Last Updated on March 19, 2024 by CreditFred

One year into the pandemic, most people haven’t been and will probably not be traveling much in the near future. With so many airline, hotel, and credit card programs to manage, how do we keep track and prevent our points from expiring without actually traveling?

How I do check which miles are expiring?

The great thing about major transferrable currencies like Chase Ultimate Rewards (UR) or Amex Membership Rewards (MR) is that they never expire as long as your account is in good standing!

In recent years, many airlines have followed this (e.g. Delta, United, etc.), but there are still several programs that will continue to expire your points (usually after a certain period of inactivity). Keep in mind that in light of COVID, many loyalty programs have temporarily paused or extended the expiration of miles. You should check with your own program for the most accurate information.

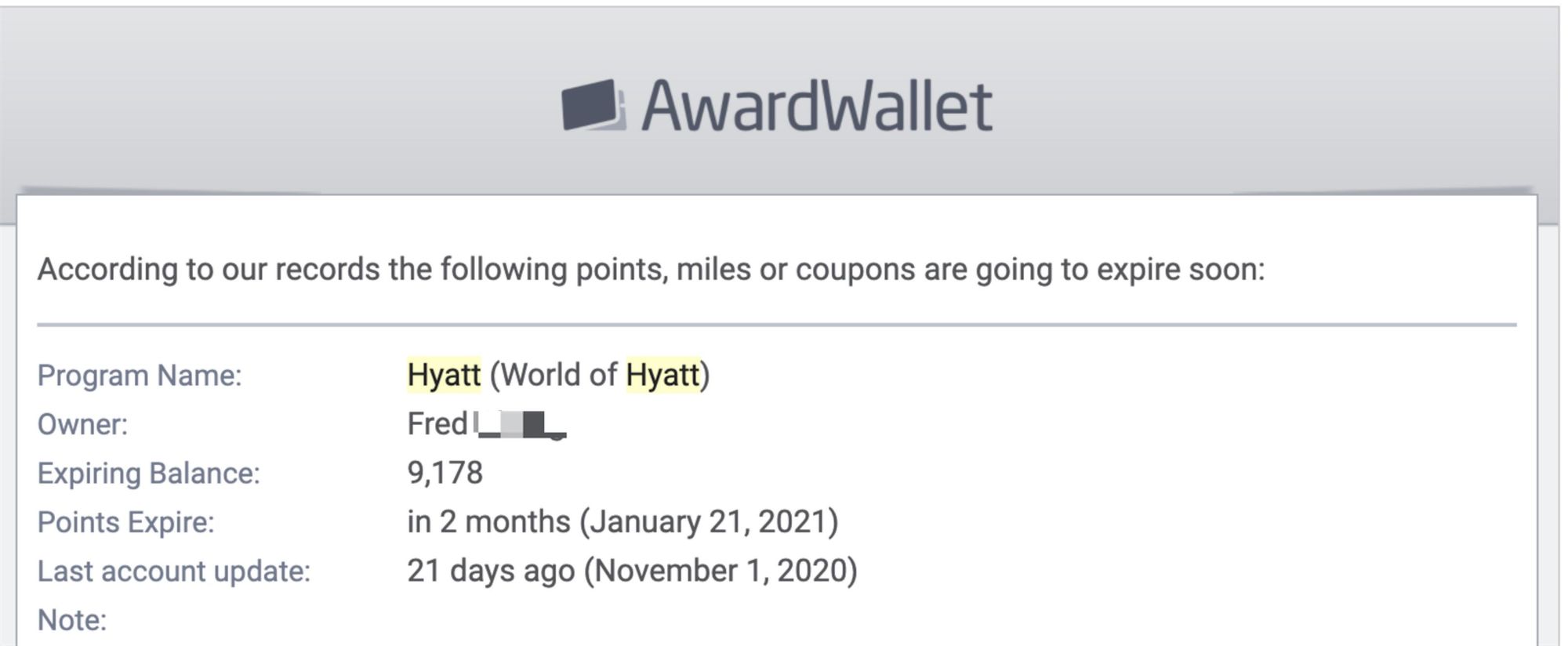

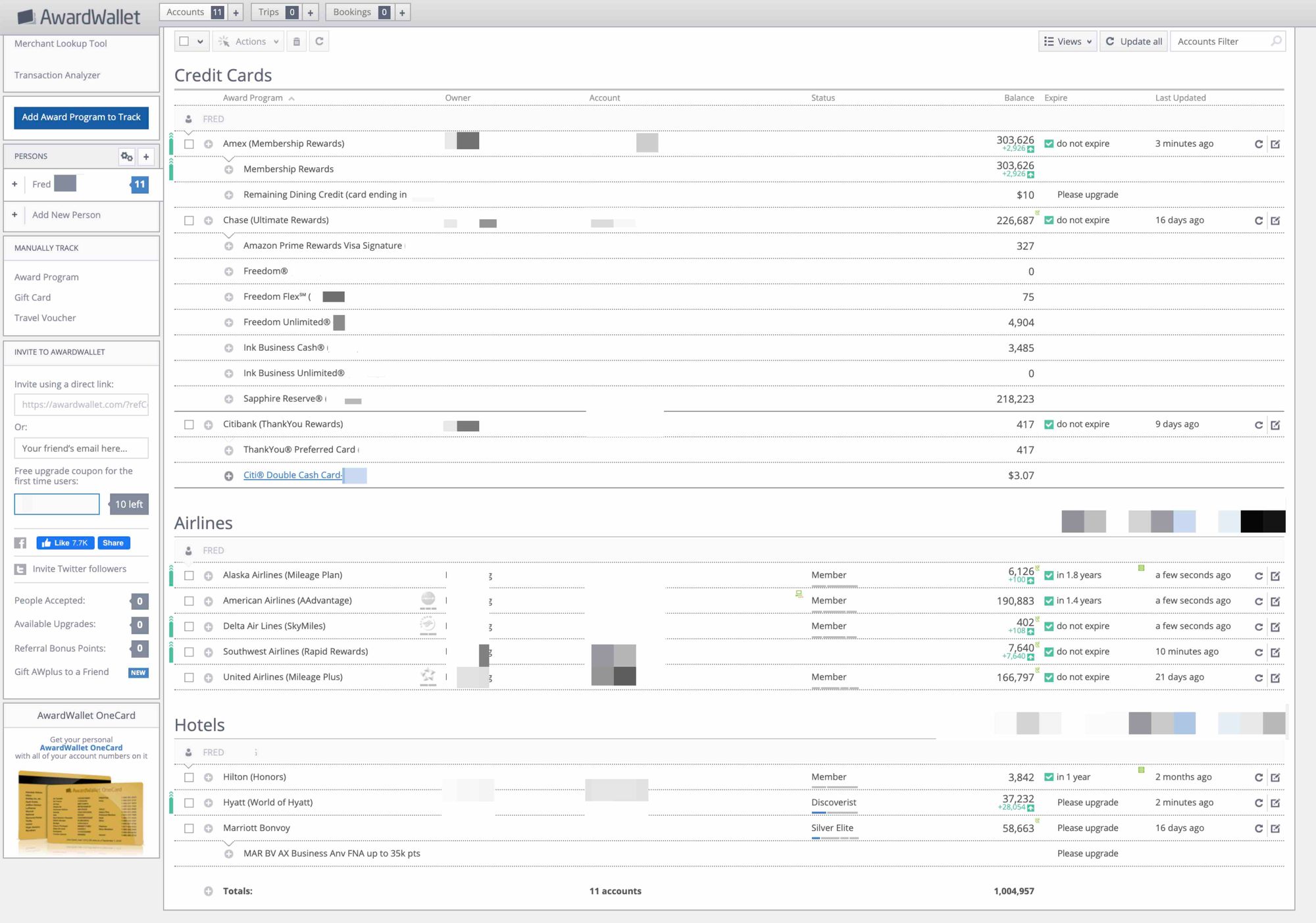

To help navigate through all the different rules and keep track of all your points, I highly recommend checking out AwardWallet. It’s a terrific web application that can help you keep track of all your points and benefits in one place. Here are some of my favorite features:

- Automatically keep track of your points balance

- Expiration tracking and reminder

- Transaction Analyzer (e.g. which card would’ve given you better returns on your dining purchase)

- Merchant Lookup Tool (e.g. for Amazon.com purchases, which card gives you best return)

- and many more…

In a future post, I’ll be doing a deeper dive into AwardWallet. In the meantime, the basic service is totally free to sign up for and try. I have a limited amount of upgrade coupons available to give out (which gives you premium features such as auto-update all accounts) – just DM me on Instagram, first come first serve!

