Last Updated on March 19, 2024 by CreditFred

Ever wondered if you are getting the best value out of your hard-earned American Express Membership Rewards (MR) points? I’ll be sharing the best (and worst) ways to redeem them below!

For best/worst ways to use Chase Ultimate Rewards (UR) points, check out this earlier post. If you don’t yet have an Amex but are considering getting one, check out my recent post on the Amex Gold Card!

A reminder that the terminology cents-per-point (cpp) will once again be used to measure the relative value of the points if we had paid for the same product/service with cash. For example, 1.5 cpp means each point is worth $0.015:

10,000 MR points = 10,000 * 0.015 = $150

Best Value ????

Below are the top 3 redemptions I recommend, from best to least ideal:

1. Transfer to Travel Partners (1-8+ cpp)

This is where Amex MR points shine the most. If your goal is to do that aspirational first class flight, no other points currency gives you as much flexibility and value (Chase is a close second in this area).

Tips:

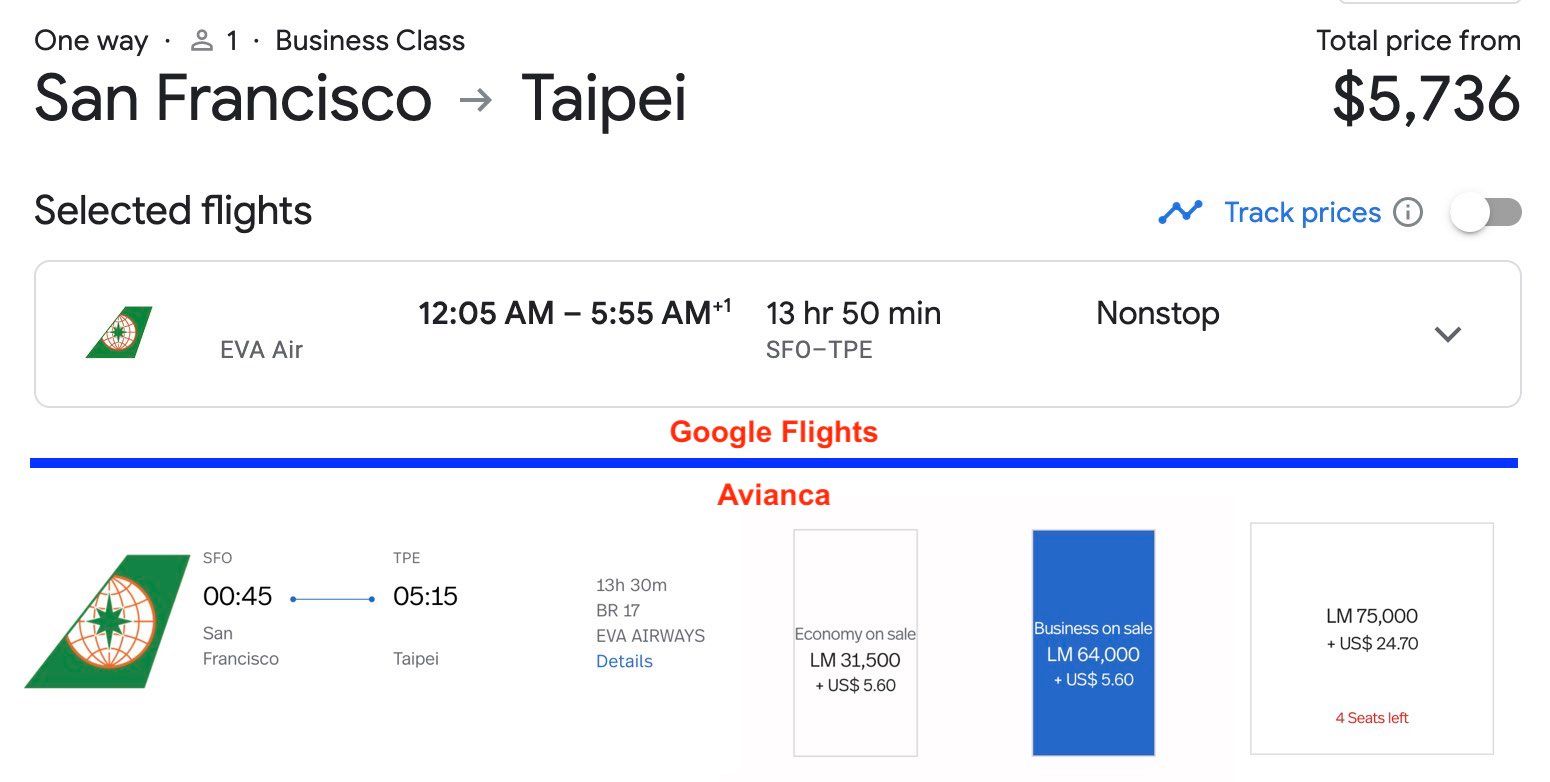

- Go for programs like Aeroplan, Avianca, and ANA for amazing redemptions on Star Alliance partner airlines like EVA Air!

- Avoid hotel transfers (conversion rate is not worth it in most cases)

- There are many partner overlaps with Chase, so this may be an opportunity to pool your points together across different banks

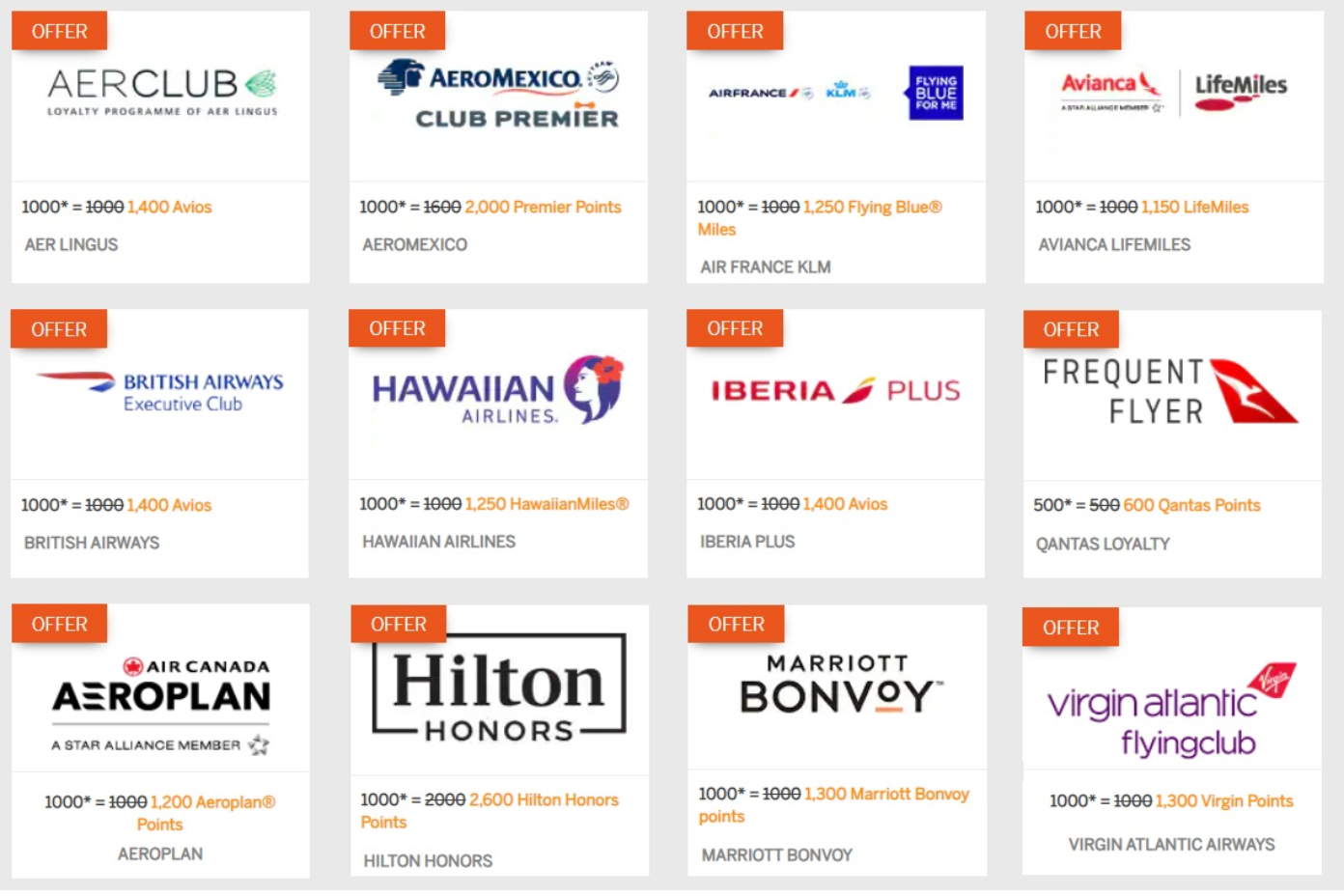

- Take advantage when there is a transfer bonus!

