Last Updated on March 19, 2024 by CreditFred

Great, you got a credit card (or several) and accumulated some points (HOORAY!). However, earning is only half the game. How you SPEND is a whole other topic and arguably more important as there are so many traps that can misguide you to redeeming your points for cheap.

Today’s article will give you an overview on the types of redemptions you can do with your Chase Ultimate Rewards (UR) points. Future articles will go more in-depth about specific redemption options.

If you are interested in best and worst ways to use Amex points, check out this article!

Quick Summary

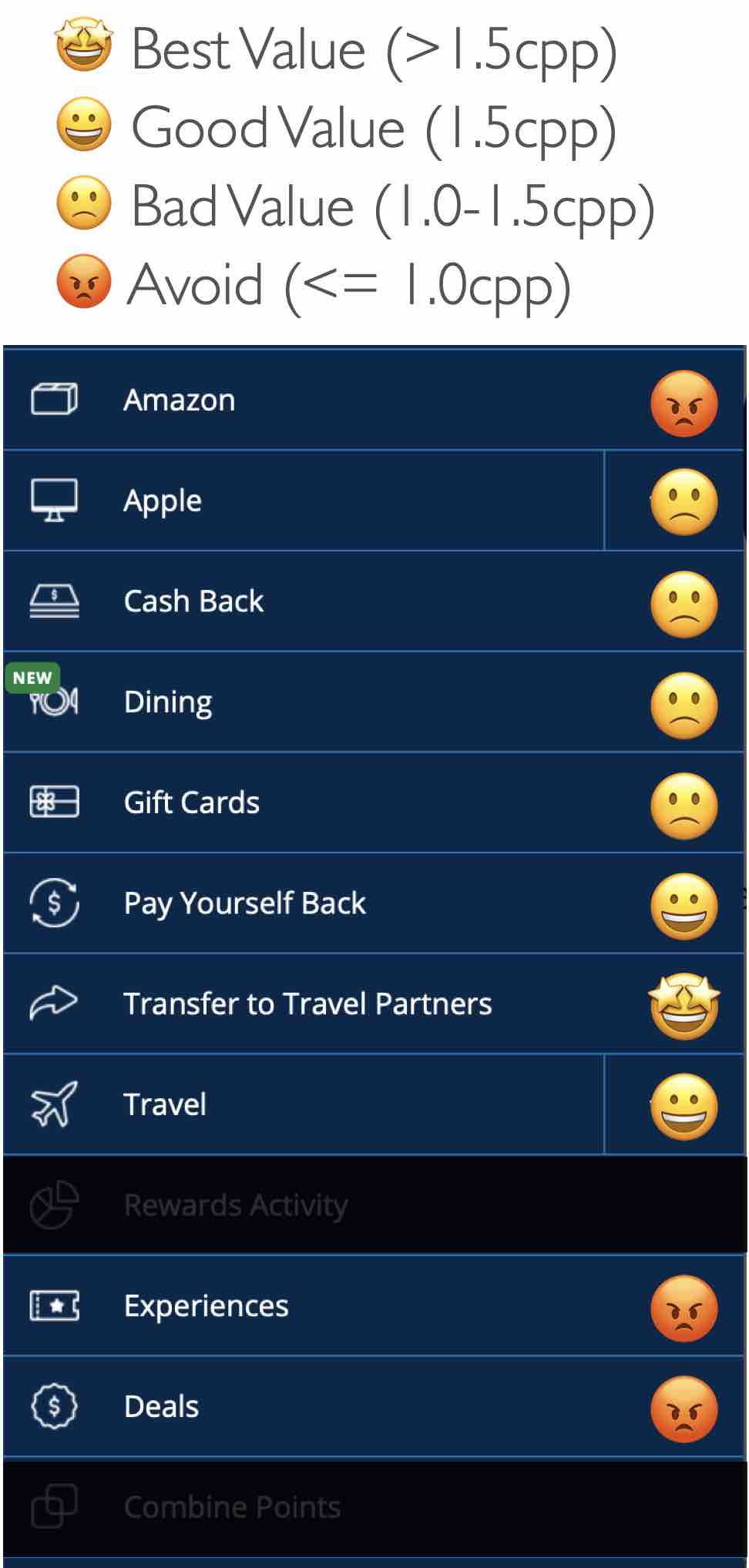

The Chase UR portal is the place where you can redeem points. Redemptions range from cashback to airfares, gift cards to Apple Products. However, which ones ACTUALLY provide the best value? And which ones are traps? Here is a quick summary of all the different options:

Note the term cents-per-point (cpp), which is what each point is worth if we had paid for the redemption with cash. For example, – 1.5cpp means each point is worth $0.015, therefore:

10,000 UR points = 10,000 * 0.015 = $150

Also keep in mind that due to the current global pandemic, travel (which UR points perform best with) may not be all that useful. However, if you are willing to save them up for future aspirational redemptions (e.g. Emirates First Class), it may be worth it. Alternatively, if you have better uses for your points in the short term, cashing them out using Pay-Yourself-Back is not a bad option either.

Next, we’ll dive a little deeper into each to see which ones to use and which ones to avoid.

Best Value ????

Below are the top 3 redemptions I recommend, from best to less ideal:

