Last Updated on March 7, 2024 by CreditFred

One of the biggest painpoints is getting approved for your first credit card with limited or no credit history.

This is particularly challenging for newcomers / international students in the US. It then becomes a bit of a chicken or the egg situation, where without credit history, you cannot get a credit card, and without a credit card, you cannot build history.

[Referral Link] Get $100 after signing up and depositing $200!

Overview

Enter Chime, a FinTech service that provides a host of great banking features to get you started, without any fees! Here are some of the features provided:

- Get Paid Early – Set up direct deposit and get your paycheck up to 2 days earlier.

- Fee-Free ATM Access – get money from 60,000+ fee-free ATMs at stores like Walgreens, CVS, 7-Eleven, etc.

- Credit Builder – build credit history! We’ll cover this in more detail in the next section.

- Modern and Simple App – unlike traditional banks, Chime’s mobile app and website is easy to use.

- No overdraft fee

- No minimum balance

- No monthly fees

- No foreign transaction fees

- FDIC insured – your funds are covered up to $250,000

Signup Bonus

Even better, when signing up using my link, we will each get $100 after signing up and setting up a direct deposit* of $200 or more within the first 45 days of enrolling.

*”qualifying deposit” technically should be one from your payroll/paycheck, but data points have shown that any ACH transaction such as Venmo, Zelle, or simple bank transfer from your existing account should trigger the bonus.

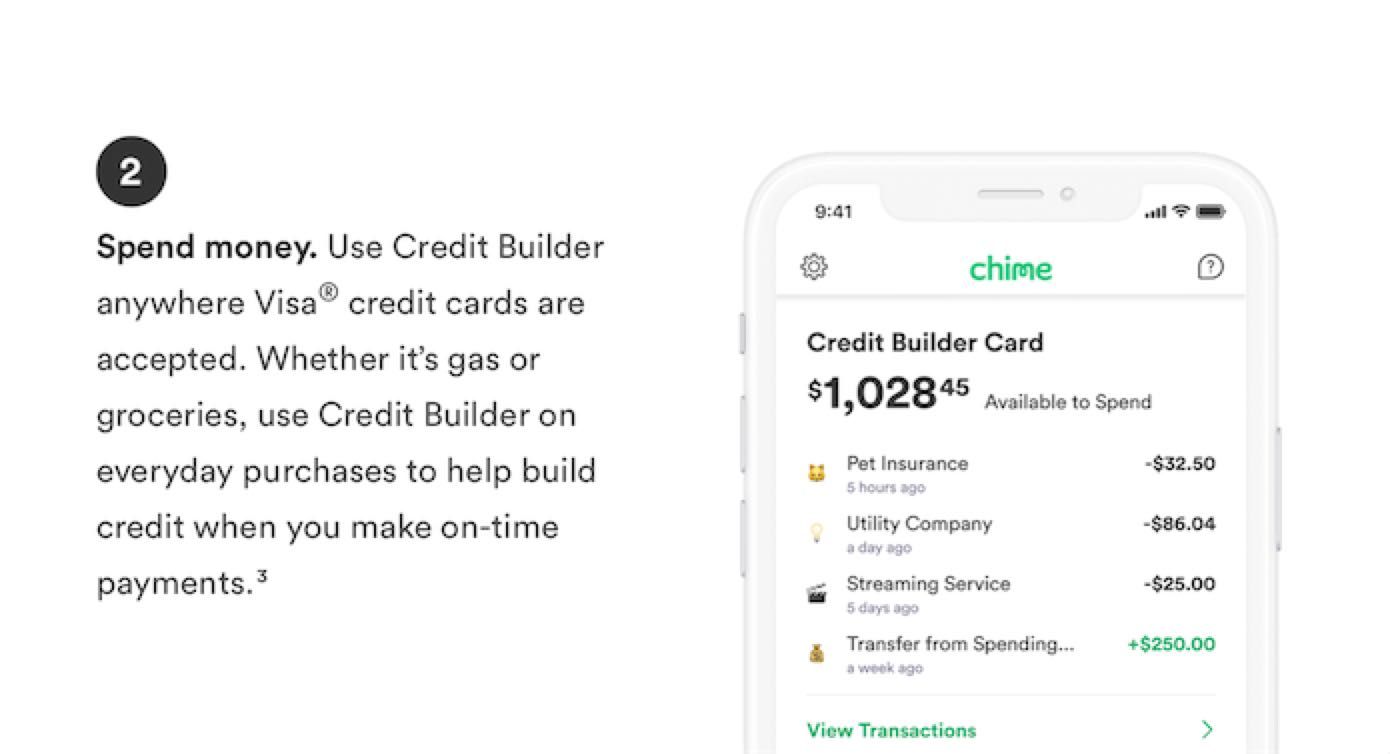

Credit Builder

This is the highlight of why Chime’s financial product may be very useful for those just starting to build history. The credit builder is a secured credit card where it will help you increase your FICO score without charging any interest, annual fees. A credit check is also not required. The way it works is you will deposit a set amount into your Chime account (e.g. $200), then as you use your Chime credit card to make purchases, it will automatically deduct from this deposit and report your credit history to the credit bureaus to help you build credit history!

Here’s more info on how it works: https://www.chime.com/credit-builder/

Alternatives

Other than Chime, there are many other products that can achieve the same goal, though with varying levels of difficulty and odds of approval.

Although the Chime secured credit card does not require a credit check, the product also does not reward you for your spend. If you are currently a student, a better alternative may be to apply directly for the Chase Freedom student card, where you earn 1% back on all spend, as well as a $50 signup bonus and $20 anniversary bonus every year your account is in good standing.