Last Updated on March 5, 2024 by CreditFred

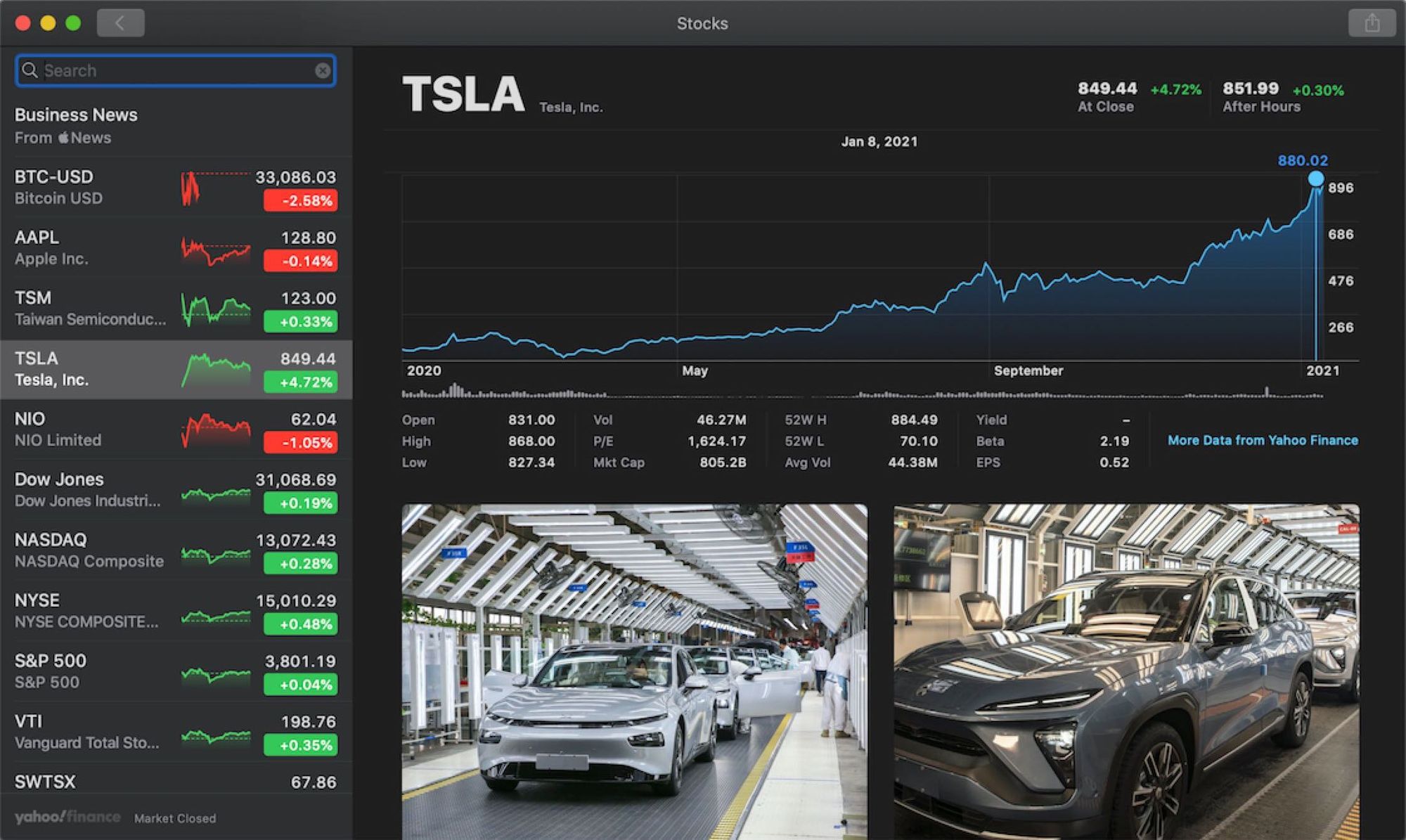

With record low interest rates, a second stimulus under way, and the inevitable inflation, the stock market has become one of the best places to retain (and grow) the value of your assets (we’re going to ignore crypto for today’s discussion). You will essentially be losing out if you are still hoarding large sums of cash in your 0.01% APY savings accounts, especially when considering that OVER 25% of the wealth that exists in the world today was created in 2020. Right now, it is more crucial than ever to protect your hard-earned wealth through investing.