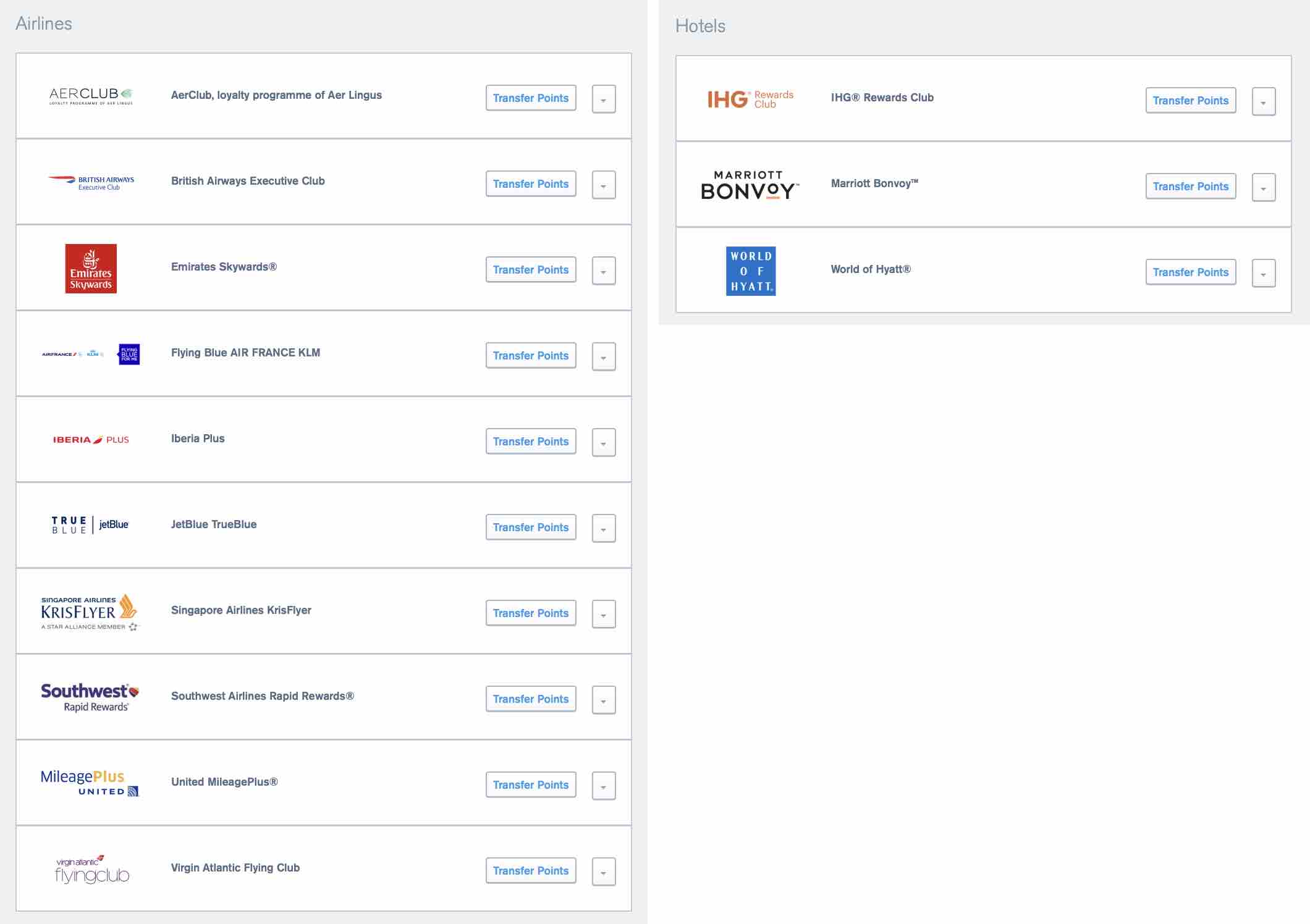

1. Transfer to Travel Partners (1-8+ cpp)

The best value of credit card points is the ability to transfer to a myriad of airline and hotel partners. It is here where you will be able to use your points to fly that aspirational first-class cabin for free or stay in a 5-star hotel. This is where your $1000 worth of cashback can redeem you a business class flight normally costing $4000+. However, not all transfer partners are equal, and it requires a certain degree of research and knowledge to do a redemption. Since each program is unique and have their own pros/cons, we will have to do a deeper dive into transfer partners in a future article. In short though, I find value in the following:

Airlines: Air Canada Aeroplan (NEW!) , United, Singapore, Virgin Atlantic

Hotels: Hyatt (avoid other hotel transfers at basically all cost!!)

An example of getting a value of 5cpp is when I transferred points to United and redeemed for EVA Air Business Class. Read this post for more details.

