Last Updated on March 19, 2024 by CreditFred

What was once seen as the king of premium travel cards has over the years evolved to something much different. The Platinum Card from American Express may have once been associated only with the wealthy elites, and often seen as a status symbol (and in many countries, it still is).

However, it has now become evident in recent years (at least in the US) that almost anyone with a decent credit score and is willing to pay the annual fee can become a cardholder. Some have even gone as far as calling it a “glorified $700 coupon book“. Is this indeed an accurate statement or far from the truth? Read on to find out!

[referral] Amex Platinum Application Link (open in incognito, be sure to compare offers before applying!)

I have just crossed the half-year mark as an American Express Platinum cardholder. I’ll be sharing my experience with the card so far, and break down whether it may be worth keeping beyond the first year.

Overview

Before going into my detailed analysis, here is a quick overview of the main features of the card:

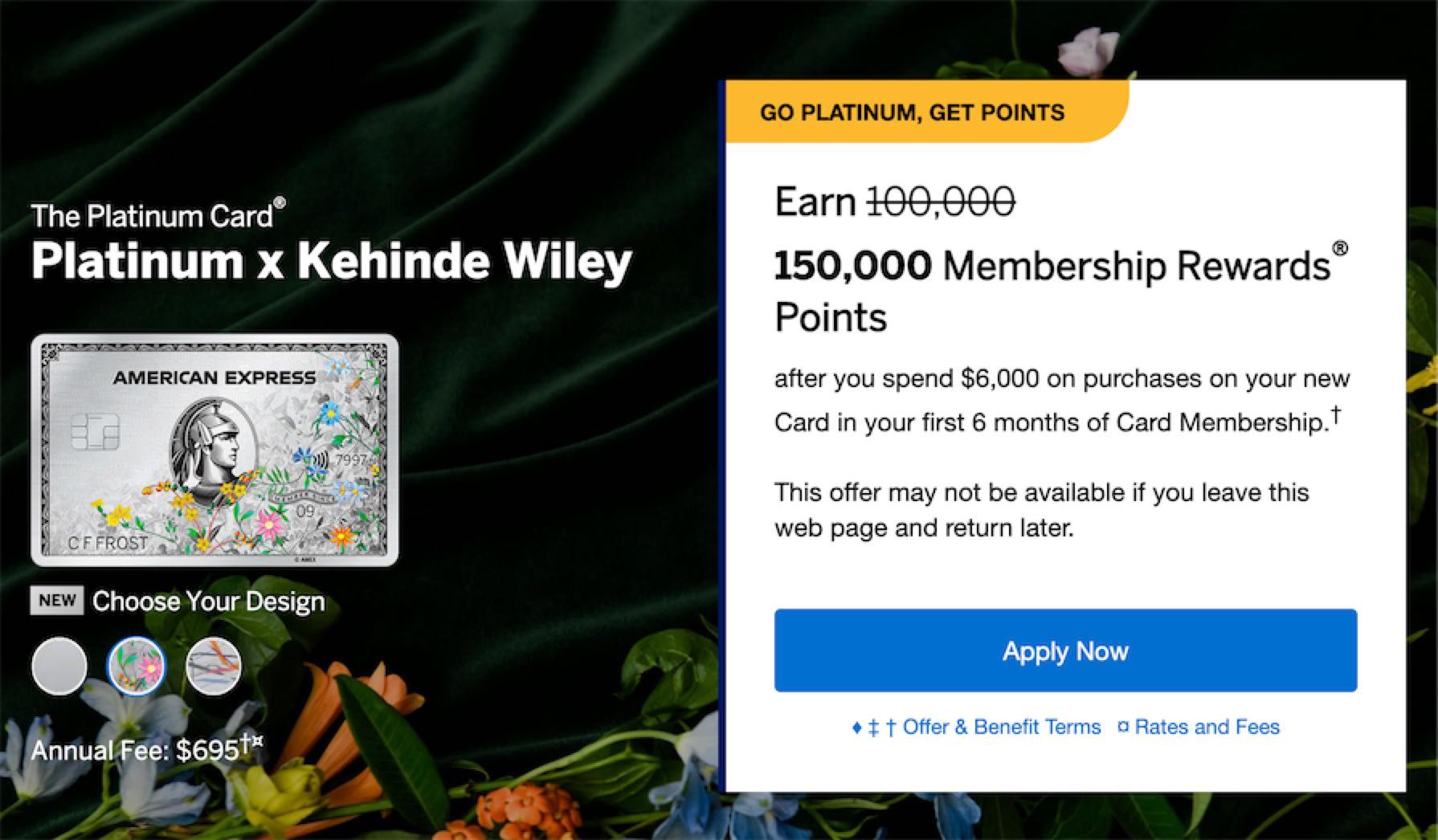

Annual Fee: $695

Signup Bonus: Varies (at the time of writing, there is a historic high of 150k MR points via referral, try incognito/vpn if seeing lower offer)

