Last Updated on March 11, 2024 by CreditFred

My American Express Gold card is due for another renewal soon. Should I keep the $250 annual fee card for another year or is it better to cancel? Read on to find out!

[referral link] – (open in incognito, make sure to compare offers before applying)

Overview & Current Offer

Here are a few highlights of the Gold Card:

- 4x Dining (Worldwide) and 4x Supermarkets (U.S.)

- 3x Flights (directly booked with airlines or on Amex Travel)

- $120 Dining Credit

$100 Airline Incidentals Credit- $120 Uber Credit (NEW)

- No Foreign Transaction Fees

- Car Rental Loss and Damage Insurance

- Extended Warranty & Purchase Protection

- Complimentary 1-year UberEats Pass subscription (Limited Time)

If you are interested, consider using my referral link (open in incognito) but also check the public links for higher offers (Amex likes to play around with links).

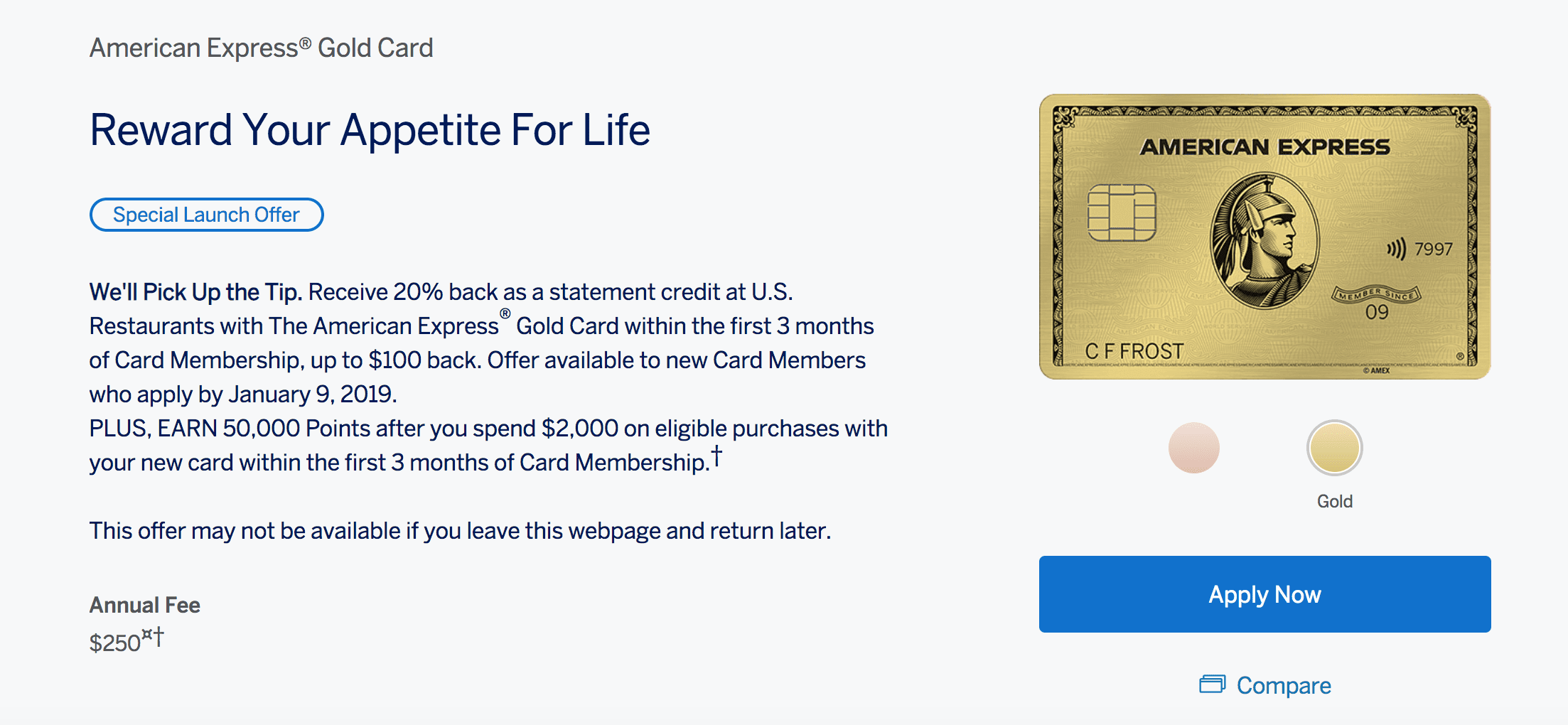

My Original Signup Offer

A lot has changed since January 2018, but here was the “launch offer” when I signed up:

- 50,000 Membership Rewards (MR) Points after spending $2000 in 3 months

- $100 statement credit (“We’ll Pick Up the Tip” promo)