Easy ways to keep your points alive without actually traveling!

Here are a few ways to keep your hotel points or airline miles without actually needing to stay at a hotel or fly with the airline.

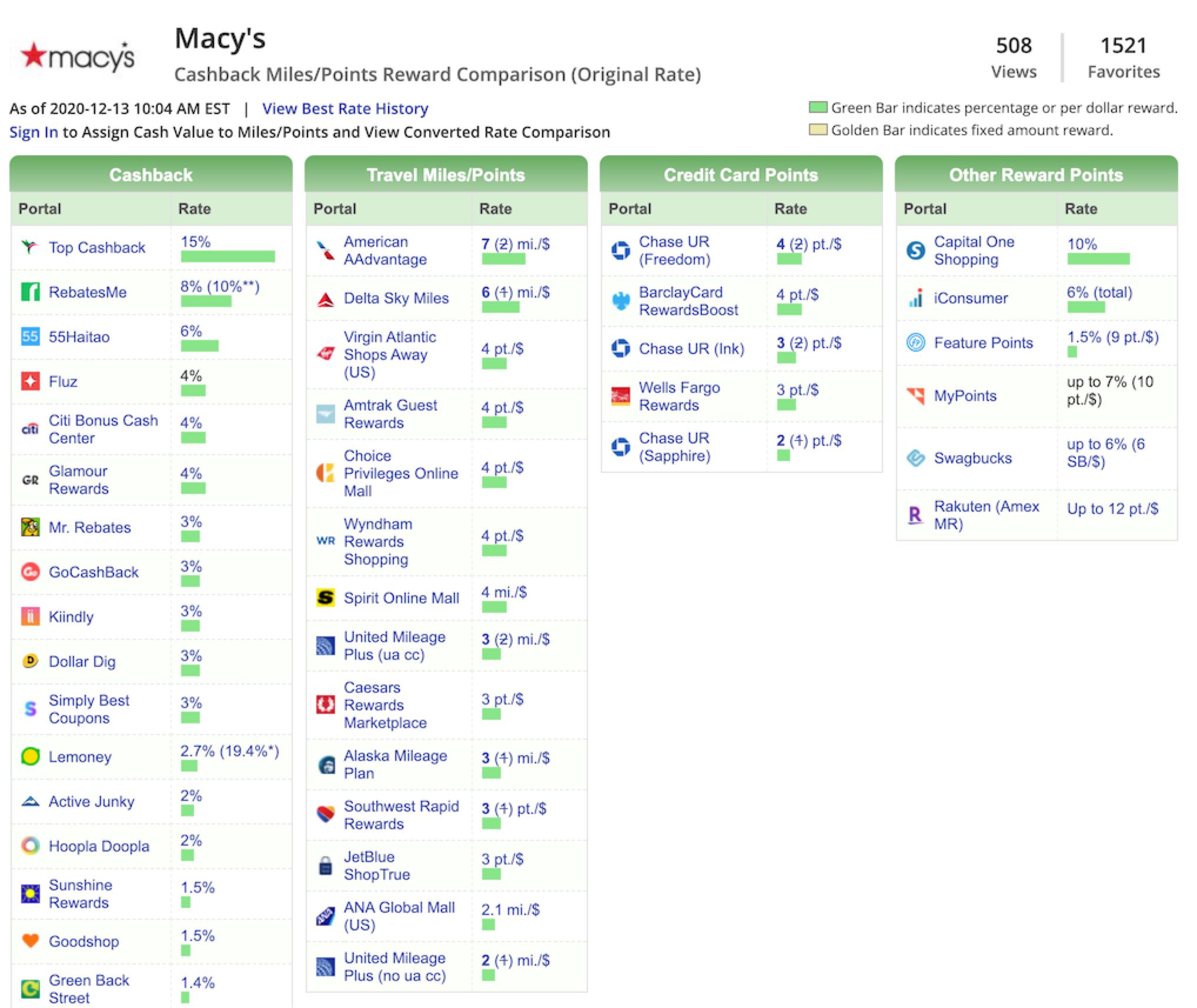

1. Earn Miles via Shopping Portals

Earning any amount of points from shopping portals can help you keep a loyalty program’s points from expiring, especially if you need the points to post in the account as soon as possible or if you do not want to get another credit card. However, not every loyalty program has a shopping portal, so be sure to double-check. For more information on shopping portals, check out my earlier post.

Example: To keep your Alaska miles alive, just search up your favorite retailer and go through the airline’s shopping portal to earn extra miles AND extend the validity of your existing miles!

2. Get Co-branded Credit Cards

Sometimes having an active credit card with a specific loyalty program will allow points to never expire as long as your account is open and in good standing. However, for other programs like Marriott, Hyatt, and AAdvantage, this is not the case. These programs require some earn/redemption activity within the last x months (depends on each program) in order to keep your points from expiring. The easiest solution is to make a small purchase (e.g. $1) on the co-branded card in order to earn points, thus extending the life of your entire points balance. For example, my Hyatt points were set to expire sometime this summer, but I recently got the World of Hyatt co-branded card by Chase, so any purchase would allow me to earn Hyatt points, thereby preventing my entire balance from expiring.

Example: Sign up for the Hyatt card, and any purchase (even $1) will earn you Hyatt points to extend the validity of your entire Hyatt points balance.