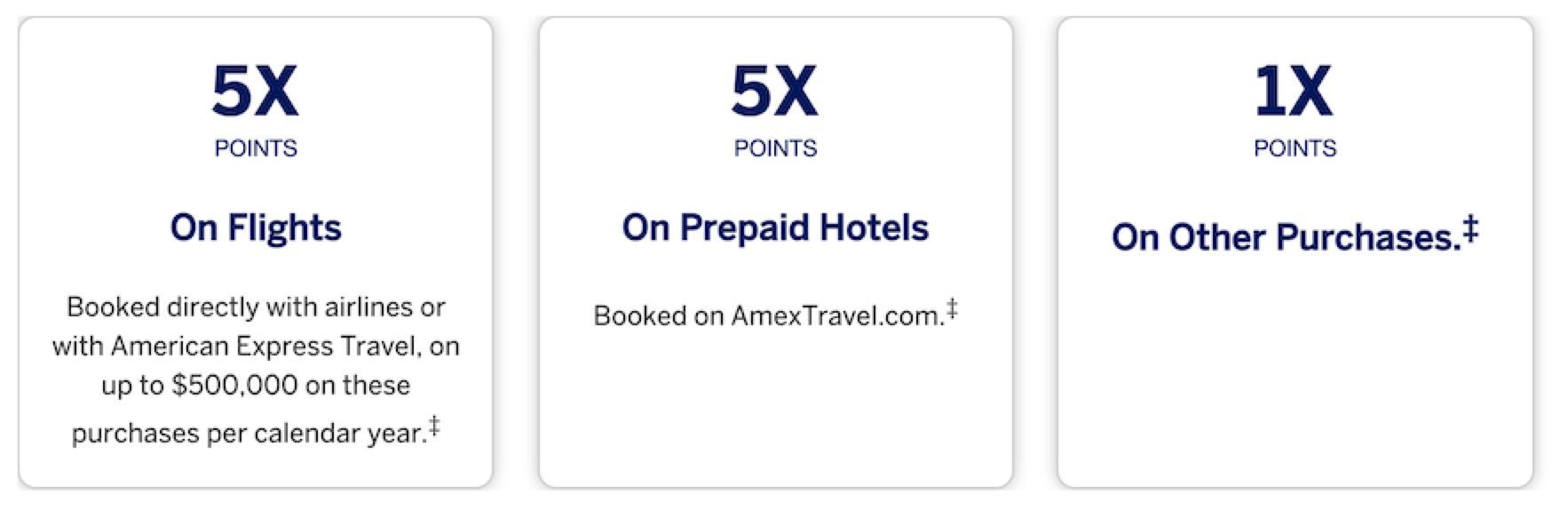

- 5x on Flights (booked directly with airlines or Amex Travel)

- 5x on Prepaid Hotels (booked on Amex Travel)

- 1x on Everything Else

- $200 Uber Cash

- $200 Airline Fee Credit

- $200 Hotel Credit

- $100 Saks Credit

- $189 CLEAR Credit

- $100 Global Entry / TSA PreCheck Credit

- $155 Walmart+ Credit

- $240 Digital Entertainment Credit

- $300 Equinox Credit

- Marriott Bonvoy Gold Elite Status

- Hilton Honors Gold Elite Status

- Premium Car Rental Status

- Fine Hotels & Resorts (FHR) Program

- The Hotel Collection Program

- Amex Centurion Lounge

- Delta SkyClub

- Priority Pass Membership

- Other Lounges

- Trip Delay & Trip Cancellation

- Car Rental Loss and Damage Insurance

- Return Protection

- Extended Warranty

- Membership Rewards Hotel & Airline Transfer Partners

- No Foreign Transaction Fees

- Amex Concierge

- Misc Benefits

Note: Do NOT to take these credits and perks at face value, as a lot of them have restrictions that may not be obvious. I will cover these in detail below!

Detailed Analysis

In this next section, I will go through each of the benefits in more detail as well as my experience utilizing them.