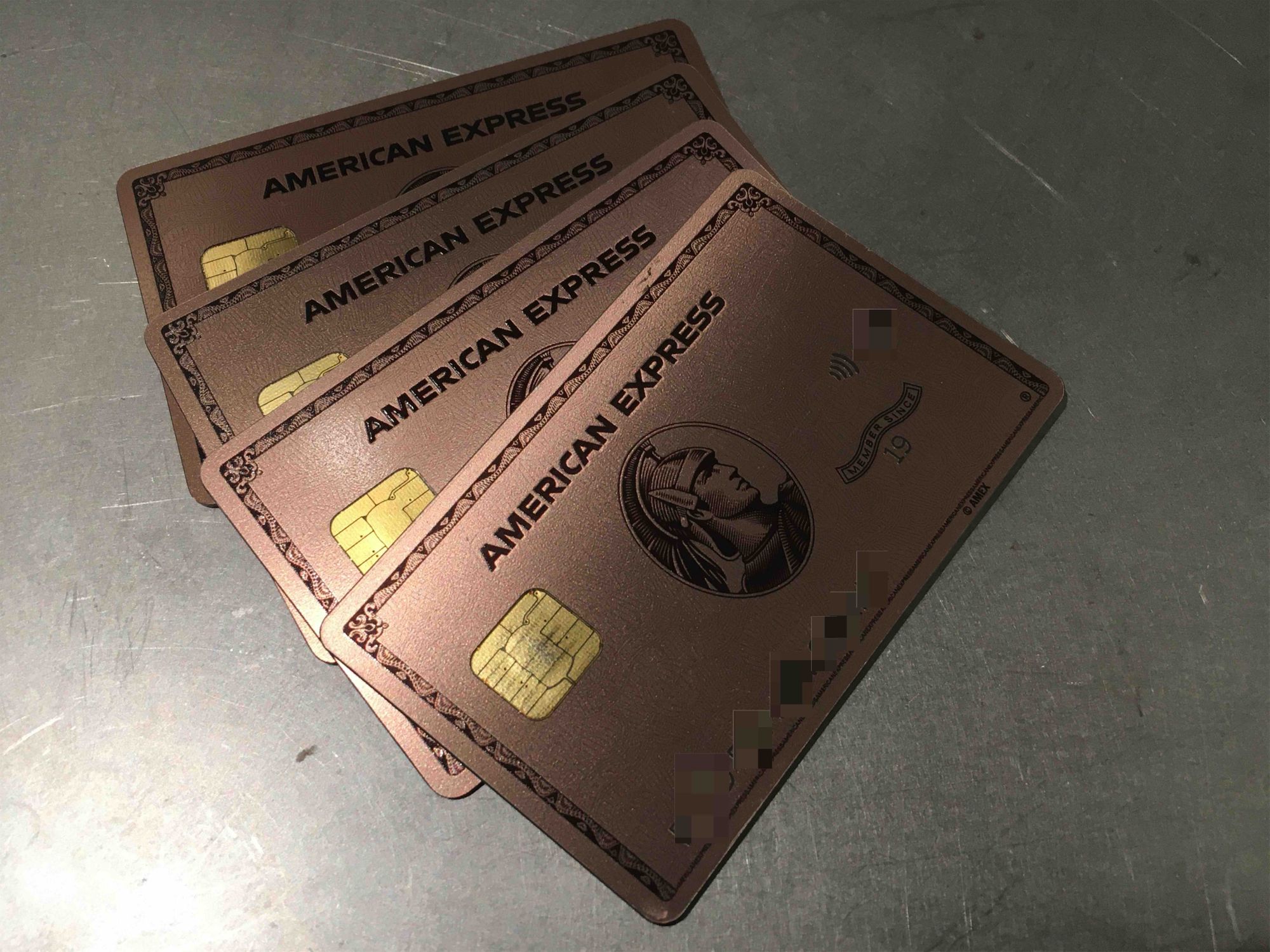

- Limited edition Rose Gold color variant (UPDATE: Amex has brought back Rose Gold variant permanently)

Since this isn’t my first year holding the card anymore, I won’t factor in the signup offer in my analysis. However, I did get a 15,000 MR retention offer (which I value at $300+) just by calling in and asking when I renewed last year. I also earned an additional 45,000 MR for referring friends and family.

In the next section, I will break down the main perks of the Gold card, discuss the benefits they brought me in the past year, and how I value them going forward.