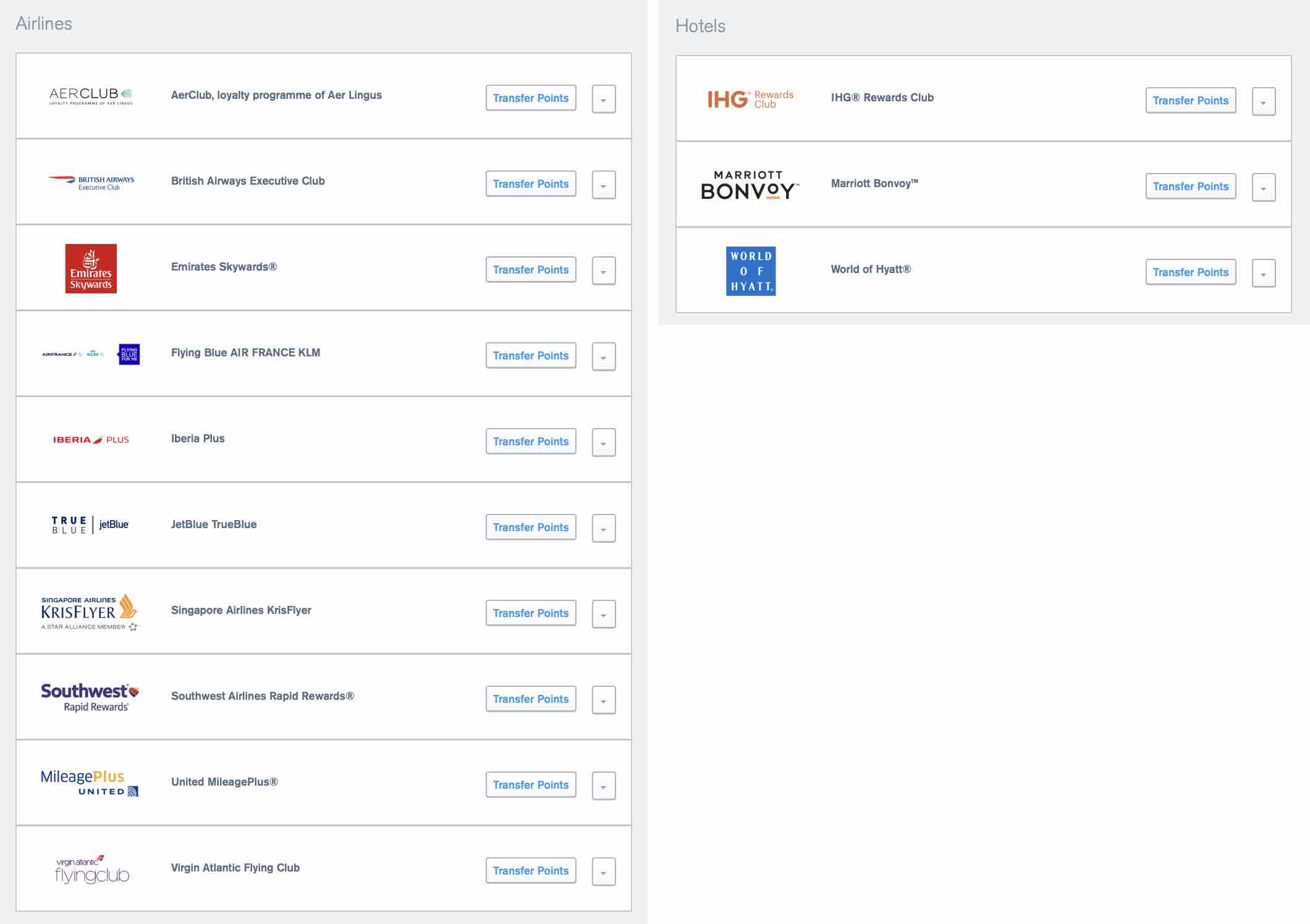

3. Use Transferable Currencies from Banks

Major transferable currencies such as Chase’s Ultimate Rewards (UR) or Amex’s Membership Rewards (MR) allow transfers to various airline and hotel partners. For example, both programs allow transferring to the Marriott Bonvoy program at a 1:1 rate (this is usually a terrible deal since UR/MR points are worth 2cpp vs 0.8cpp for Marriott, so I would only do the minimum 1000 points if absolutely necessary). This transfer should count as new activity in your account and help extend the life of your miles. Note that rules change all the time, so be sure to check your specific program and confirm with a support agent before initiating the transfer.

Example: IHG points expire after 12 months of inactivity. This isn’t the best conversion, but if you want to keep your IHG Rewards balance alive, you can transfer 1000 points over. Alternatively, holding an IHG card that grants elite status (see method 3) allows your points to stay alive.