The Risks vs. The Rewards

Of course, the stock market can be a scary place, where you often hear stories of people losing their life savings in a matter of minutes. However, one can find a balance between the right risk and reward.

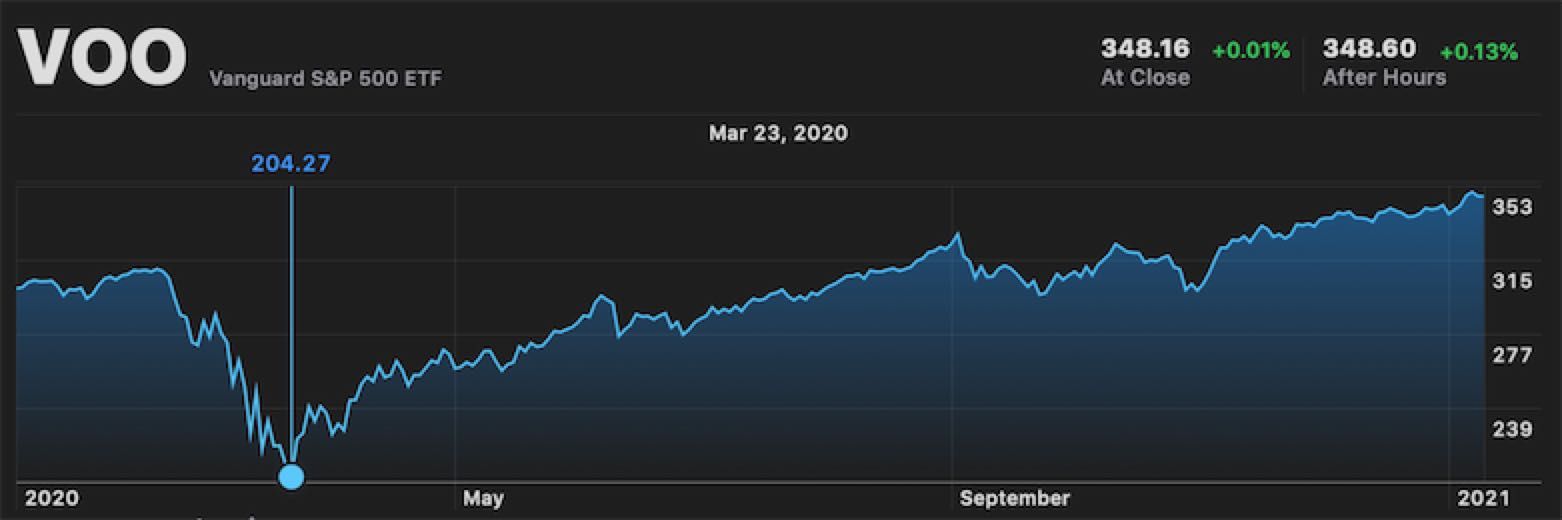

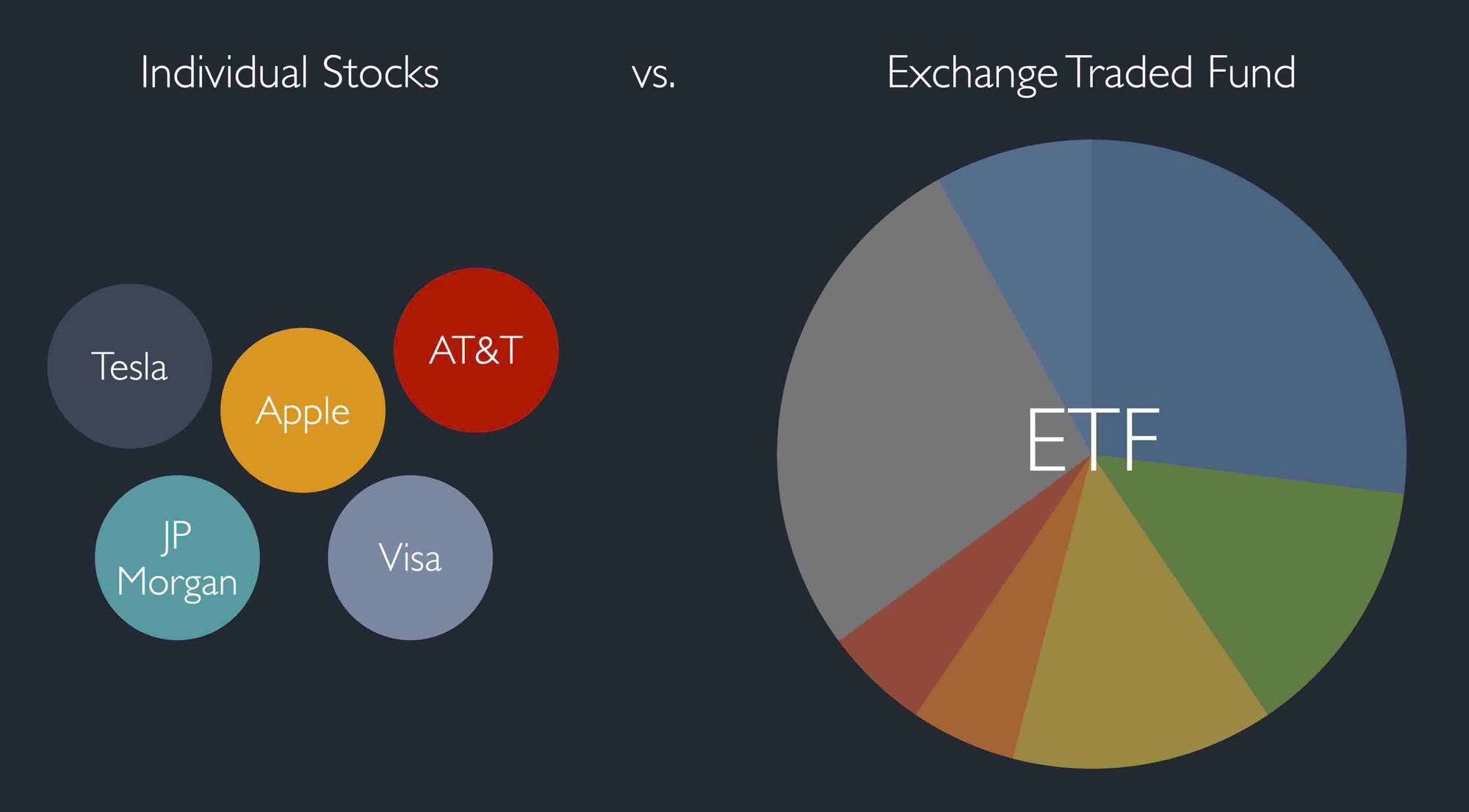

With riskier investments, you can go from losing your entire portfolio’s value one day to becoming a millionaire the next. You can avoid this by diversifying your portfolio and investing in ETFs (e.g. VOO) that allow you to buy a small piece of hundreds of companies, thus spreading your risk (but this also reduces the potential returns). Decide on an investment portfolio that works for you depending on your risk tolerance. The most important thing is for you to take action.

My Story

I was actually quite risk adverse before the pandemic and largely stayed away from investing. Looking back, I left the funds in my IRA account for over 2 years WITHOUT INVESTING simply because no one ever told me about this. I was scared of losing my money and, as life went on, I forgot about it.