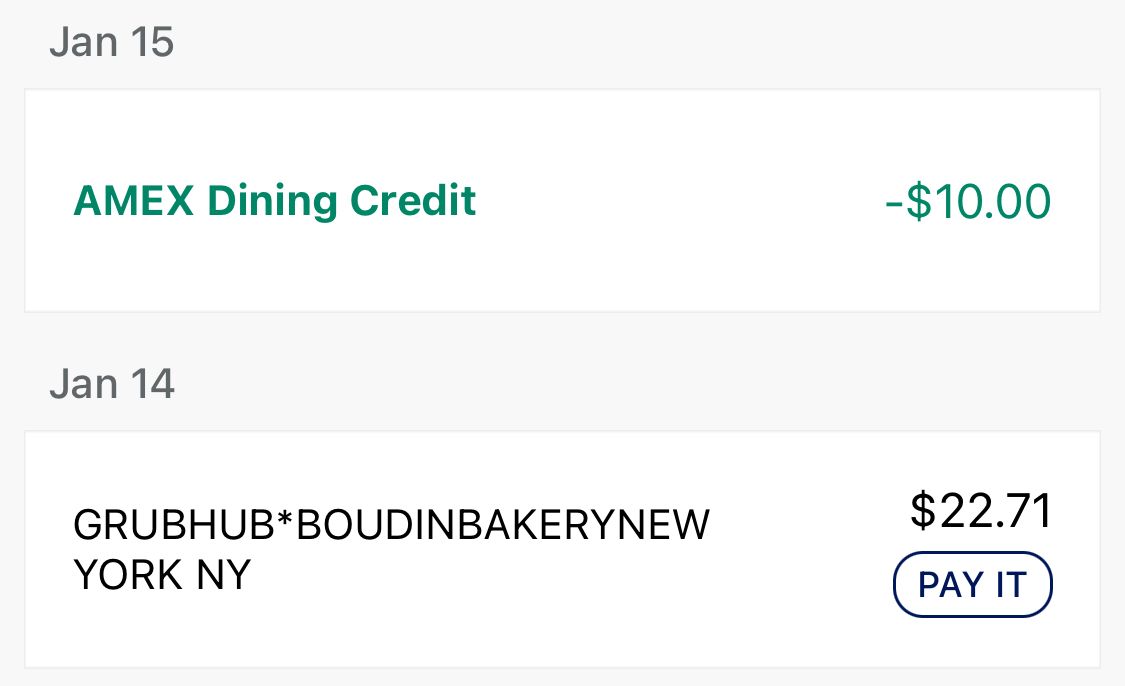

$120 ($10/mo) Dining Credits

This credit is reimbursed on eligible dining expenses up to $10/month. As of June 2022, the eligible partners are:

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Milk Bar

- Shake Shack

I order from Grubhub at least once a month anyways, so this is easily 100% utilized. I also took advantage of my complimentary Grubhub+ membership from my Chase Sapphire Reserve to get free delivery and additional benefits.