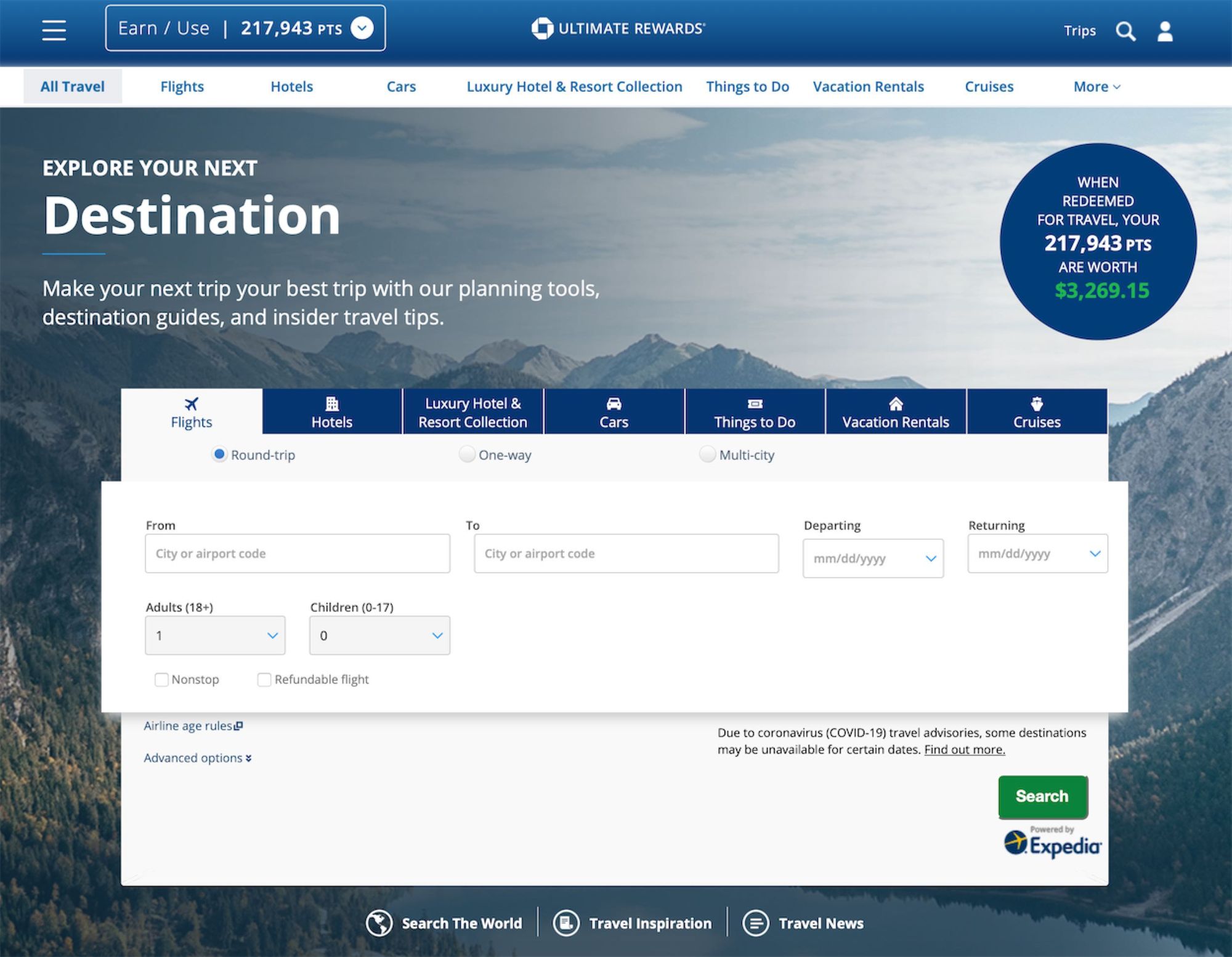

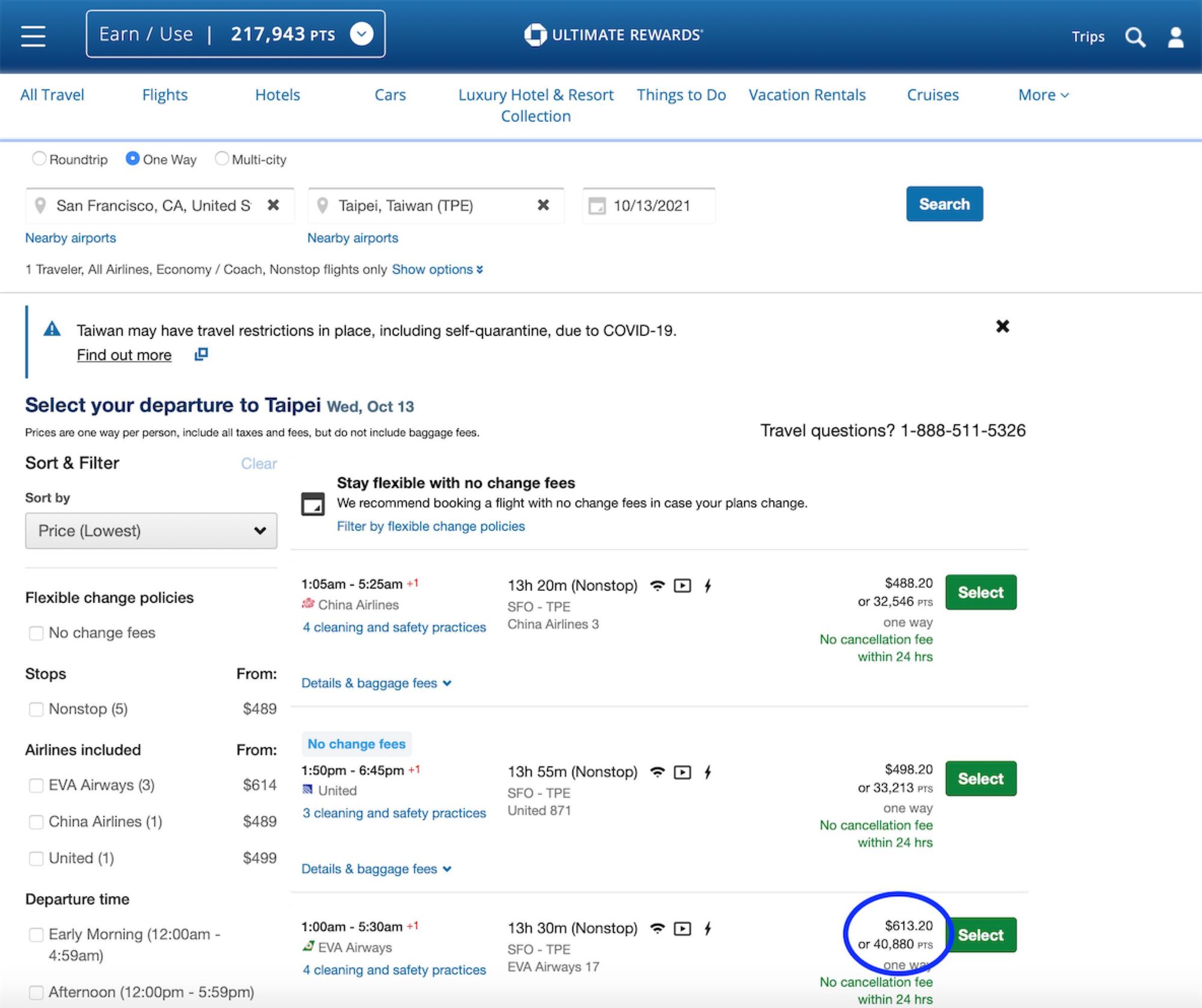

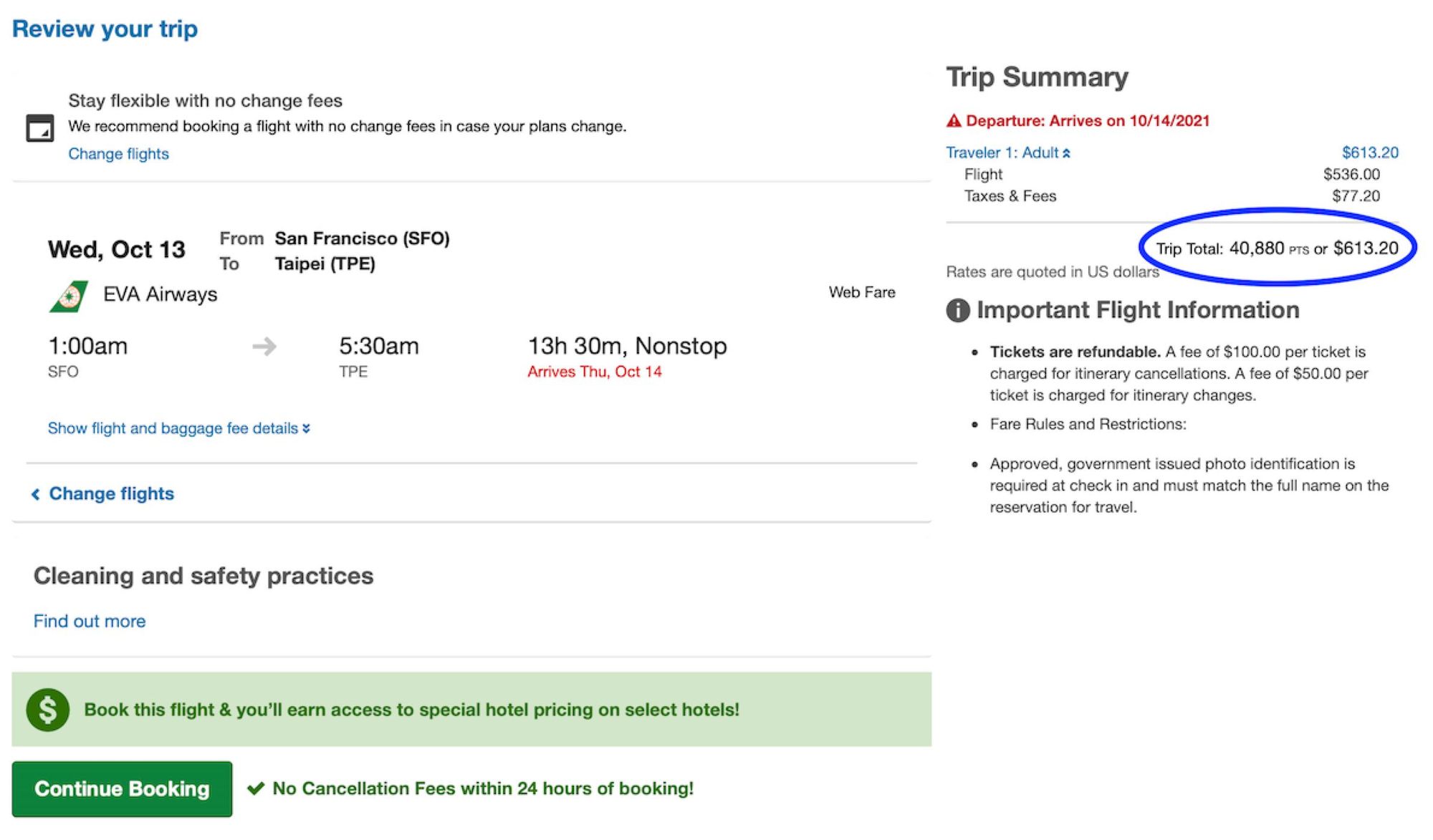

2. Chase Travel Portal (1.5cpp)

For those that want simplicity or are beginners to credit cards, Chase has partnered with Expedia to run a travel search engine where you can book flights, hotels, rentals, cruises, etc. the same as you would on expedia.com. However, the benefit here is that you can use your points, and if you hold a card like the Chase Sapphire Reserve, you can get an extra 50% more value on your redemptions, giving you an easy way to redeem at 1.5cpp. It also works similarly on the Chase Sapphire Preferred but only at 25% more value, so 1.25cpp.

When you search for your flight, the website will display the amount needed in points or cash. You can also choose to pay a portion in points and the remaining in cash if you wish. An added benefit of using this portal is that you will be able to earn additional airline miles for flights, as this is considered a purchase and not a reward redemption. I find great value here when using points to book economy flights.