Below is an example of a business class flight from San Francisco to Taipei. A one-way fare would cost $5736 in cash. However, by doing a transfer from Amex MR to Avianca LifeMiles, you can redeem for the flight with 64,000 to 75,000 LifeMiles. The cash and point prices will fluctuate depending on demand and other factors, but we are still looking at a redemption value of 7 – 9 cpp, which is many times the next best alternative.

I’ll be diving deeper into the various transfer partners in a future article!

2. Cashback via Schwab (UPDATED 9/1/2021: 1.1 cpp)

This one is limited to holders of the American Express Platinum for Schwab. As a cardholder, you will be able to easily cash out your points at a fixed 1.25 1.1 cpp value. This could be worth it if you are looking for the easiest way to liquidate your points (e.g. to put into the stock market). Unfortunately, this is essentially the only way to cash out at a decent value, unlike Chase.

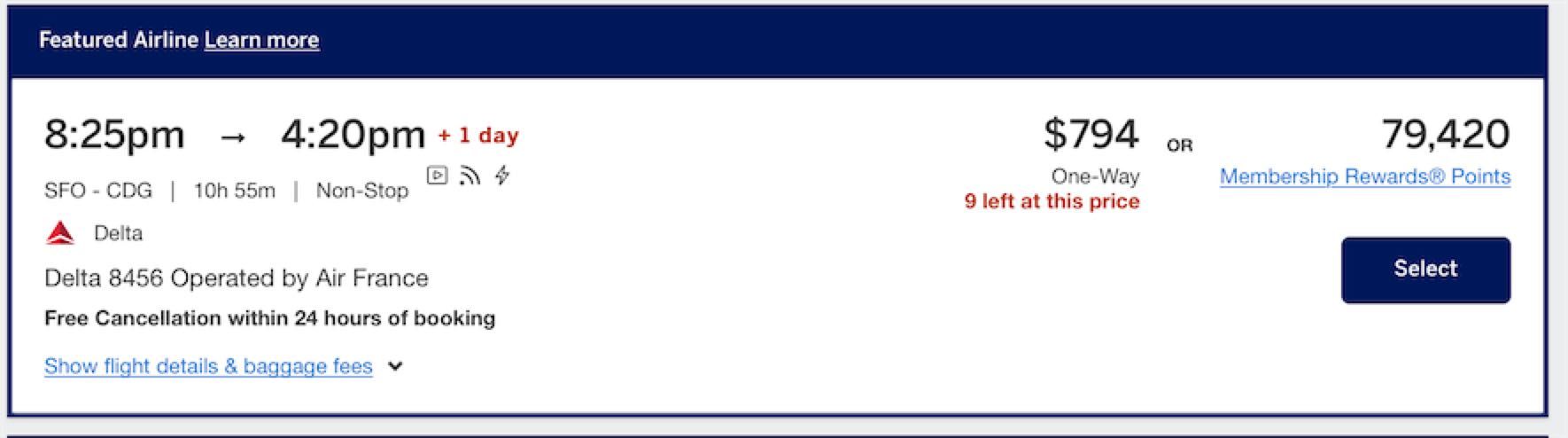

3. Amex Travel Portal (1-2 cpp)

Booking travel directly on Amex’s travel portal could be a fair deal if you value simplicity, but it may not provide the best value, especially compared to transferring to airline partners.

In the example above, you are getting almost 2cpp (~$800 flight for ~40k points), which is a good value!

However, most flights will be priced closer to 1cpp. On the bright side, since this is considered a fare purchase, you will be able to earn miles flown with the airline.

Worst Value ????

Below are the worst possible ways to use your points, starting with the lowest value redemption:

1. Go Shopping (0.5 cpp)

A huge rip-off, avoid it at all costs! Let’s take a look at an example.