To summarize, I think Grubhub is easiest to use, especially when you do pickup. Cheesecake Factory and Shake Shack could be good too if you are near a location and visit regularly.

$100 Airline Incidental Credit (discontinued)

The Airline Fee credit is a reimbursement on qualifying expenses up to $100/year.

It is technically meant to only be used on incidentals like checked bags or in-flight food/beverage purchases, but in the past, there have been many ways to trigger the credit. However, these “hacks” get patched all the time and it will take a little effort, so research the methods ahead of time. Even though I was able to fully use the credit by converting the funds to future flight credits, I would not recommend beginners to value this credit at 100% value. The good news is that this credit is going away after 2021 and is being replaced with…

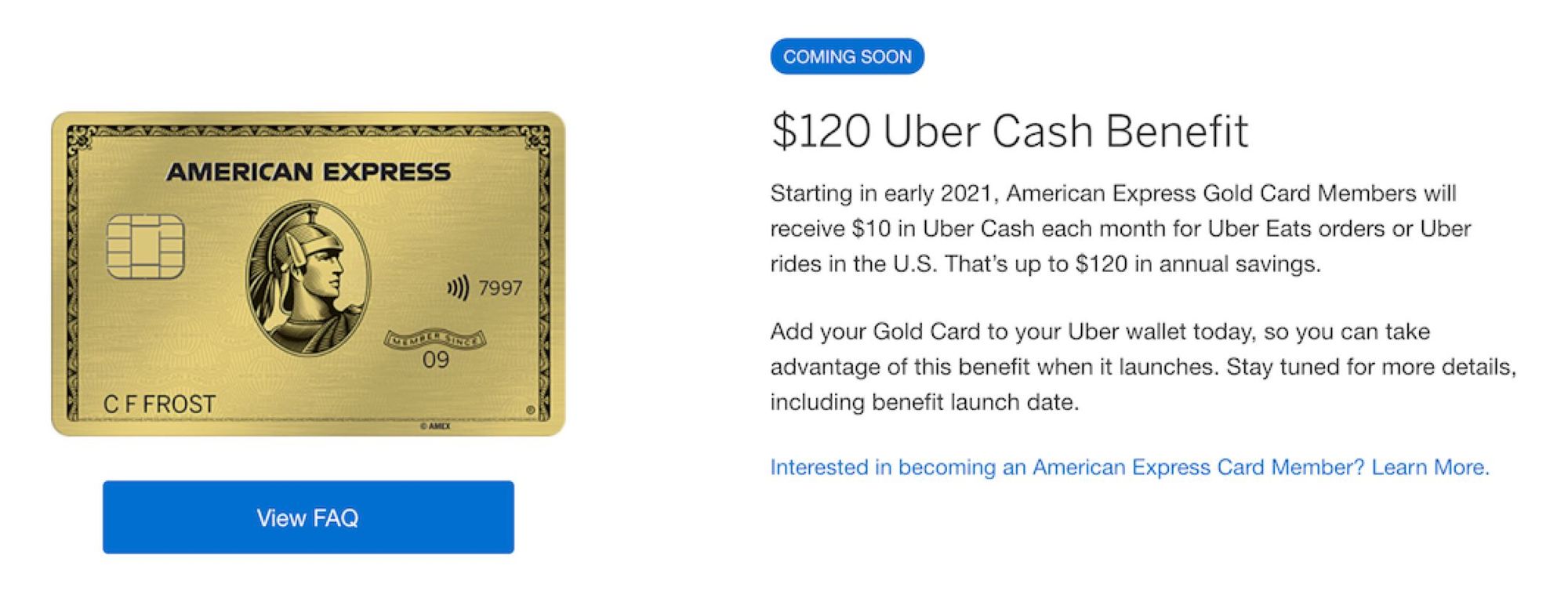

$120 ($10/mo) Uber Credit (NEW)

In February 2021, Amex introduced a $10/month Uber credit that will automatically be deposited into your Uber account.