Annual Fee

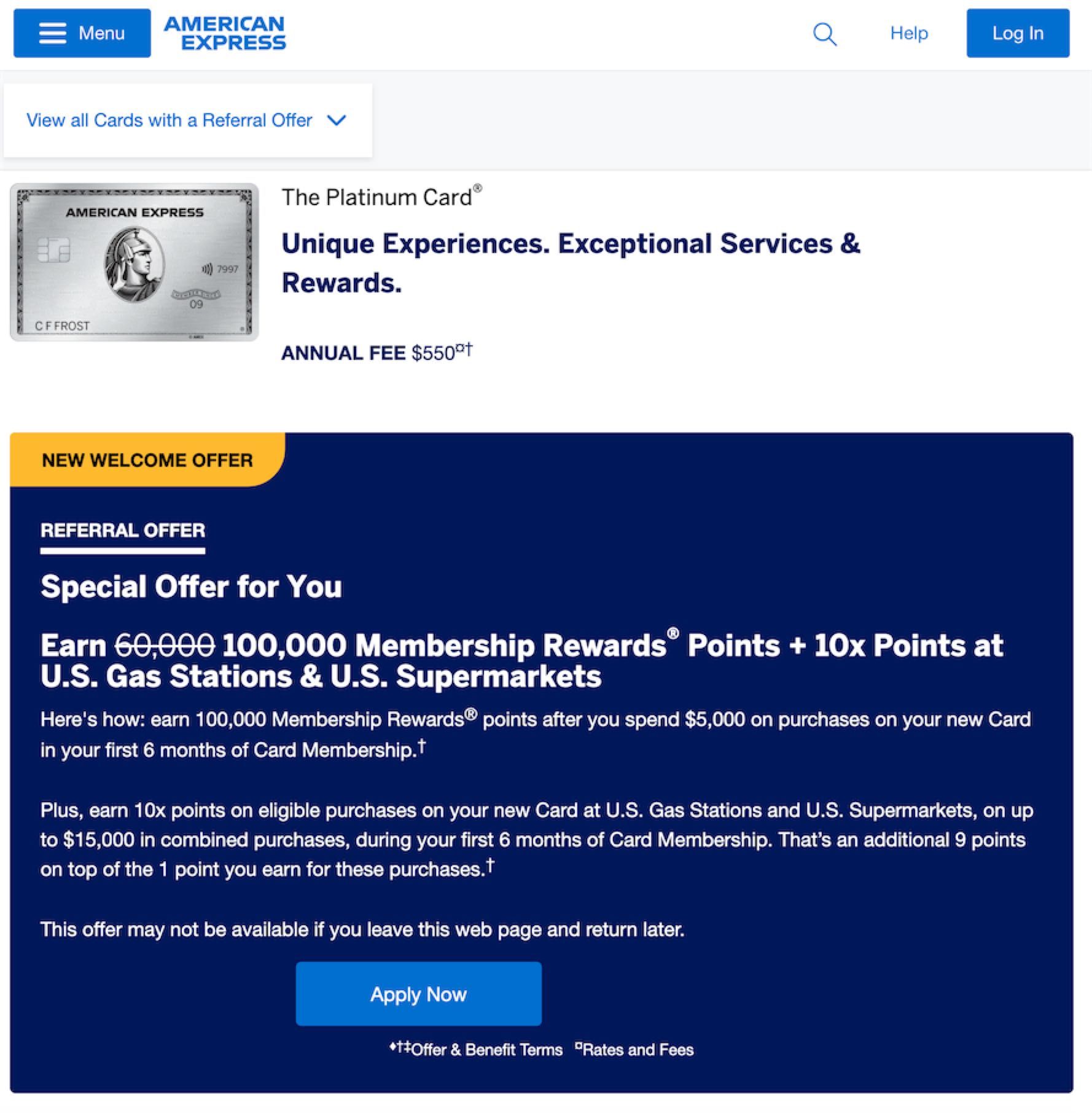

$695 – not waived the first year. This is a hefty increase from the $550 rate (when I signed up). Read on to find out how the benefits may outweigh this cost.

Note that Amex has lately been very generous in offering retention bonuses, which are statement credits or points in exchange for keeping the card open for another year. Learn more in this post.

Signup Bonus

In general, any credit card should be “profitable” in the first year, due to the signup bonus, and the Amex Platinum is no exception. The 100k-150k signup bonus that is currently offered right now is worth at least $1500+ in travel. Check out this post on how/where to use Amex Membership Rewards (MR).

When I signed up for the Platinum, the bonus offer was 100k MR points with $5000 spend + 10x on dining & grocery purchases in the first 6 months.

After the bonus period ended for me, the signup bonus (100k) and the bonus categories spend earned me over 151,000 MR points (worth at least $1500)!

In a way, the current signup offer is more competitive as it gives you 150k straight. That being said, I did get in at a much lower annual fee and got to take advantage of many temporary promotions.

Point Earnings

5x Flights

On flights booked directly with airlines or with Amex Travel, up to $500,000 per calendar year. This is a really good return. For example, a round-trip ticket to Asia could cost around $2000 during peak season (pre-covid). Putting this charge on the Platinum could earn you $2000 * 5 = 10,000 MR points (easily worth $100+). Furthermore, if you book for friends or family, this return can quickly stack up and easily justify the annual fee.

5x Prepaid Hotels

On prepaid hotels booked on Amex Travel. I find this benefit pretty useless, since prices are usually more expensive than on other travel sites (eg. Chase Travel, Capital One Travel, Expedia, etc.), and when not booked directly with the hotel (e.g. Marriott, Hyatt, Hilton, etc.), you do not typically receive any elite benefits and do not earn points on your stay. One exception is when used in conjunction with the hotel credit via the FHR or Hotels Collection program (more on that later).

Credits

$200 Uber Credit

Get $15/month (+extra $20 in December) in Uber Cash, which can be used on Uber rides or UberEats. Note that the credits do not carry over and expire at the end of each month if left unused! Since I order regularly and I combine it with the $10/month credit from my Amex Gold card, I value this benefit at nearly face value (I know food prices are inflated on the platform, but such is life).

$200 Airline Fee Credit

Select one US airline and receive up to $200 in statement credits per calendar year on incidentals, such as checked bags, in-flight food, lounge passes, etc. In my experience (and from many data points online), this can be used in “creative ways” to trigger airfare too. I value this at full $200 value since I am able to use this on actual airfare. Hint: United, Southwest 🙂

$200 Hotel Credit

Get $200 back in statement credits each calendar year on prepaid hotel bookings from the Fine Hotels + Resorts® (FHR) or The Hotel Collection on Amex Travel. This was a new benefit added as part of the annual fee increase last year. I was able to take advantage of this benefit by staying at The Ritz-Carlton Residences, Waikiki Beach (review). More details on my FHR booking here.

$100 Saks Credit

Get $50 in statement credits semi-annually (by calendar year) for purchases at Saks Fifth Avenue (in-store and online) when paying with the Platinum card. Even though many complain about this not being useful, I’ve found some very solid items and value this at least at 75% value. For example, I managed to stack the $50 Saks credit with the $30 PayPal credit (no longer available) and went through a cashback portal for this wallet purchase, resulting in my net cost to be $10 out of pocket! Update: As of 5/2023, looks like Saks has min $100 for free shipping, so potentially more annoying to use…

There is also a hack where you can buy items and return in-store for store credit, then once you’ve accumulated enough credit you can buy a higher priced item you actually want.

