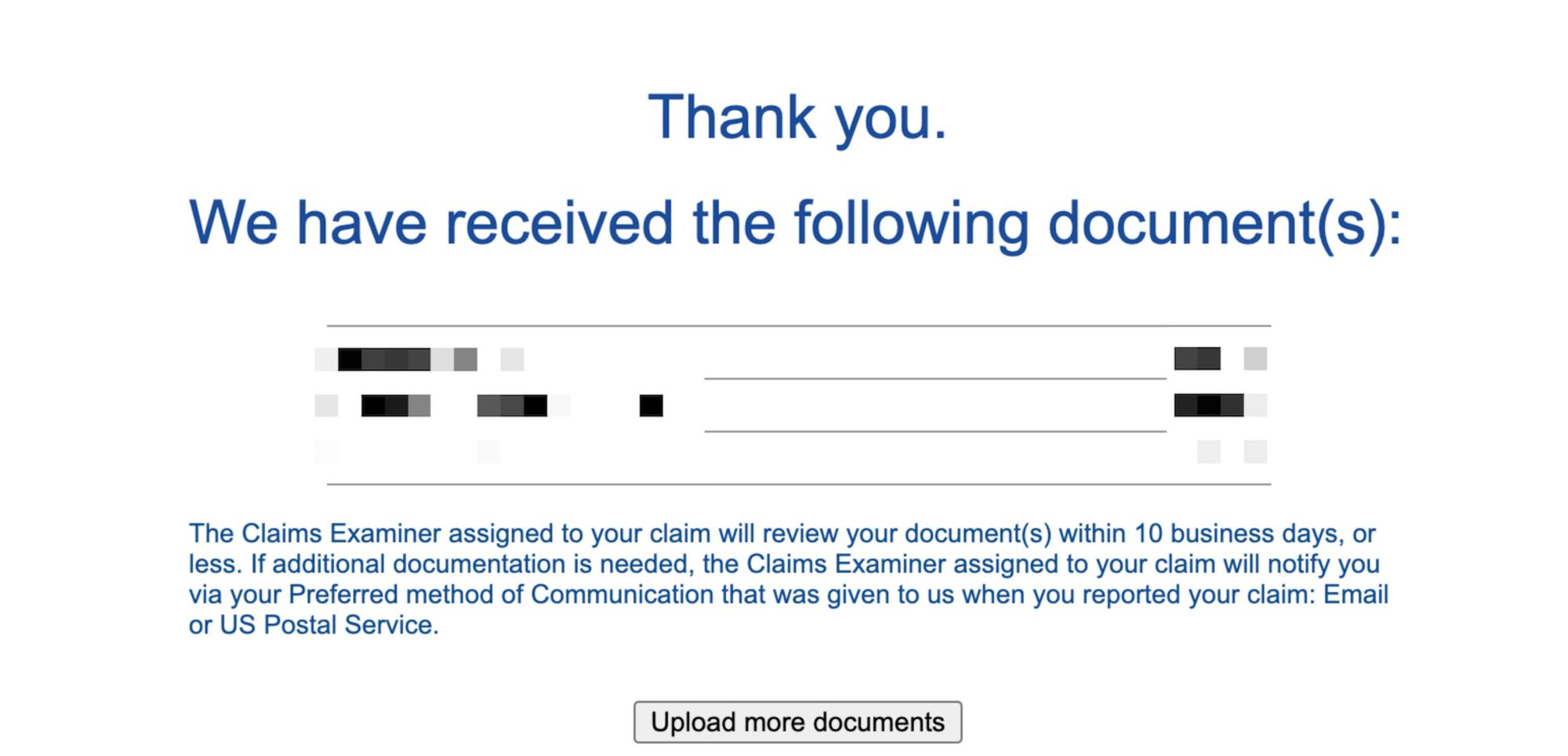

- Upload required information

- Wait to hear back! You will be contacted via email with the result of the claim and if additional information is needed. You may be paid in check, direct deposit, or issued a statement credit (my case).

Conclusion

Overall, just the reimbursements for these two incidents more than justifies my Amex Platinum annual fee, and this is before accounting for all the other benefits of the credit card. This is why I highly recommend people to get credit cards – it is not just for the “points/rewards” earning, but more importantly the protection benefits these cards offer! To learn about more ways your credit card can help you, check out the Why Credit Cards page!