This can be used for UberEats, rides, or other Uber services. This is MUCH easier to use than the airline credit that this is replacing. I use UberEats often anyways combined with a complimentary UberEats Pass subscription (~$119 value), so I save even more with $0 delivery fees, 5% off orders, and more!

4x Dining & 4x Groceries

The 4x earning multipliers for food (dining and groceries) are where the card really shines. This is basically a card made for foodies – whether you dine out, order delivery, or buy groceries to cook at home.

So what is the bare minimum you need to spend on food to break even?

I value Amex MR points at 2cpp which roughly translates to 8% back on my dining and groceries. However, let us assume base case scenario where points are worth 1cpp ($0.01 per point), and assuming you don’t use ANY of the dining credits, you only need to spend $521/month on food (dining out and groceries) to break even. I think this is a reasonable amount to spend on food that I think most people will have no trouble coming out ahead. If you are fully able to utilize the food credits, you only need to spend $21/month on food to come out ahead!

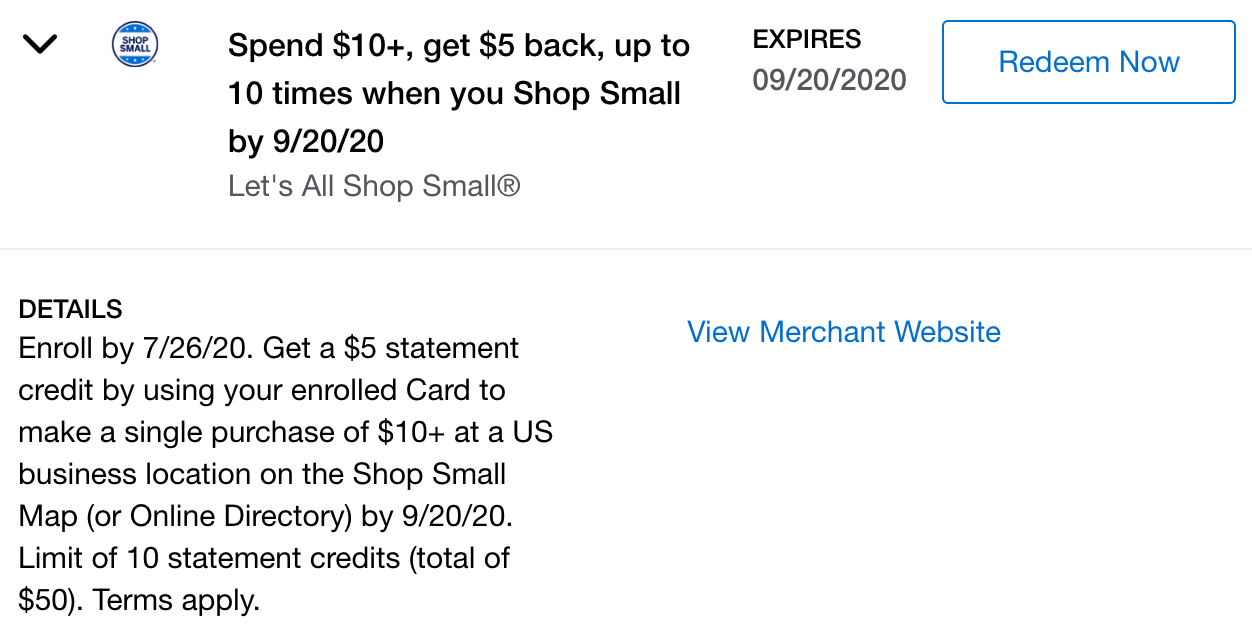