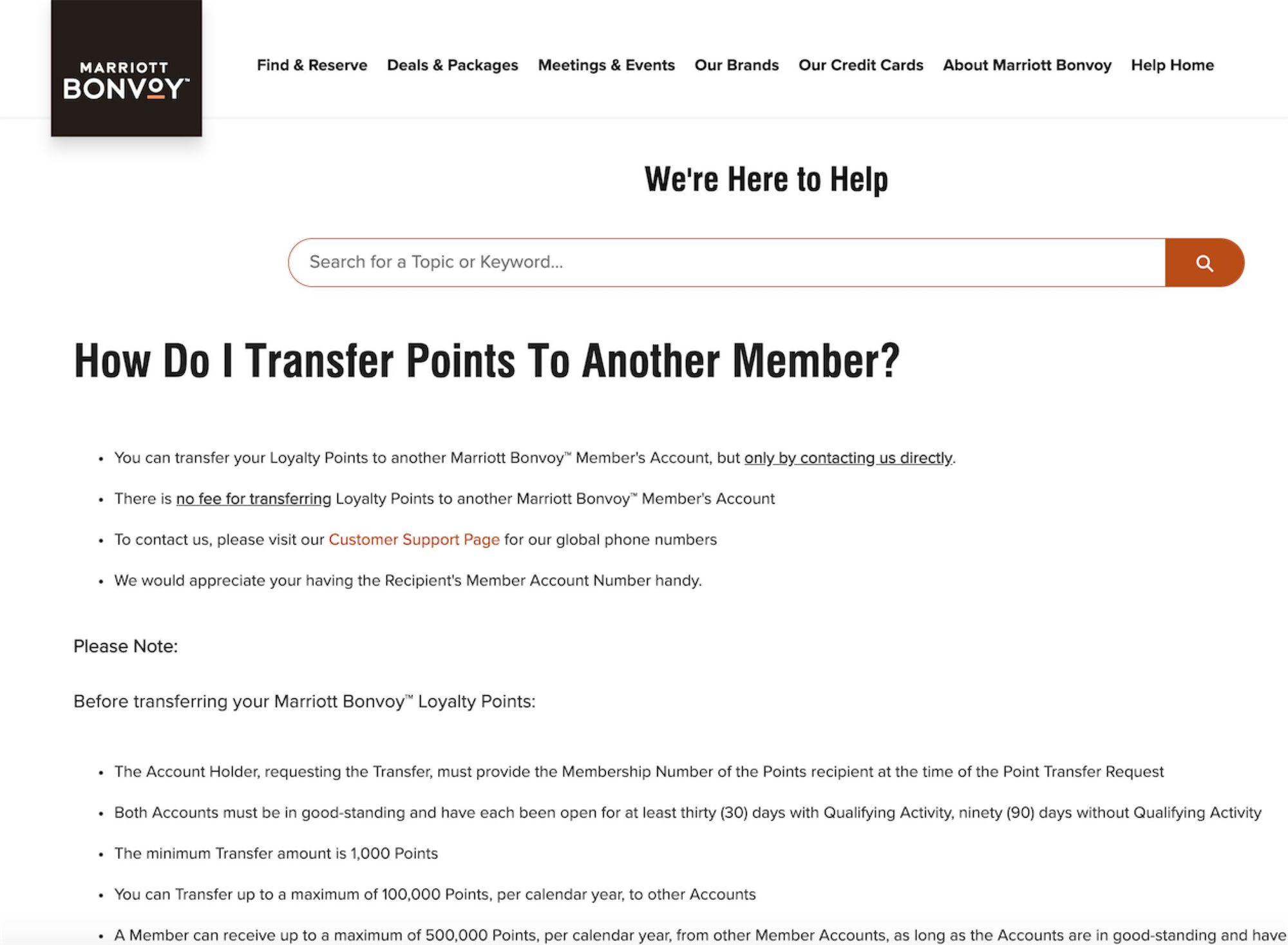

4. Transfer Between Accounts

Some programs allow you to combine points into one account from the same loyalty program, albeit often a more complicated process requiring reaching out to customer service and verifying your identity. There are also quotas sometimes for how much you can transfer or limits to who you can transfer to. For example, Marriott Bonvoy allows you to transfer up to 100,000 Bonvoy points per year to another account. Note that both accounts need to be open for at least 30 days with activity or 90 days without activity. This also requires you to call in to initiate the transfer.

Example: If you have a family member to pool points with from the Marriott Bonvoy program, combining them into one account will qualify as activity and keep the points balance alive.

5. Link Partnering Programs

Loyalty programs often partner with one another to offer you the ability to earn points simultaneously from multiple programs. Note that these partnerships are subject to change at any time and usually requires linking your accounts. Here are a few examples:

- Hyatt + American Airlines – earn extra AA miles from Hyatt stays!

- Marriott + Uber – earn extra Marriott Bonvoy points from your Uber Eats or Rides!

- Lyft + Hilton/Delta – earn your choice of Hilton points or Delta miles on your Lyft rides!

6. Last Resort…

If all else fails, you can use methods such as donating a portion of your points, subscribing to magazines using points, or even paying a fee to reinstate already expired miles. However, in many cases you end up losing value and it may not be worth it to spend more money.

Example: Donate some AA miles to charity to keep the remaining balance alive.

Summary

There are so many ways to prevent your hard-earned miles from expiring, and it can be as simple as spending $1 through a shopping portal (see method 1) to achieve! However, keep in mind that sometimes the value of the miles are not worth more than the cost of keeping them alive, so always evaluate carefully before spending money to keep alive points that may have little or no value to you.