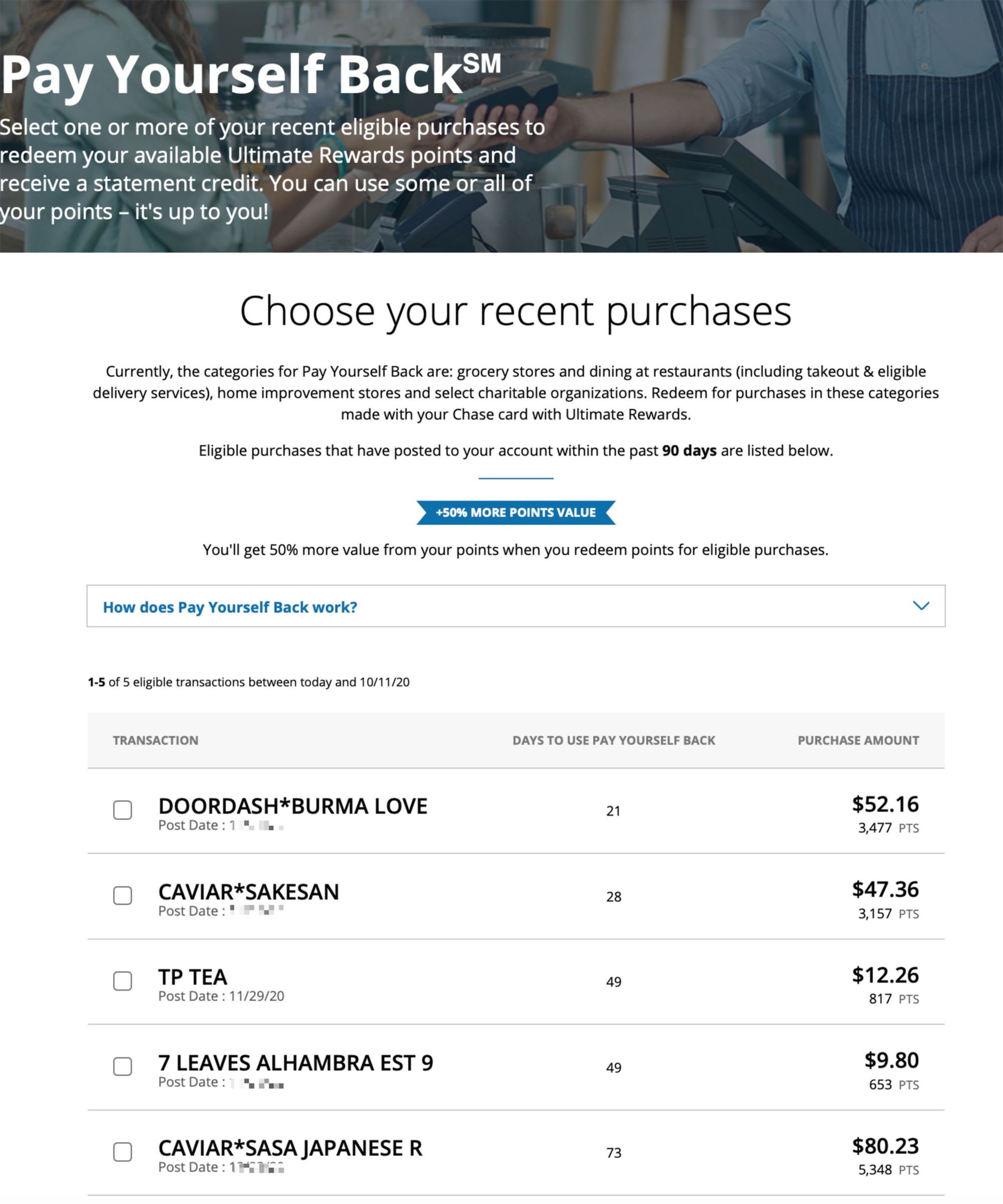

3. Pay-Yourself-Back (1.5cpp)

With the global pandemic, the use of travel redemptions has been severely limited. In response, Chase rolled out a new way to use points via Pay-Yourself-Back. Essentially, for eligible purchases (see screenshot below), you will be able to “wipe” them from your statement with an additional 50% bonus value, essentially redeeming points at 1.5cpp value.

Personally, I had a larger balance of UR points than I needed in the short term for travel. Therefore, I decided to redeem ~100,000 points for $1500 of statement credit, which I then put into the stock market as an investment and hedge against inflation.

Worst Value ????

Below are the worst possible ways to use your points, starting with the lowest value redemption:

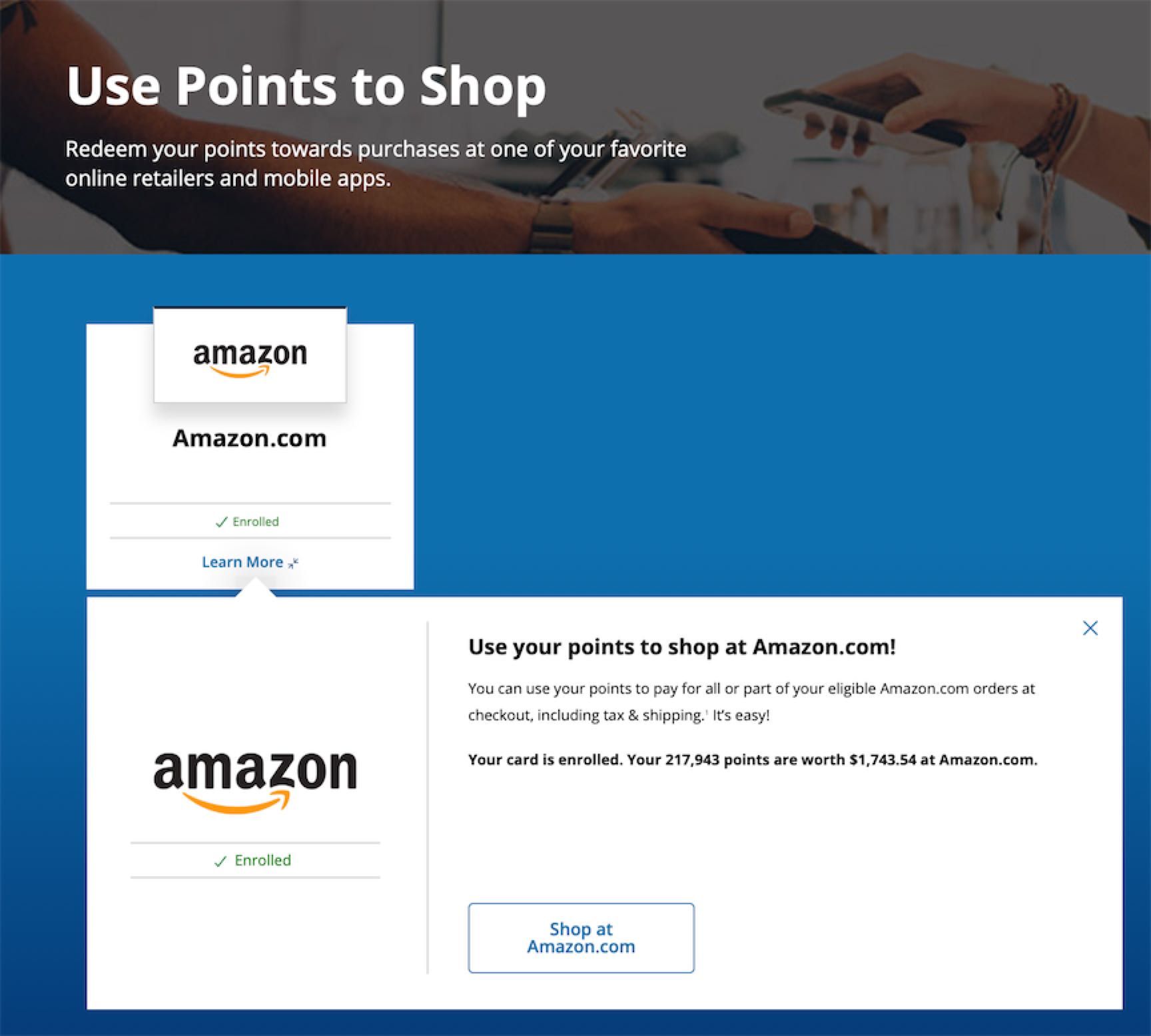

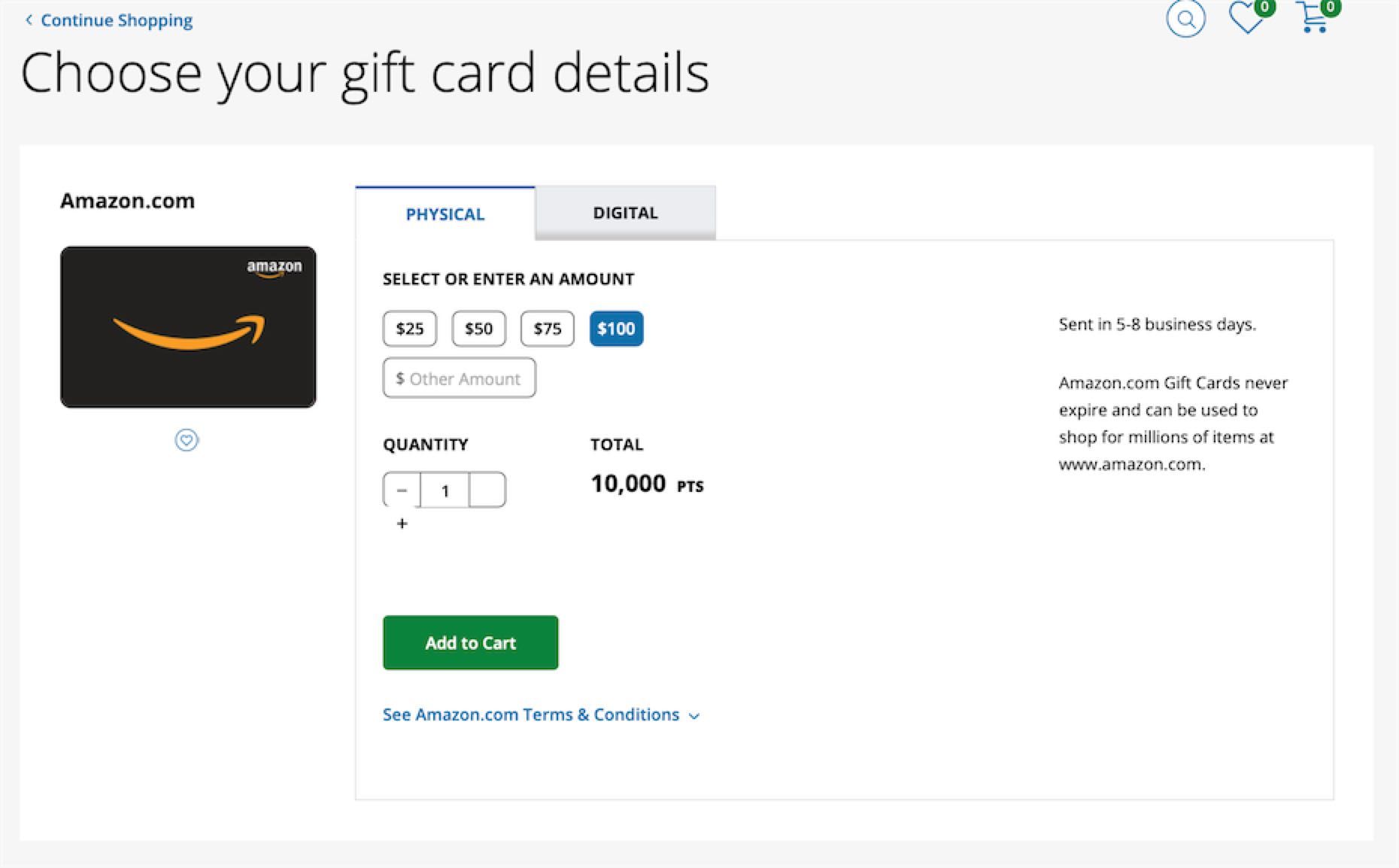

1. Amazon (0.8cpp)

This is the single worst redemption available but one that many beginners will probably fall prey to due to its familiarity. As you can see, my 200,000+ of points are not even worth $2000, giving me a redemption value of 0.8cpp. You will also lose out on additional points you can otherwise earn for Amazon purchases, such as with the Chase Amazon card (5%), along with forfeiting the purchase protection and extended warranty perks. You would be better off cashing out directly as cashback and then earning additional credit card points on purchases at Amazon.com.