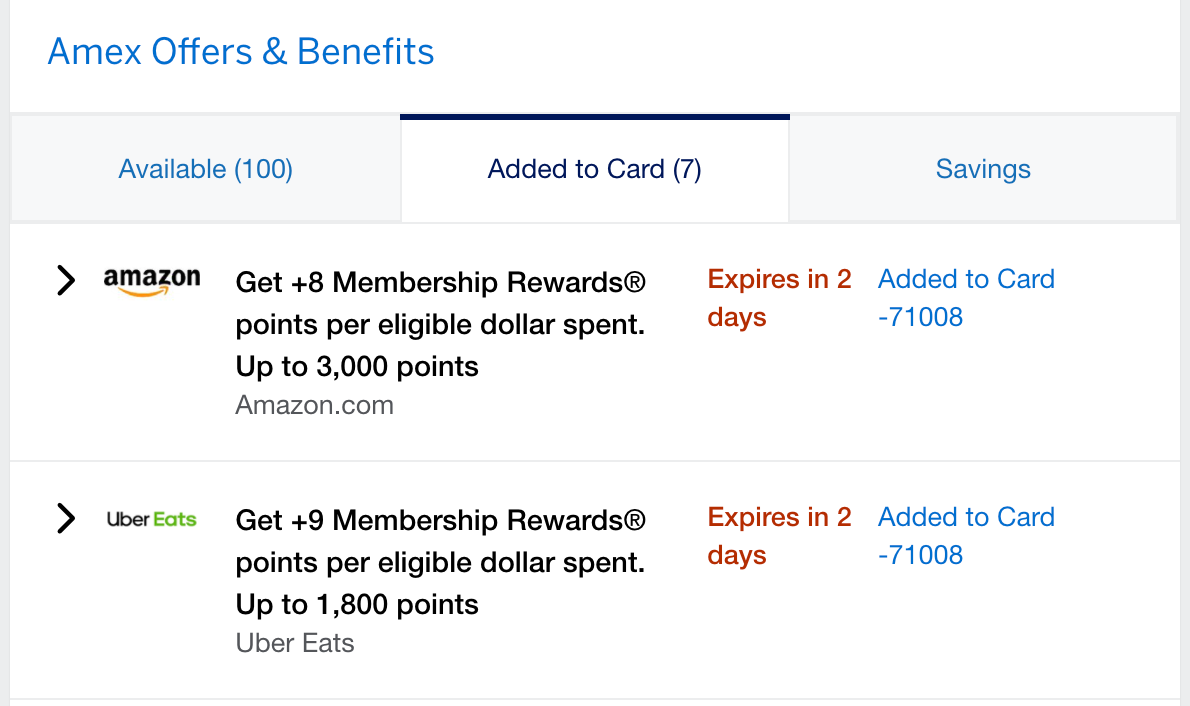

Amex Offers ($200+)

From time to time, different offers will get added to your account. Out of the major banks that offer this, Amex has the best promotions hands down. Just this year alone, I saved more than $215 (almost the annual fee!) not including points promotions just by taking advantage of some of the Amex Offers with merchants like Lululemon, Marriott, GoPro, etc. This summer, Amex also rolled out a “Shop Small” campaign to support small businesses, including easy credits just by making my usual purchases at neighborhood grocery stores, coffee shops and food trucks!

In addition, Amex also had pretty amazing offers such as 8x on Amazon and 9x from UberEats!

Insurance, Warranty, and Protection Benefits

Sometimes the extra 1-2x back isn’t what’s most important when making high-value purchases. When buying a new laptop or camera equipment, Amex has you covered with free Extended Warranty and Purchase & Return Protection. If you are thinking of renting a car, use your Gold card to get Rental Loss & Damage Insurance. Finally, if you are traveling, there is Trip Delay and Baggage Insurance (although I have to say Chase Sapphire cards provides better coverage in this department).