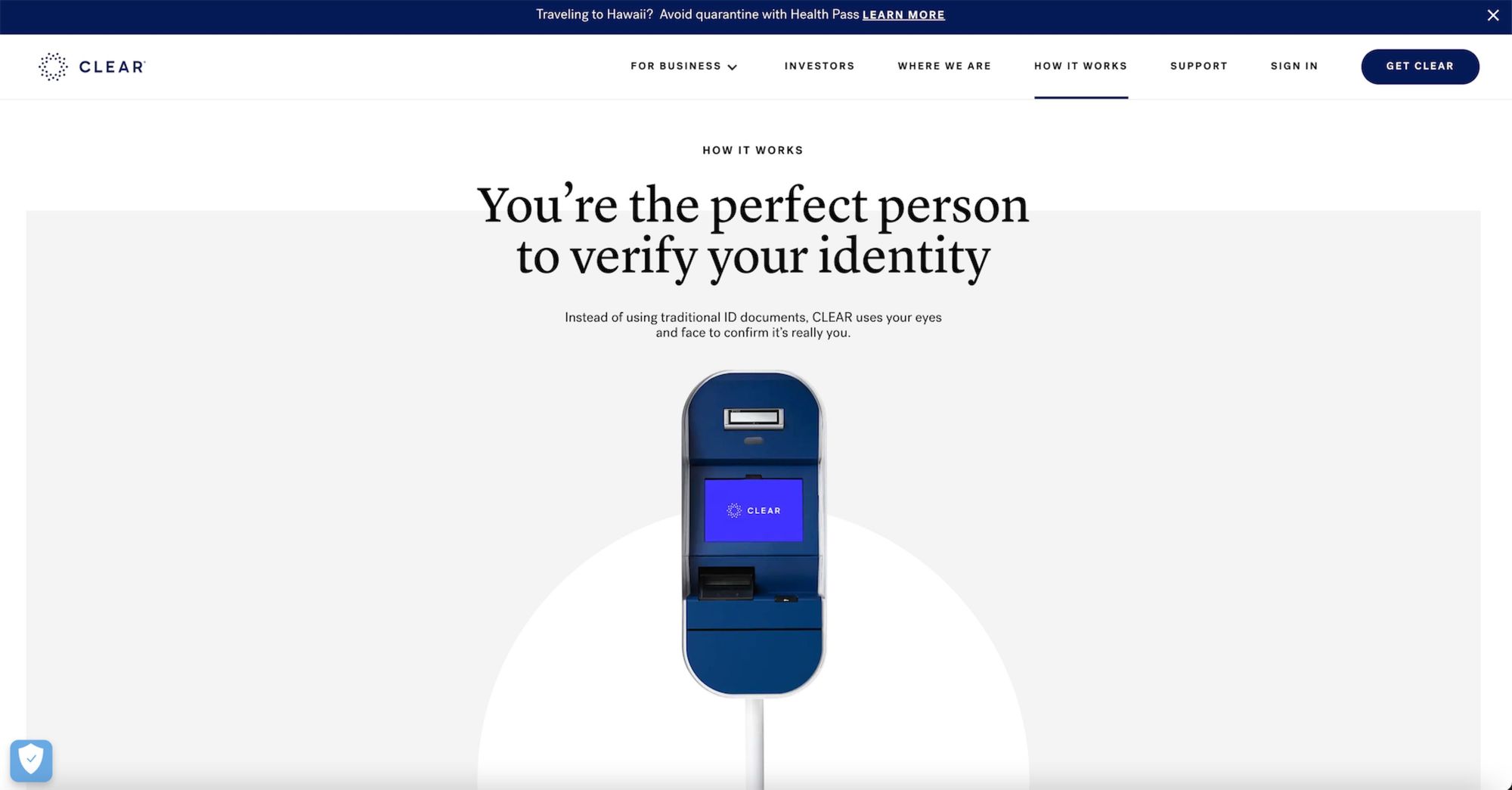

$189 CLEAR credit

Get up to $189 back each calendar year on CLEAR membership costs. If you go through loyalty programs like United or Delta, you can get CLEAR at even lower costs (which allows you to add additional members to your family plan). After my recent experience at JFK, I’ve found this service to be worth it if you travel through major airports during peak periods! For more on my CLEAR experience and how to sign up, check out this post.

$100 Global Entry / TSA PreCheck Credit

Receive either a $100 statement credit for Global Entry (every 4 year period) or a $85 statement credit for TSA PreCheck (every 4.4 year period). The cool thing about the Amex Platinum is that you can add up to 99 additional “Gold” authorized users (not to be confused with Amex Gold card, which is a separate product), each with their own Global Entry/TSA PreCheck credit, for FREE! For more details, check out this post.

$155 Walmart+ Credit

The Platinum card covers the full cost of a Walmart+ membership (including taxes), which gives you free same-day grocery delivery (where available) and free shipping with no order minimums. I personally have not found much use since I rarely order from Walmart, but signed up for the membership regardless in case I ever needed something.

$240 Digital Entertainment Credit

Get up to $20/month in statement credits when you pay for eligible purchases with your Platinum card, which currently includes Peacock TV, The New York Times, and SiriusXM. UPDATE 4/6/2022: Amex has added additional services including Hulu, ESPN+, Disney+!

$300 Equinox Credit (probably useless)

Get up to $300 (annual) in staetment credit when you pay for eligible Equinox membership (which costs $200+/month…). I guess if your company is already reimbursing you, then this is great, but for most of us, this is arguably even more useless than the Digital Entertainment Credit above. UPDATE 11/2022: Amex is now making this credit easier to use.

Status Benefits

Marriott Bonvoy Gold Elite Status

Receive complimentary Marriott Bonvoy Gold status, which gives you benefits such as 25% bonus points on stays, enhanced room upgrade, 2pm late checkout, welcome gift of points, etc. I’ve found this benefit useful (such as in Hawaii), even if my travel has been restricted to domestic ones so far. This could provide even more value once international travel fully recovers.