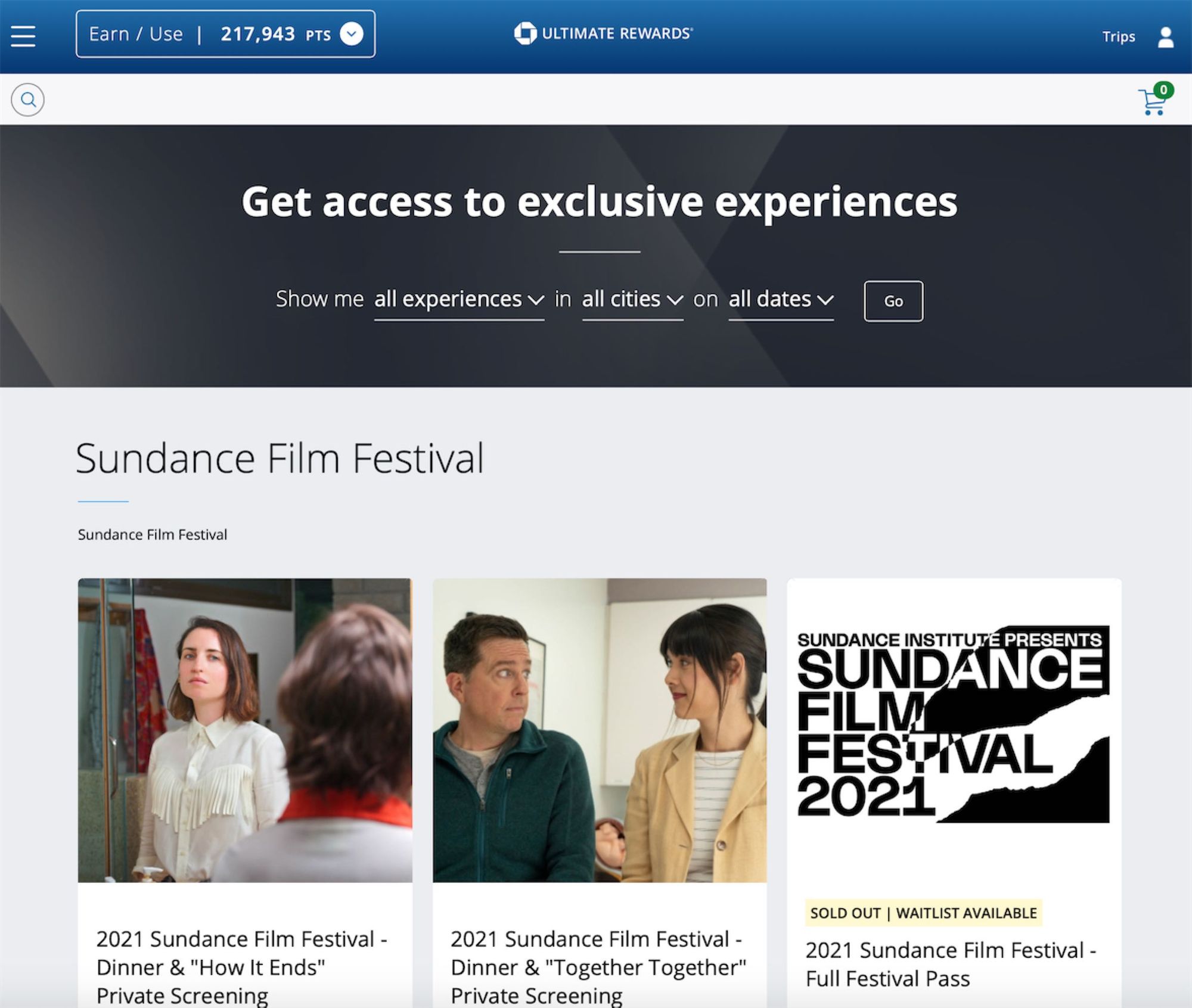

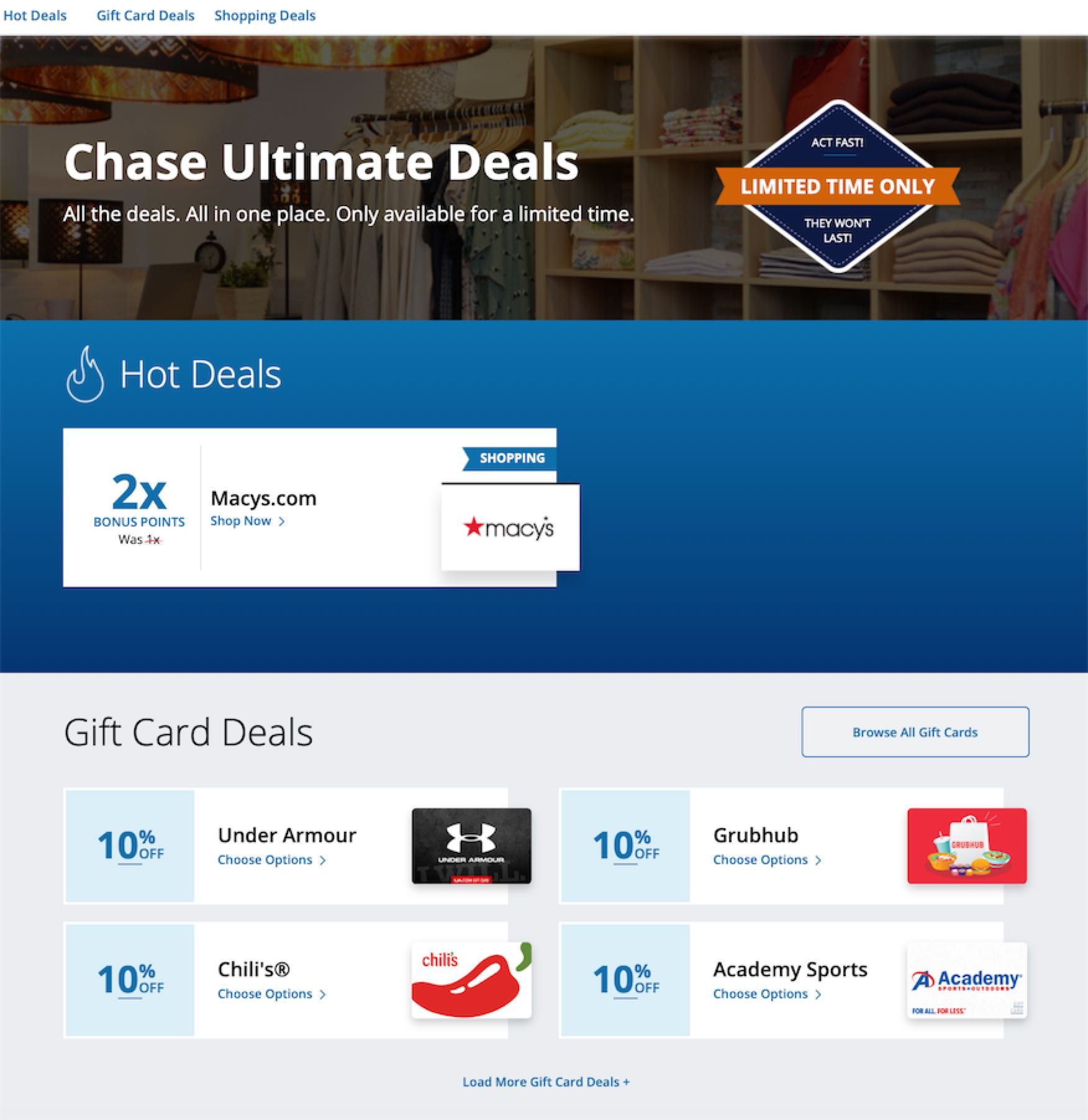

2. Deals and Experiences (~1cpp)

Overall, these redemptions can be ignored. They are usually within the range of 1cpp-1.1cpp and offer limited choices compared to other options. For Experiences, sometimes there are “exclusive” invitations to events that you can choose to pay in points, but in my experience they haven’t been very enticing and the value you get is a measly 1cpp. As for Deals, it isn’t a redemption in itself but a portal showing you the available gift card redemption promotions (see below), which are also not a great value (~1.1cpp).

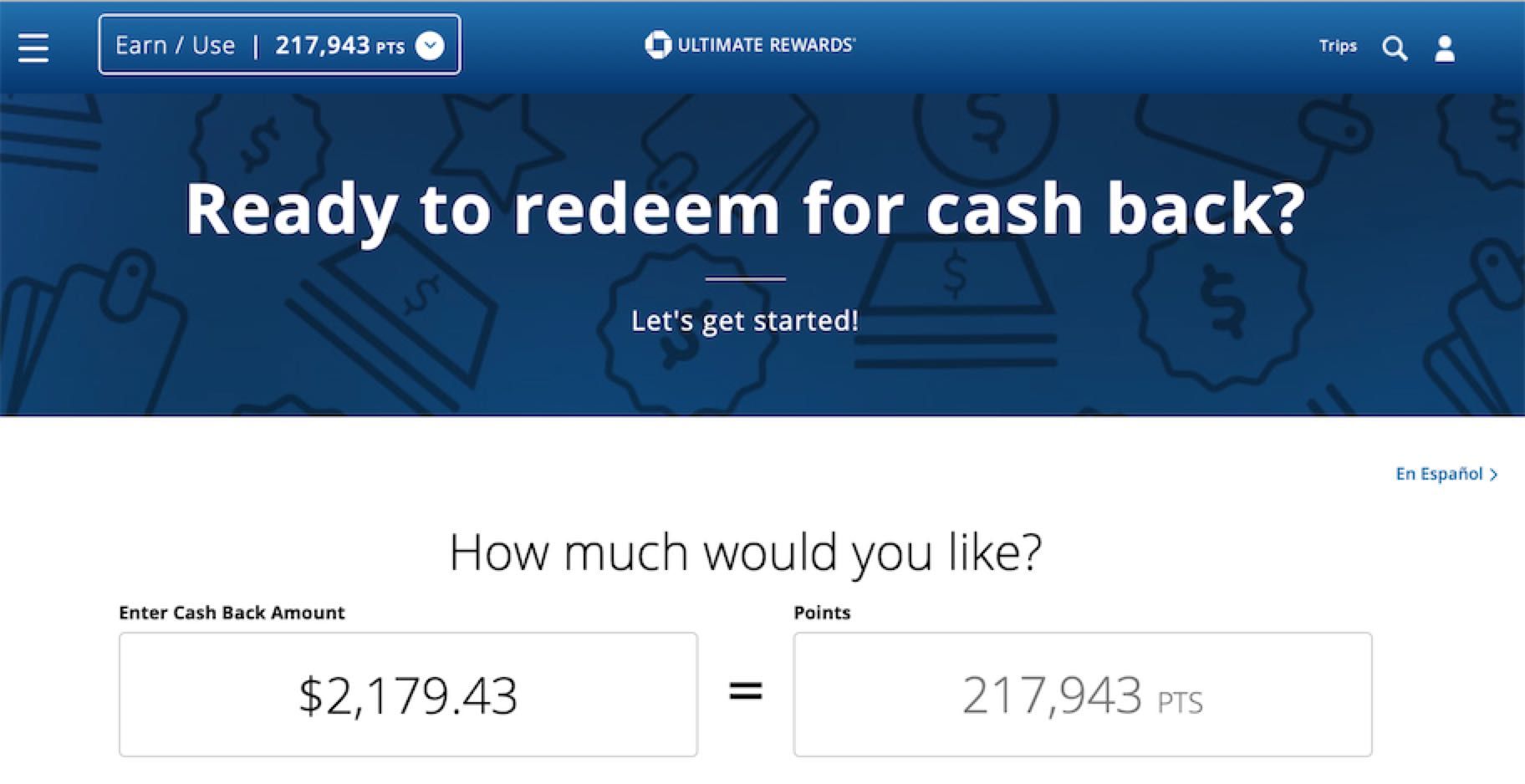

3. Cashback (1cpp)

A very simplistic way to receive monetary rewards from your credit card purchases by cashing out at 1cpp (100 UR points = $1). Although not great value, the simplicity and liquidity of cash is an advantage, and it’s good to know that you at least have this option if all else doesn’t work for you or you have an urgent need for the cash. However, I would suggest seeing if you can use Pay-Yourself-Back instead to essentially achieve the same result but at a much higher redemption value.