Amex Gold Benefits

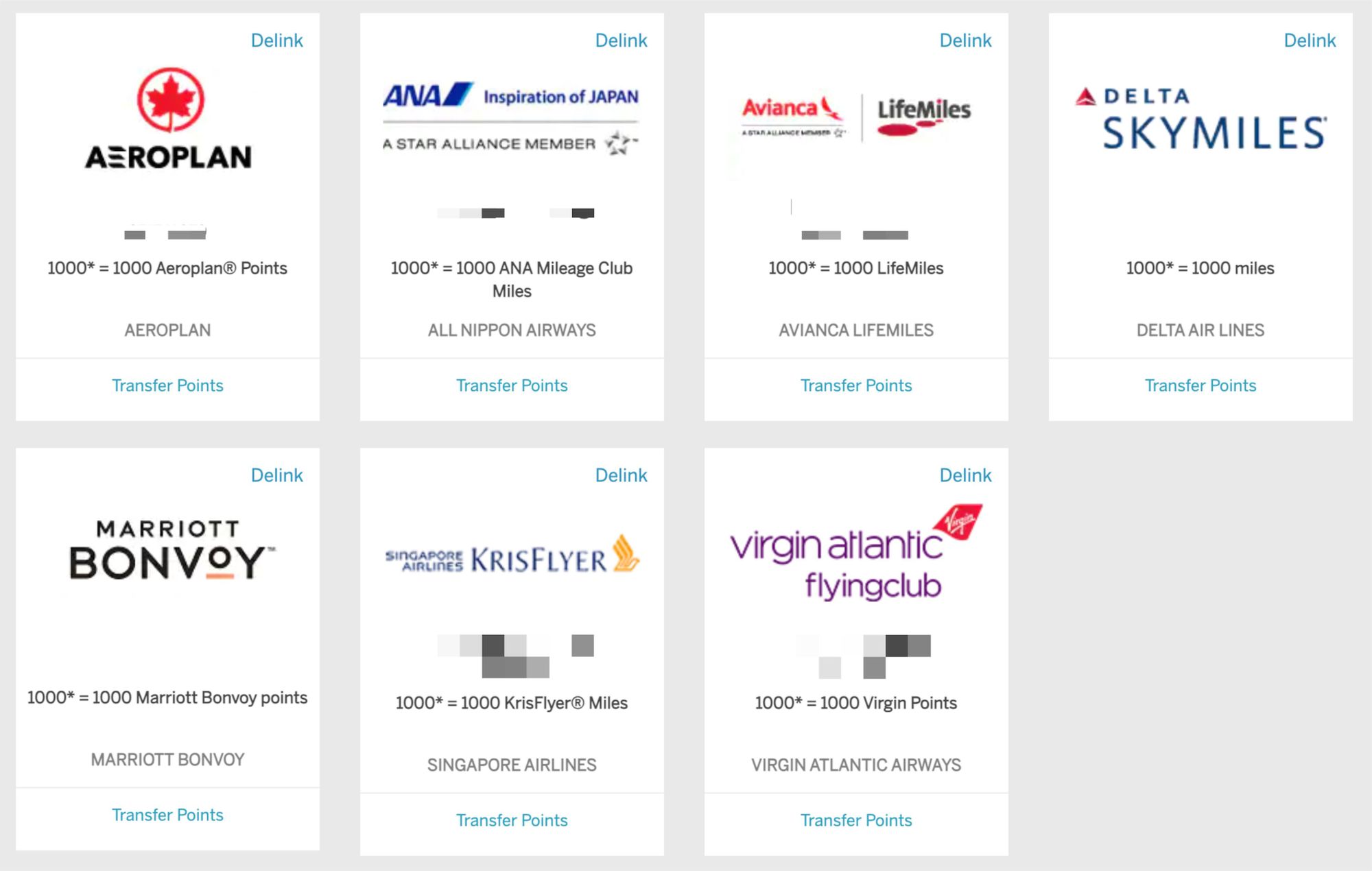

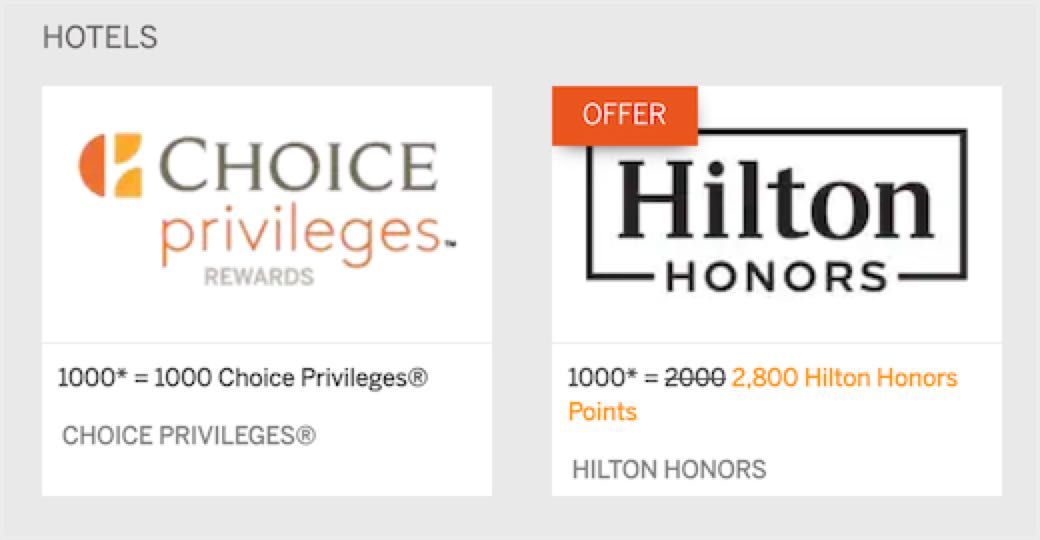

Transfer Partners

Amex MR points are best used when transferred to their airline and hotel partners. There are great redemption offers that allow you to book aspirational trips such as long-haul business class flights, especially for certain airlines. From time to time, there are also transfer bonuses where the transfer rate is higher than normal.

For example, I recently transferred some Amex MR points to Delta to book these Delta One suites!

Authorized Users

The Gold card allows you to add up to 5 Authorized Users (AUs) free of charge! Each cardmember gets their own metal gold card, the same earnings and perks, and the card can be mailed to your authorized users ANYWHERE IN THE WORLD. I added my parents so they too can enjoy the perks, and I also took advantage of a limited time offer and earned an additional 10,000 MR points for adding them.

Amex Concierge

I had a chance to try out Amex’s concierge service when I lost my AirPods Pro in Taiwan last year. Since they were newly released, they weren’t technically in stock outside the US market yet. However, the agent actually helped me call up multiple stores in Taiwan to inquire about availability, and even offered to ship one from the US for me (at a cost of course), which I politely declined since I was flying back in a few weeks anyway. The agent was also very friendly and supportive, waiting patiently on the line while I took a call with the bus company regarding my lost item. Overall, this is an often overlooked service that really comes into use when you don’t know where else to look for a resource.

Easy Retention Offers

Retention offers are what banks may give you (whether in points or statement credit) when banks want to keep you from cancelling your card. You can use this knowledge to your advantage and proactively reach out to Amex to get these offers. In my experience, I’ve been able to get offers that more than offsets the annual fee every other year. Just recently, I was offered 30k Amex MR points after spending $3k in 3 months for keeping the card open. This offer alone to me is worth $600+ in value, so I definitely said yes! Check out this article for more tips on how to waive/reduce your credit card annual fees:

Conclusion

If you are on the fence, now is not a bad time to sign up. There’s a historic-high 75,000 MR point offer (worth at least $1300 based on my valuation) after meeting the signup bonus conditions alone.

Even without factoring in the signup bonus and only looking at the credits, the dining credit ($120) + Uber credit ($120) = $240 alone pretty much already covers the $250 annual fee. Factor in all the other perks described above and you’ve got a keeper card.

Simply put, this is one of my favorite credit cards and an amazing looking one too! I will definitely be keeping my card for another year!