Hilton Honors Gold Elite Status

Receive complimentary Hilton Honors Gold status, which gives you benefits such as additional point bonuses on stays, room upgrades, daily food & beverage credit (US) / free breakfast (non-US), etc. Since I don’t really stay at Hilton properties, this has not been very useful to me. Furthermore, the new Hilton food credit for US properties is a complete scam, though I could see the free breakfast being useful if you stay at international Hilton properties often!

Premium Car Rental Status

Cardholders can enjoy complimentary premium status at Avis, Hertz, and National rental cars. Many cards like the Chase Sapphire Reserve and Capital One Venture X also provide similar benefits, and has arguably better insurance policies attached. In addition, you can also status match across various programs, check out this post for more details.

In my experience, using the Amex Platinum corporate code for booking saved me several hundred dollars off the weekly rate, an absolute deal! I recently booked a Tesla Model 3 (review) using my Amex Platinum (+included Hertz status) and had an amazing experience!

Fine Hotels & Resorts (FHR) Program

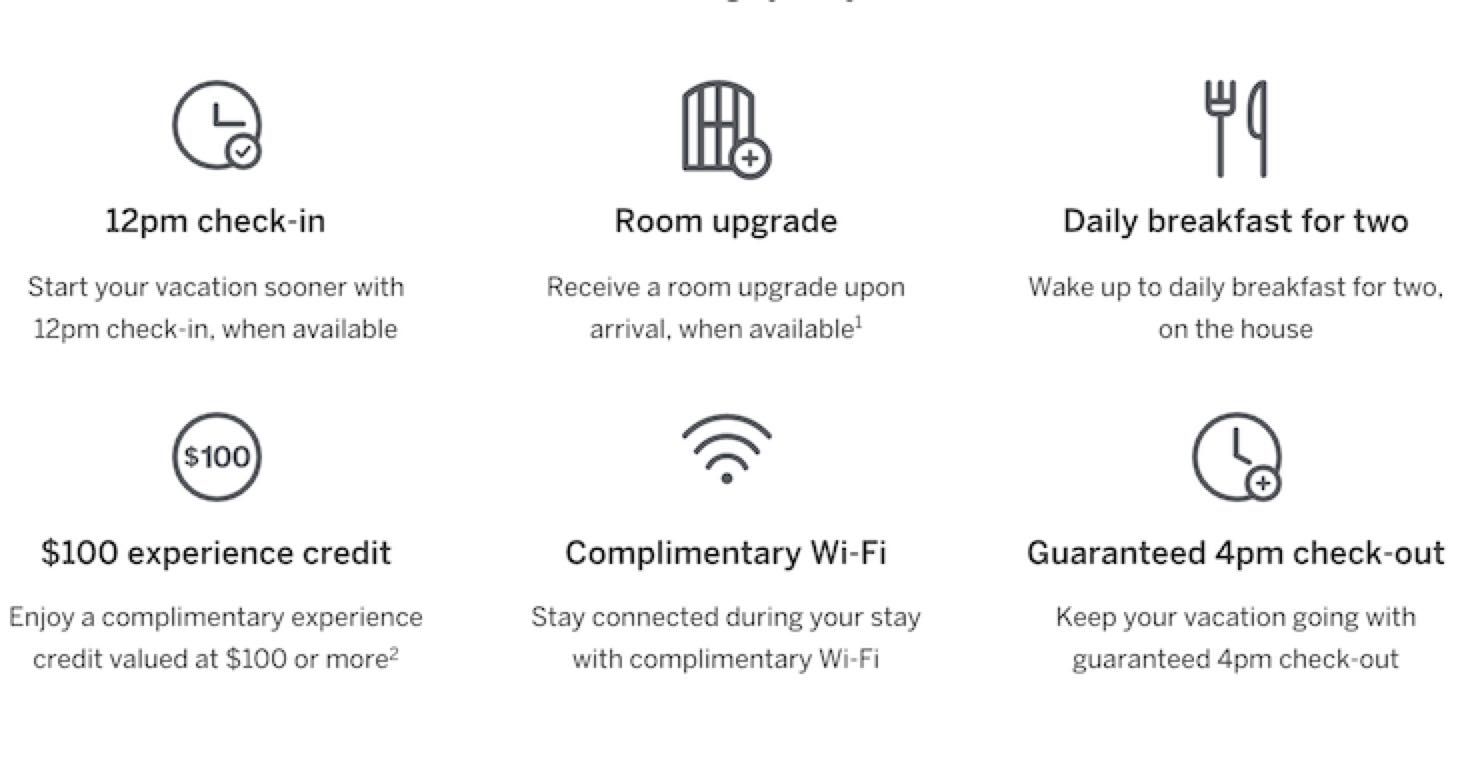

When booking through this program, enjoy benefits (even without any status) such as daily breakfast for two, 4pm late check-out, noon check-in (when available), room upgrade (when available), and a resort experience/food credit (varies by property). For example, I used this to stay at the Ritz-Carlton Waikiki in Hawaii (review).

For more details on how my FHR booking, check out this post. Note that in some cases, bookings through FHR will be more expensive.