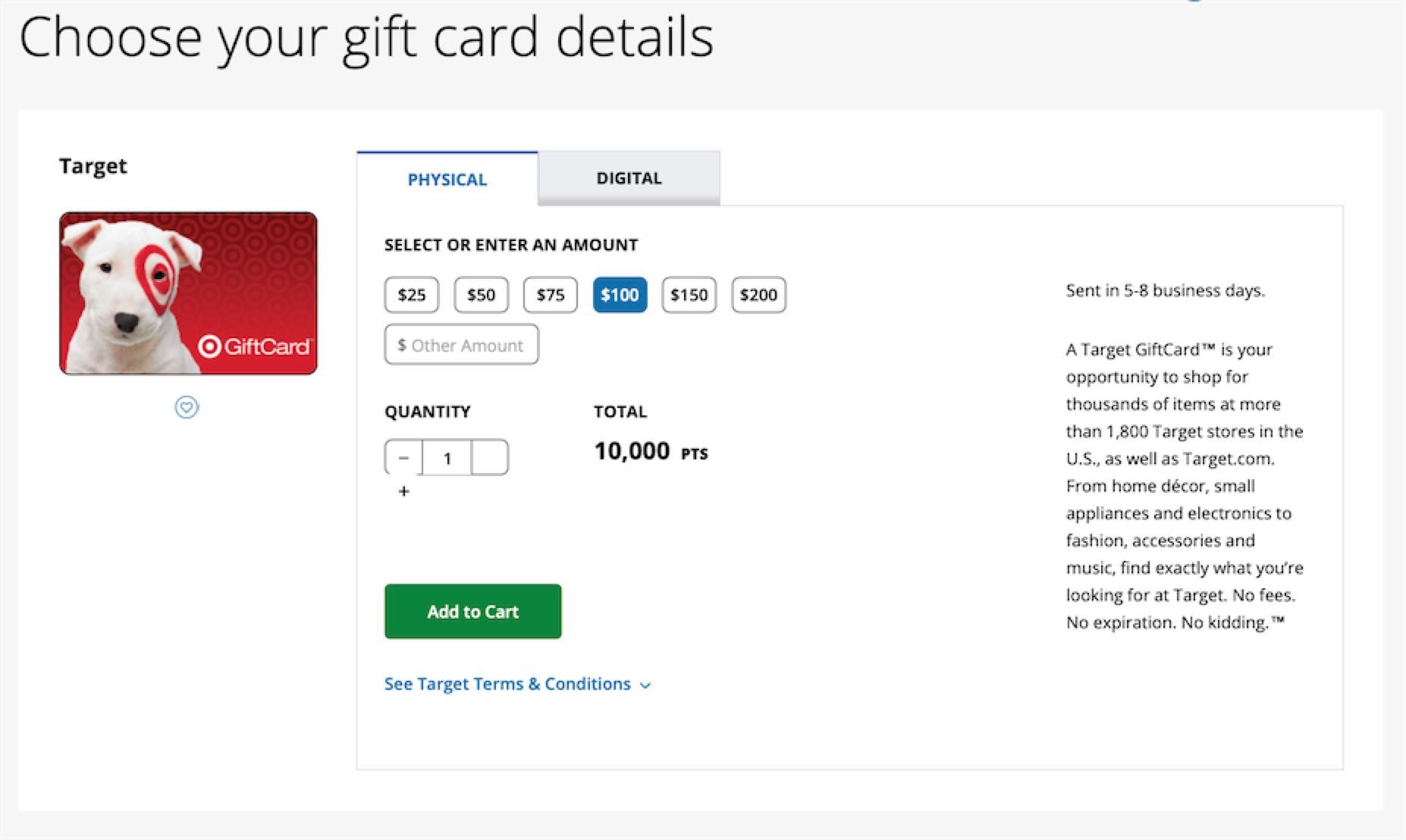

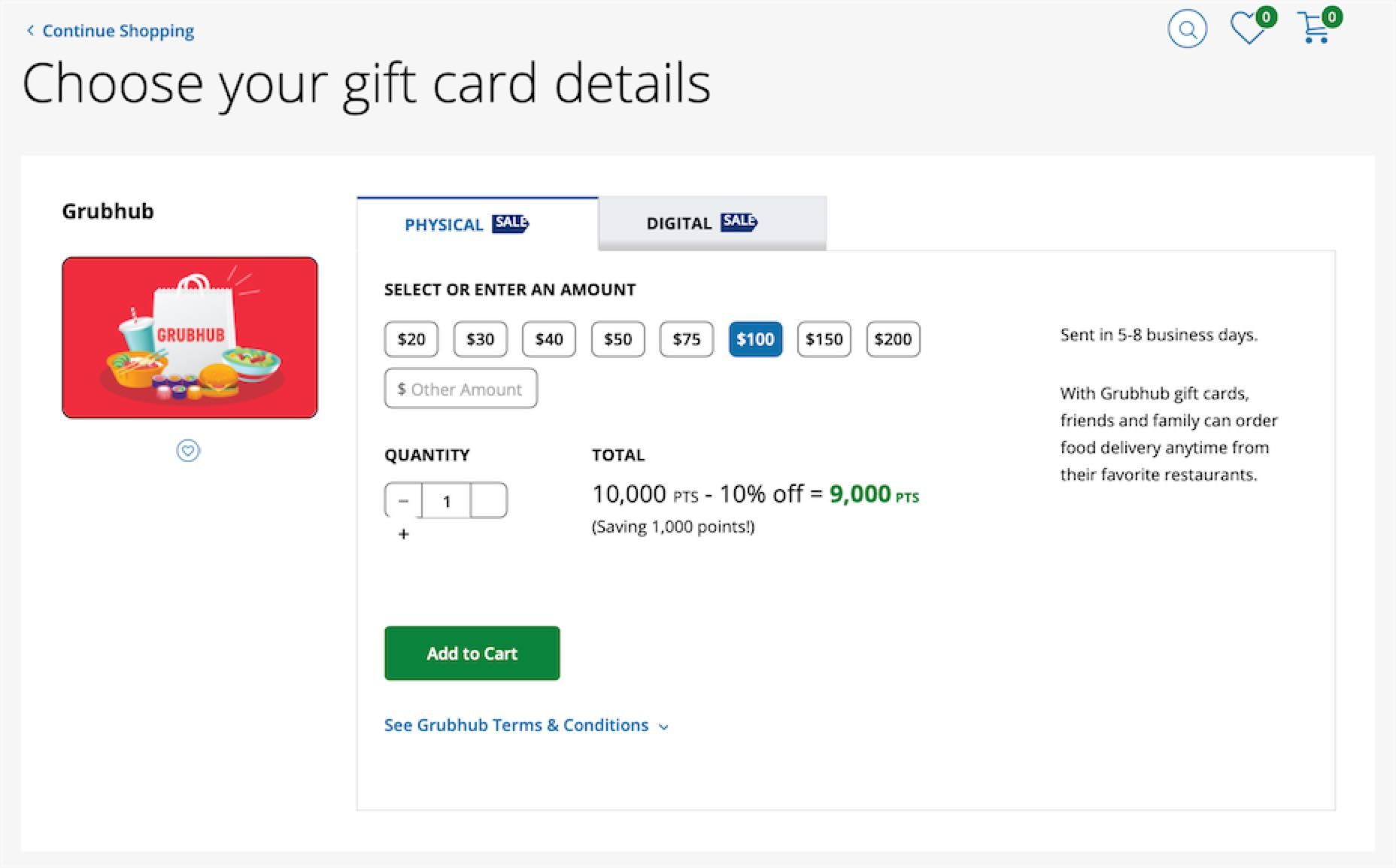

4. Gift Cards (~1-1.1cpp)

Another option many beginners may choose due to the ease-of-use. However, note that even with the occasional promos (see Grubhub example below), there are many other options available that can net you substantially more value than gift cards.