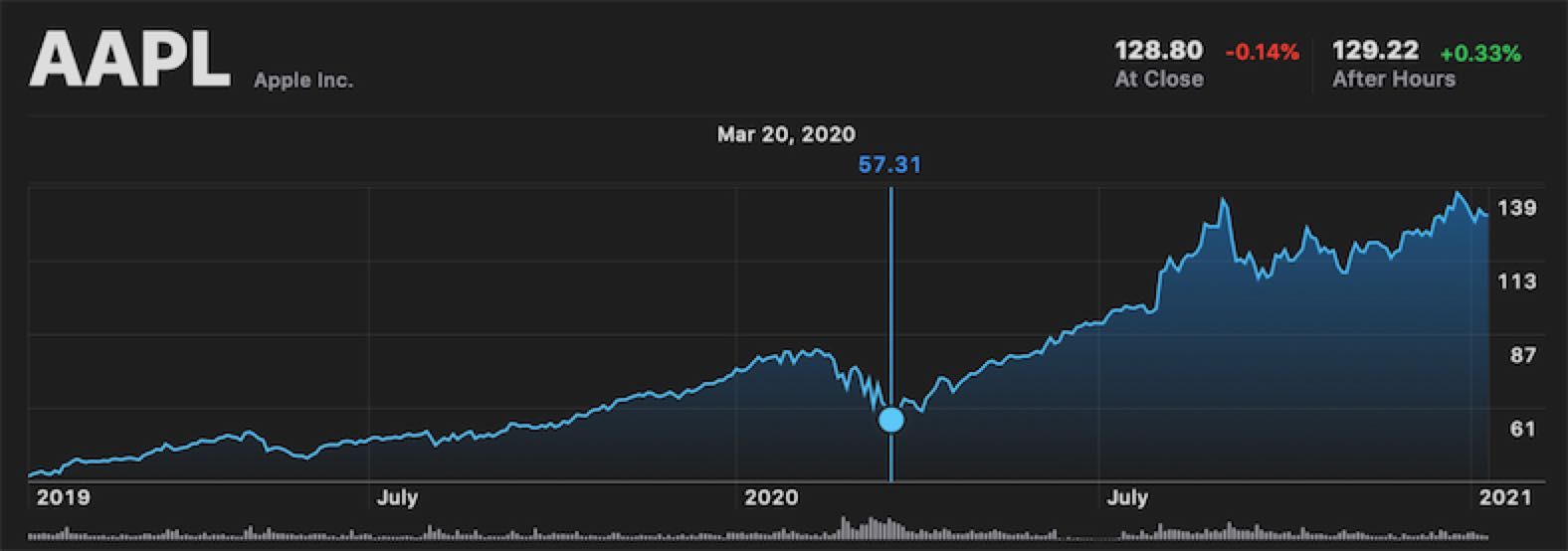

However, when the market crashed back in March of 2020, I decided this was the time to start. I told myself – it would be great if I earned some profit, but worst case scenario, it would just be a great learning opportunity that will help me manage my money better in the future (plus, it’s a steal compared to paying higher education tuition).

I recommend everyone who has been sitting on the sidelines for too long to just try investing a little. It can even just be $1, so you can watch how markets perform over time and learn. I’m still learning too, so hopefully one day we can grow this into a community where we can share all sorts of personal finance tips with one another!

1. Don’t Procrastinate. Just Start.

Don’t try to time the market. The best way to learn is to just start doing something. You can start as small as $1 and build up as you become more comfortable. Looking back, it didn’t matter if you bought high or low. If you had bought Apple at ANY TIME before last summer, it would look like a bargain by today’s standards!