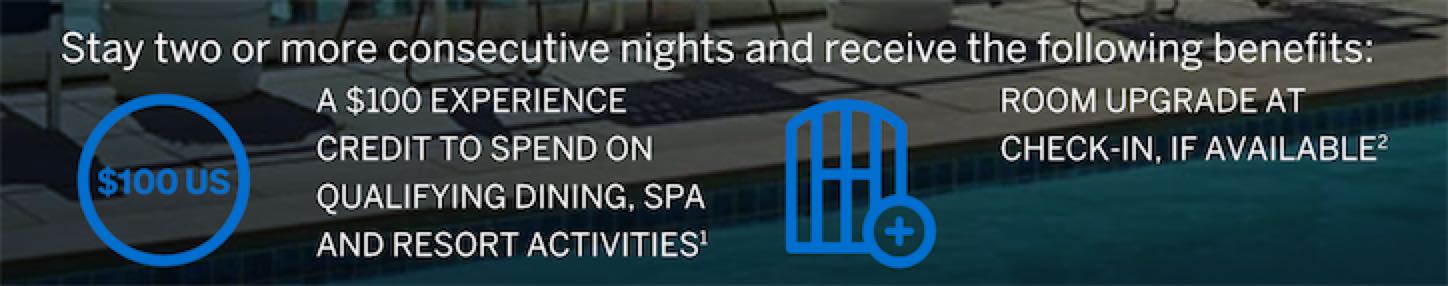

The Hotel Collection Program

Similar to FHR, bookings through this program will provide you benefits such as $100 experience credit and room upgrade at check-in (if available). The main difference is that there is a 2-night minimum for each booking.

Airport Lounge Benefits

One of the key benefits of the Platinum card is access to The Global Lounge Collection. I’ll be breaking down the main lounge networks cardholders have access to:

Amex Centurion Lounge & International American Express Lounges

Platinum members have unlimited complimentary access to The Centurion Lounges, which are American Express’s own premium lounge network, but as of 2023, guests are no longer complimentary. This is a huge devaluation in my opinion.

That being said, I still find the lounge benefit useful as a couple entries over the year can really add up in terms of airport food savings, and certainly beats waiting at the crowded terminal gate area (especially if there is a delay!).

For more details on access and my experience, check out my Centurion Lounge Reviews at SFO, JFK, LGA.

Delta SkyClub

Cardholders also have unlimited complimentary access to Delta Sky Clubs when flying on Delta. Note that there are no free guests allowed, but you have the option of paying a fee for guest access. For more details on access and my experience, check out my Delta Sky Club reviews at SFO, JFK.

Priority Pass Membership

The Priority Pass membership allows complimentary and unlimited access to the global network of over 1000 lounges in 130+ countries. You will also be able to bring guests (usually up to 2, but check in app for latest update) free of charge. This benefit is more valuable when traveling internationally, as US priority pass lounges are usually over-crowded and low-quality. I have been to many above average lounges in the network pre-pandemic using my Chase Sapphire Reserve.

Note that if you are mainly getting a card for Priority Pass access, I would recommend looking at Capital One Venture X, which gives you up to 4 additional authorized users (all with their own Priority Pass membership) for no additional fee! Chase Sapphire Reserve also comes with Priority Pass and each authorized user is an additional $75. The Chase Sapphire Reserve include access to Priority Pass non-lounge experiences, such as airport restaurants and spas! This is a big differentiator as the Amex Priority Pass membership exclude non-lounges!

Other Lounges

The Global Lounge Collection also provides you access to many other lounge networks such as Escape lounges, Plaza Premium lounges (which recently left Priority Pass), Air Space lounges etc. For full details, visit the official Amex website.

Protection Benefits

Trip Delay & Trip Cancellation

If a round-trip is paid entirely with your Platinum card and a covered reason delays your trip by more than 6 hours, Trip Delay Insurance can help reimburse certain additional expenses, up to $500 per trip. For more details, click here.

If your round trip is paid entirely with your Platinum card and a covered reason cancels or interrupts your trip, Trip Cancellation and Interruption Insurance can reimburse you for non-refundable expenses, up to $10,000 per trip. For more details, click here.

I have not yet had a personal experience with using this benefit. Note that Amex coverage is only for round-trip tickets, so I recommend using the Chase Sapphire Preferred/Reserve, or the Capital One Venture X for more comprehensive coverage. Check out my experience with filing delayed/lost luggage claim with Chase.