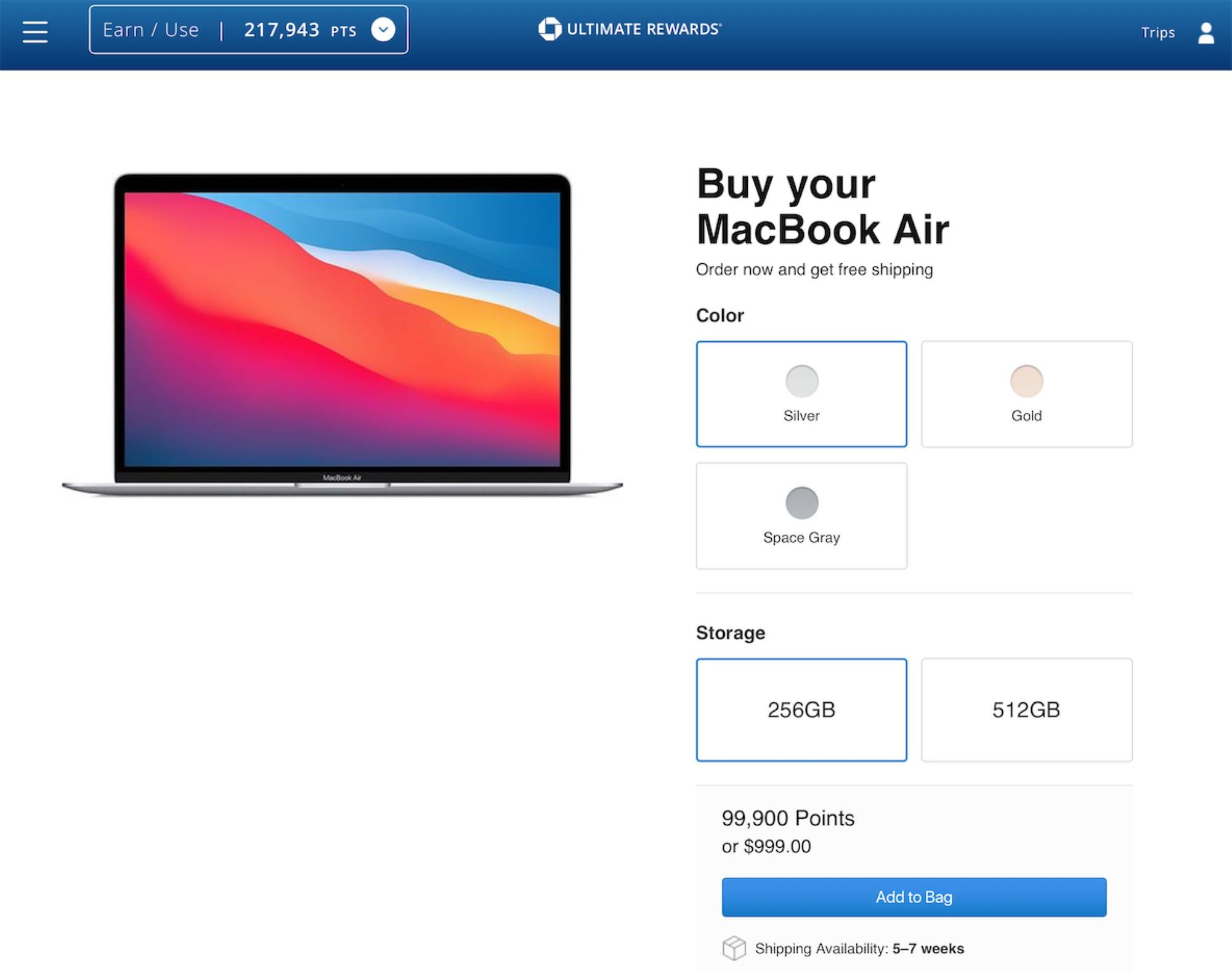

5. Apple (1-1.5cpp)

The thought of getting free Apple products via your credit card points sounds extremely enticing. However, the 1cpp redemption value is not great, and you would be better off redeeming for cashback and earning an additional 3% by using a credit card with a shopping portal like Rakuten. This is even true when Chase occasionally runs promotions where you get an extra 50% in value, giving you a 1.5cpp redemption. Most importantly, you miss out on the purchase protection and extended warranty perks that are included when you purchase using certain credit cards.

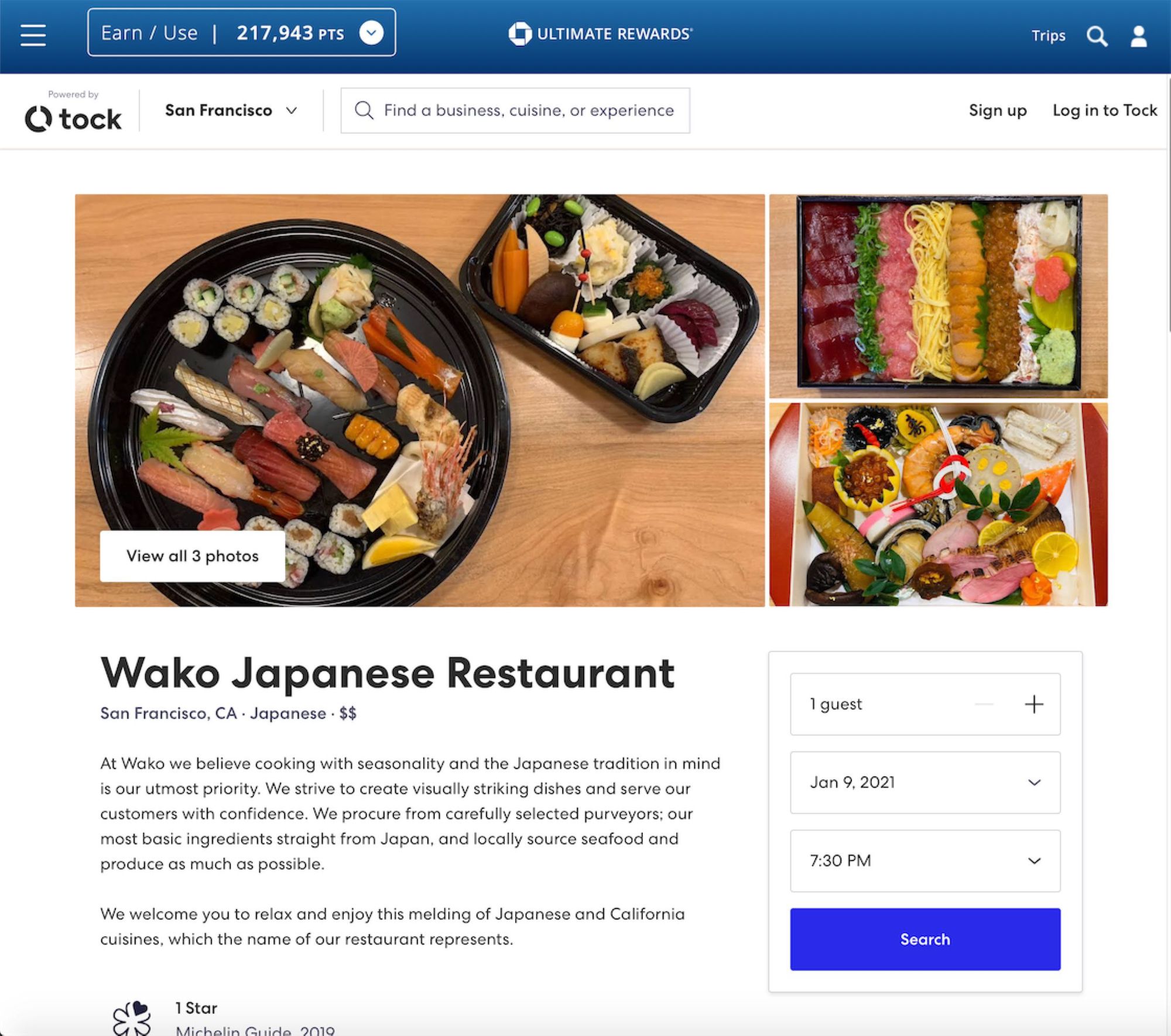

6. Dining (1.5cpp)

Should none of the “best” options outlined earlier work for you, redeeming your points for 1.5cpp value on food is a solid redemption. However, do note that many cards like the Chase Sapphire Reserve offer 3x on dining, or the Amex Gold 4x dining, so you will be missing out on that when redeeming using this option.

Important Notes about Chase Ultimate Rewards

- Points from Chase UR earning cards (e.g. Sapphire Reserve, Sapphire Preferred, Freedom, Freedom Flex, Freedom Unlimited, etc.) can be combined together into one account for redemption.

- Chase allows different members of the same household to pool their points together. This is great as you can have just one member holding the more valuable Sapphire Reserve and have all other members transfer over for the higher redemption value. This transfer can go both ways, so move them around as you see fit.

- Chase points never expire as long as your accounts are open and in good standing.

- Chase allows you to upgrade/downgrade your cards, so you do not lose your “points” just because you downgraded. They simply show as cashback until you upgrade again.

- Points transferred to airline and hotel partners cannot be reverted (one-way street), so make sure there is award availability before you transfer your points (e.g. Chase UR –> United MileagePlus).

Next: Here are the best (and worst) ways to use your American Express (Amex) points!