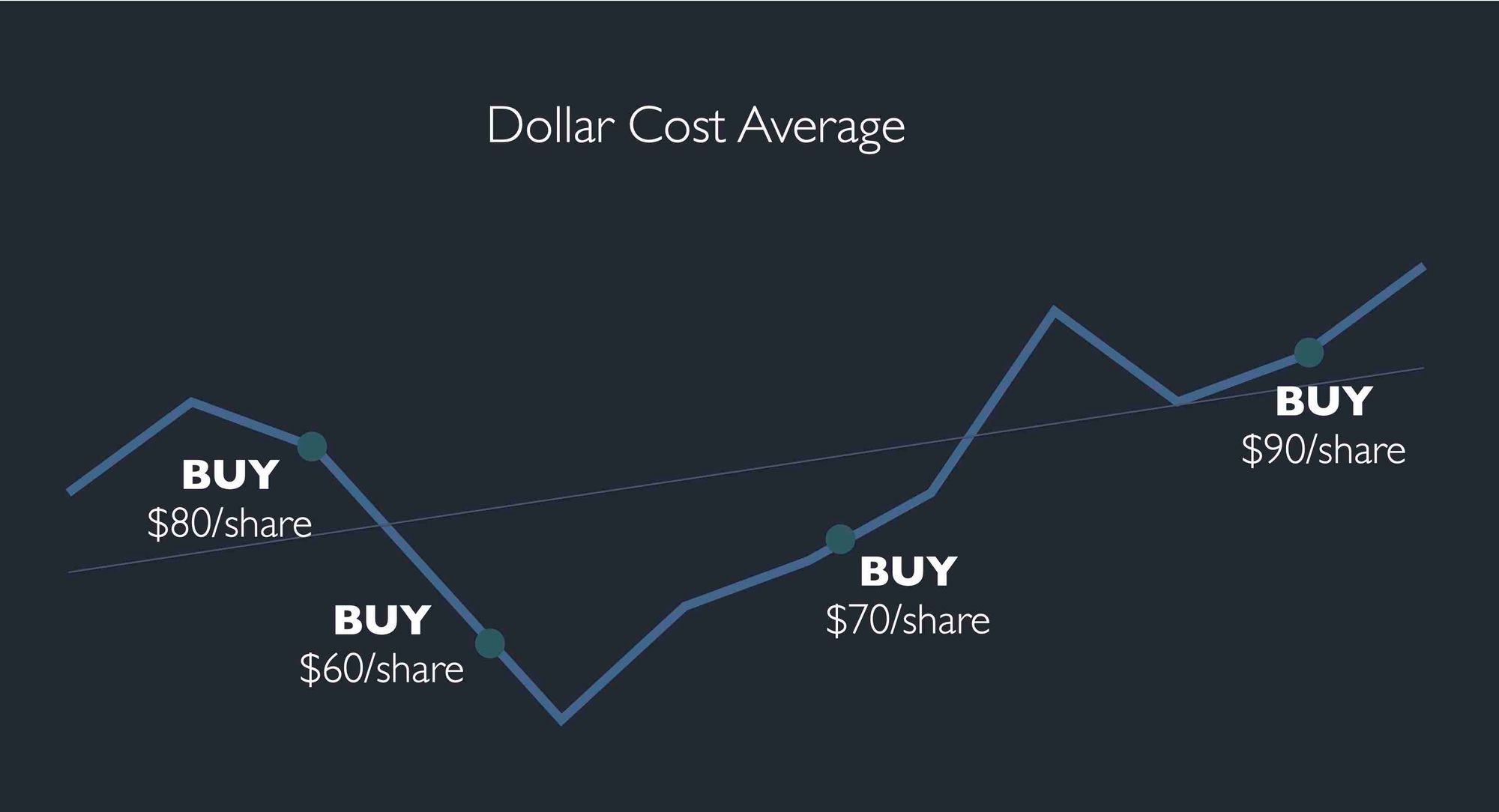

2. Dollar-Cost Average

You may think Apple and other “hot stocks” are too high and expensive to buy now, but if you believe the company has value (and not just pure speculation), start by buying in little bits over time. For example, rather than spend $120 to buy a share of Apple in one instance, buy $30 every week so that if there is a sudden drop or rise, your “cost-basis” will be averaged out. Fractional shares are more readily available across major platforms today than they were a couple years back.

3. Buy ETFs

If picking individual stocks scares you, don’t worry! In food terms, if à la carte dining isn’t your thing, go with set menus. That is exactly what an Exchange Traded Fund (ETF) is. For ETFs, rather than buying a stock of one specific company, you will be buying a little piece of many companies. There are ETFs that track the S&P 500 index (e.g. VOO), or tech-heavy ETFs (e.g. QQQ), or even the entire market (e.g. VTI). Want to buy into airlines but not sure which to get? There are airline ETFs too! I highly recommend starting with broader, more diversified ETFs if you want simplicity or to minimize risk, then start picking individual sectors or specific stocks once you feel more comfortable.

4. Consider Tax Advantaged Accounts

When you sell a stock for a profit, you will have to pay taxes. There are also some additional complications if you make too much from dividends or if you invest in real estate “ETFs” (REITs). If you would rather not deal with the tax hassle, consider opening up a tax-advantaged investment account (e.g. Roth IRA)! Since there is a lot to cover on this topic, comment below (or reach out on social media) if this is something you would like to see covered in the future!

5. Buy and Hold

The power of compounding will really show over time, especially if you don’t try to cash out your profits the second you realize them. Contributing regularly also helps accelerate this growth. For example, someone that contributes $6000 every year and sees an average 15% gain (it could vary a lot year by year, but this is a conservative average), here is how their portfolio will grow over 6 years:

Y1 ($6000) * 1.15 = $6900

Y2 ($6900 + $6000) * 1.15 = $14835

Y3 ($14835 + $600) * 1.15 = $23960

Y4 ($23960 + $6000) * 1.15 = $34,454

Y5 ($34454 + $6000) * 1.15 = $46,522

Y6 ($46522 + $6000) * 1.15 = $60,400

Contrast this to someone who simply saved the same amount every year but did not invest it, they would only have $36,000! What a difference!