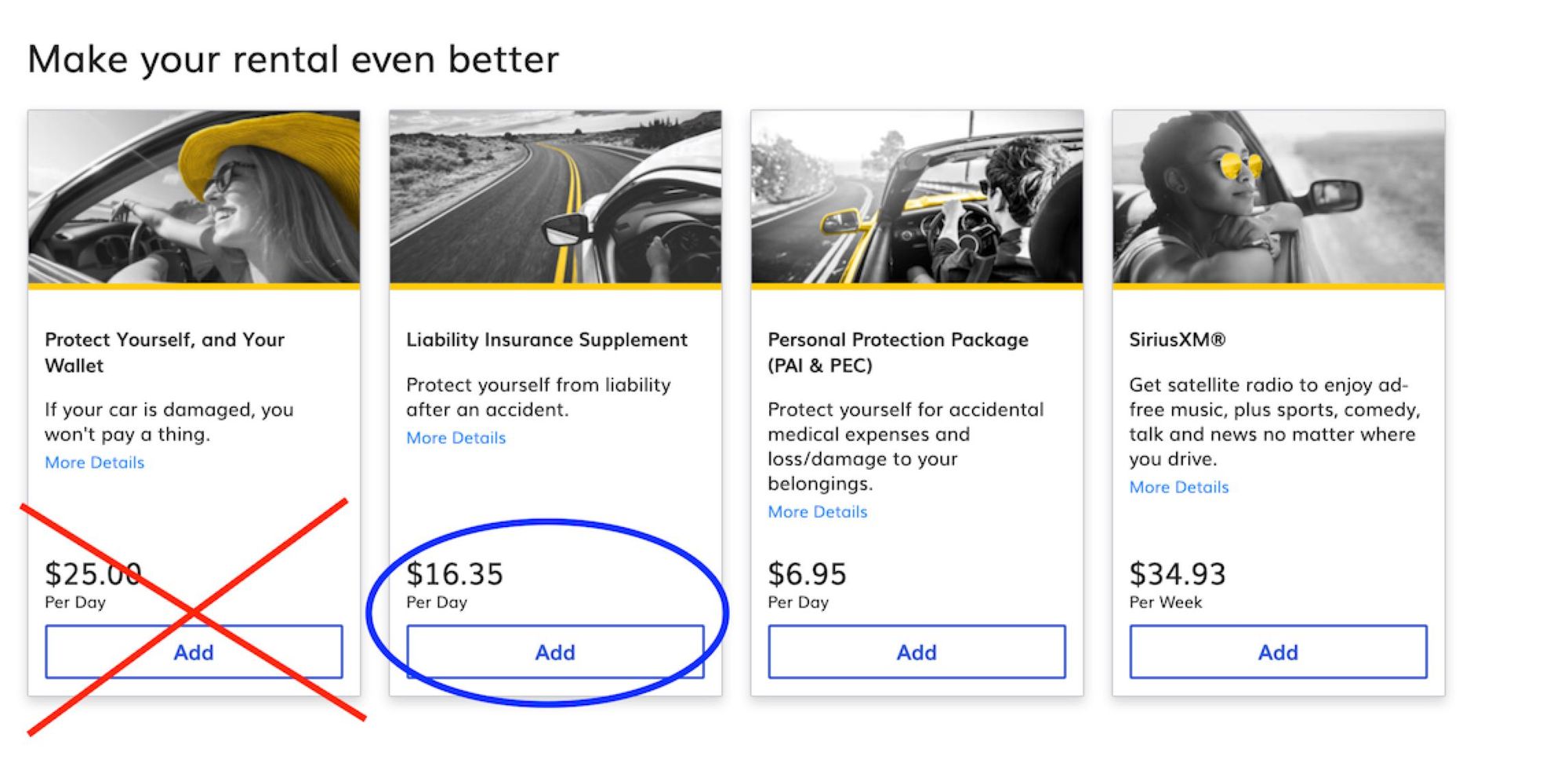

Car Rental Loss and Damage Insurance

When using the Amex Platinum to pay for the entire rental and declining collision damage waiver (LDW), you can be covered for damage to or theft of the rental vehicle in a covered territory. This can easily be a $25+/day savings! Note this provides secondary coverage (I strongly recommend using Sapphire Preferred/Reserve or Venture X since they offer primary coverage) and does NOT include liability coverage. However, if you do not have another insurance provider anyways (i.e. don’t own a car in US), then secondary coverage becomes primary.

Return Protection

If you try to return an eligible item (made in US) within 90 days from date of purchase and merchant won’t take it back, Amex may refund you the full purchase price, up to $300 per item. I recently had to use this benefit and had a really good experience. Check out my full post here.

Extended Warranty

This benefit extends the original manufacturer’s warranty by up to one additional year when purchased using your Platinum card. Applies to warranties 5 years or less, and up to $10,000 per item. I was able to take advantage of this benefit and had a good experience. Check out my full post here.

Other Benefits

Membership Rewards Hotel & Airline Transfer Partners

The ability to redeem Amex MR points for valuable airline and hotel transfer partners is probably the biggest reason to earn this Amex points. This is where you will get the most outsized redemption values enabling you to travel in business/first class for free!

Check out my full post on the best ways to use your Amex MR points!

No Foreign Transaction Fees

FX fees usually offset any potential reward earnings, so it is nice to see the Platinum card waiving the transaction fee. However, this has become a pretty standard on most cards with annual fees these days, so nothing really special here.

Amex Concierge

Direct line to an Amex Platinum agent that can assist with any issues or requests, such as making a reservation at a popular restaurant. I’ve found this to be hit-or-miss, but did a have a positive experience securing a last minute reservation at a popular restaurant in Hawaii.

Misc. Benefits

There are many additional benefits that come with the Platinum card. I encourage you to read through the full benefits on the Amex site (my referral link). These additional benefits are probably not very useful for 99% of people, such as the SoulCycle At-Home Bike credit, or the private jet membership discount. Regardless, it is good to know these “benefits” exist.

Authorized Users

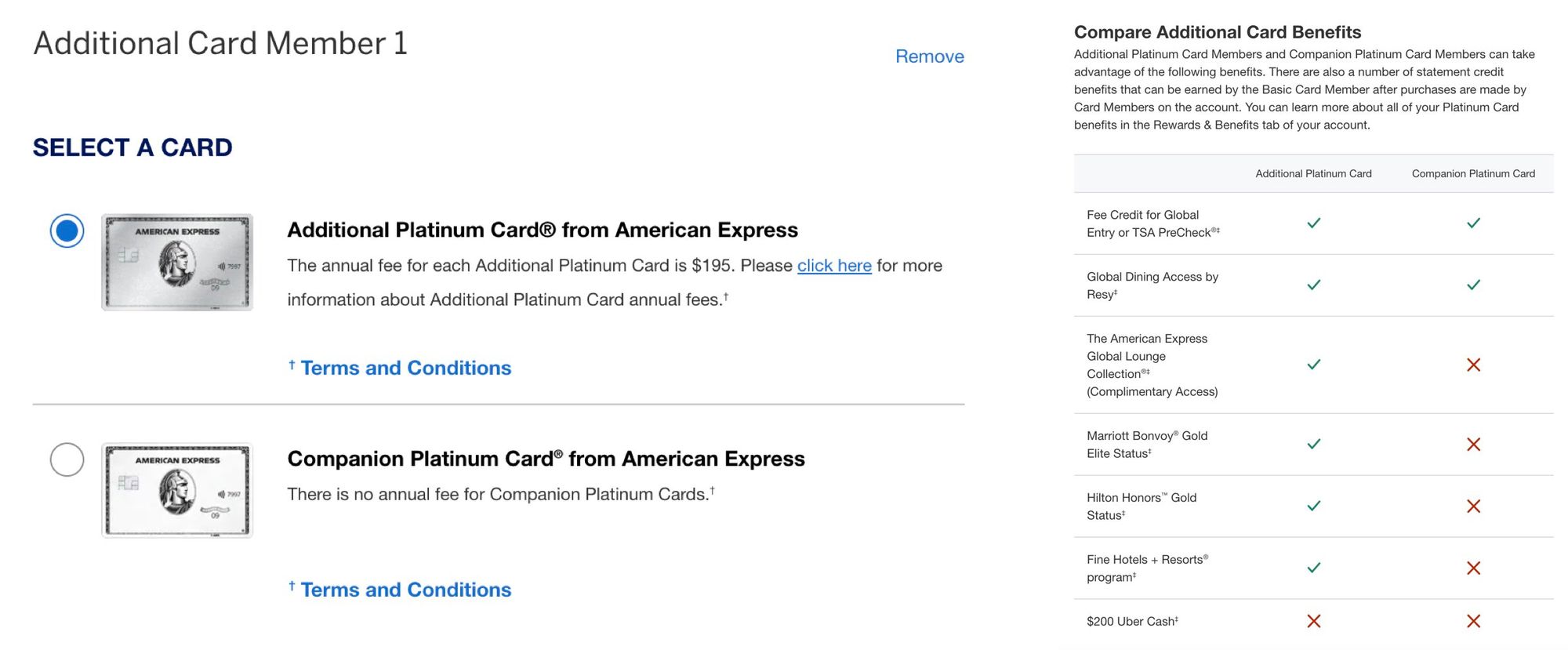

Platinum cardholders are able to add two types of authorized users:

- The first is a “Companion Platinum Card”, which is free to add (up to 99 additional cards). These cards earn all the same multipliers as the primary Platinum card, but is made of plastic and does not come with lounge access benefits.

- The second type is an “Additional Platinum Card”, which is costs $195 for each additional card, with the primary difference being that these cards get their own lounge access and status benefits.

Both types of authorized users get their own Global Entry / TSA PreCheck credit.

Cost Benefit Analysis (based on first year 2021 benefits)

Cost: $550

Benefits Used (until renewal, estimates):

- 100k Signup bonus =

~$1000 - 51k 10x Intro bonus (groceries & gas) =

~$510 - Paypal promo credits = $30 * 2 =

$60 - Amex add additional authorized user promo = 20k * 2 =

~$400 - Referral bonuses = 55k =

~$550 - Uber credits =

$215 - Saks credits = $50 * 3 =

$150 - Airline credits = $200 * 2 calendar years =

$400 - FHR credits = $200 * 2 calendar years =

$400 - Lounge access = $16 * ~20 visits =

~$320 - CLEAR =

$189 - Return & Purchase protection claims =

~$460 - Marriott Gold elite status =

~$100 - Various Amex offers =

$150 - Additional point earnings on spend = 30k MR =

~$300

Benefits: $5204

Grand Total: $5204 - $550 = $4654

Even when removing the value of the first year signup bonus, and being conservative on the points valuation, I’m still getting over $3000 in value for keeping this card!

Conclusion

The success and ubiquity of the Platinum card can be seen everywhere, from the often overcrowded Centurion Lounges to nearly everyone who wants the card to get approved as long as they are willing to pay the annual fee. With the cost of owning the card rising, Amex has gradually added additional features to justify the annual fee increases.

That being said, in recent years (especially with the pandemic), the additional benefits seem to relate less and less with travel, but more with a certain lifestyle (think a New Yorker who uses Equinox and orders UberEats). Moreover, a lot of benefits added do not make any sense (Walmart+ membership and bulk exercise bike rebate?), and have many beginning to feel that the Platinum card has lost its luster and direction.

With the many hoops that Amex makes its cardholders jump through to fully utilize the credits, the almost $700 card has many feeling the product to resemble more of a “glorified coupon book” than a premium travel card.

Amex’s shift in focus from travel to lifestyle is really highlighted in the recent “card refresh” where they partnered up with artists to offer 2 new looks to the physical card. In a day and age where most things are moving to the digital world, I really wish Amex spends more time improving actual card features to be more user-friendly rather than focusing on the external appearance. That said, maybe this is exactly the target demographic they are going for.

So will I be renewing or cancelling this card at the one-year mark?

I will most likely be keeping the card around, especially if offered a retention bonus. For someone who can take advantage of aspirational airline and hotel redemptions, and is organized enough to keep track of the credits and constantly evolving rules, this can be a huge money-maker.

However, given how complex the card has become, I simply cannot recommend it to most people – unless you know exactly what you are doing and are familiar with the Amex MR system. For the vast majority of people out there, the hassle of dealing with all the credits just to break even with the annual fee is simply not worth it. If you are looking for a more simplistic premium travel card, consider looking into the Capital One Venture X, Chase Sapphire Preferred, or Chase Sapphire Reserve!

If you found this analysis helpful and would still like to apply, consider using my referral link as it greatly supports my work and keeps this site up and running! Thank you!