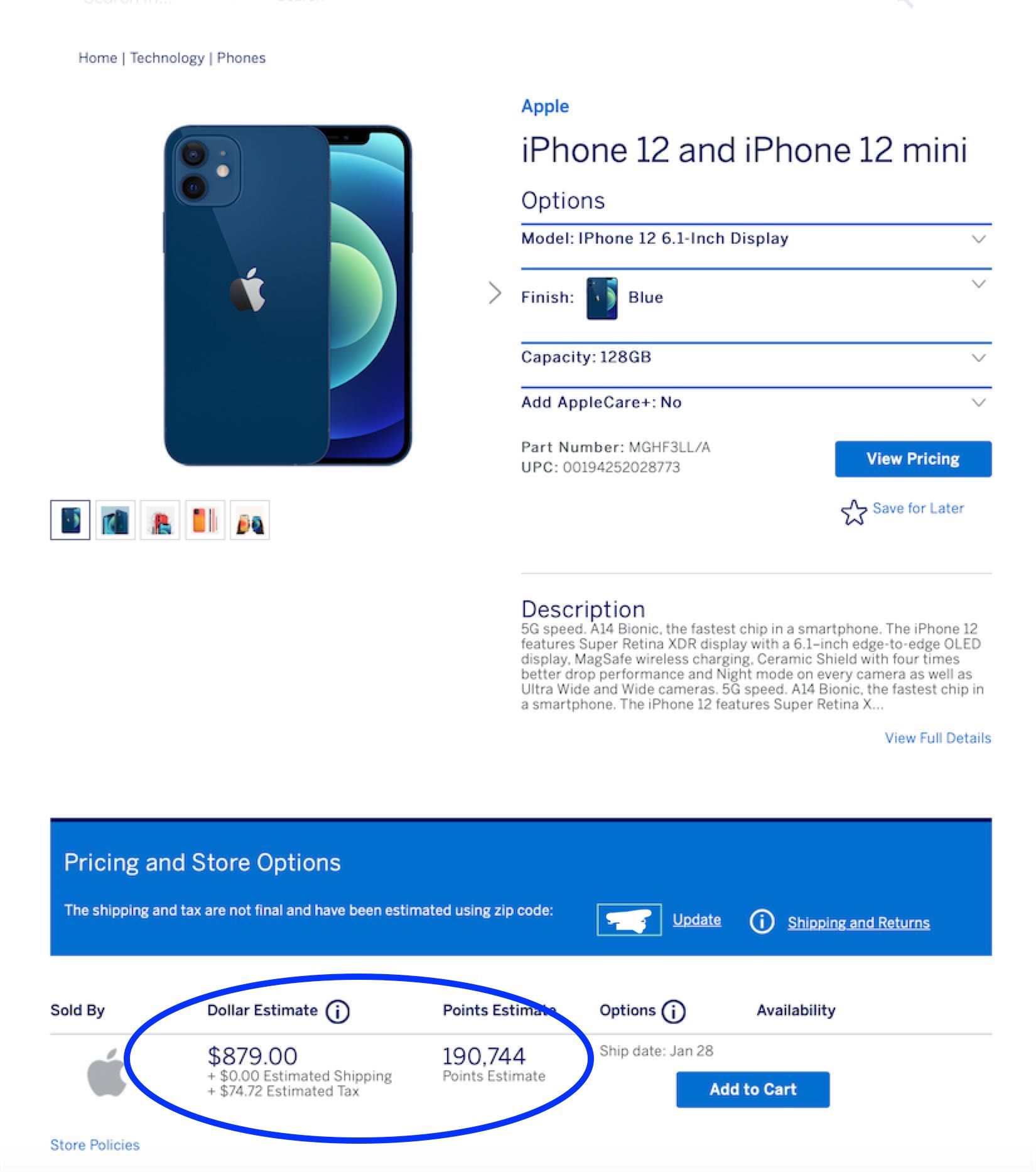

One item you can buy on the Amex Shopping site is an iPhone, which you could buy at $879+tax ($953.72 in my case). The alternative is paying a whopping 190,744 MR points. This translates to:

$1953.72 / 190,744 = $0.005 per point

In addition, you miss out on the 1-2% additional cashback you would have received if put on a credit card, the purchase protection & extended warranty benefits, as well as the ability to stack your cashback through a shopping portal.

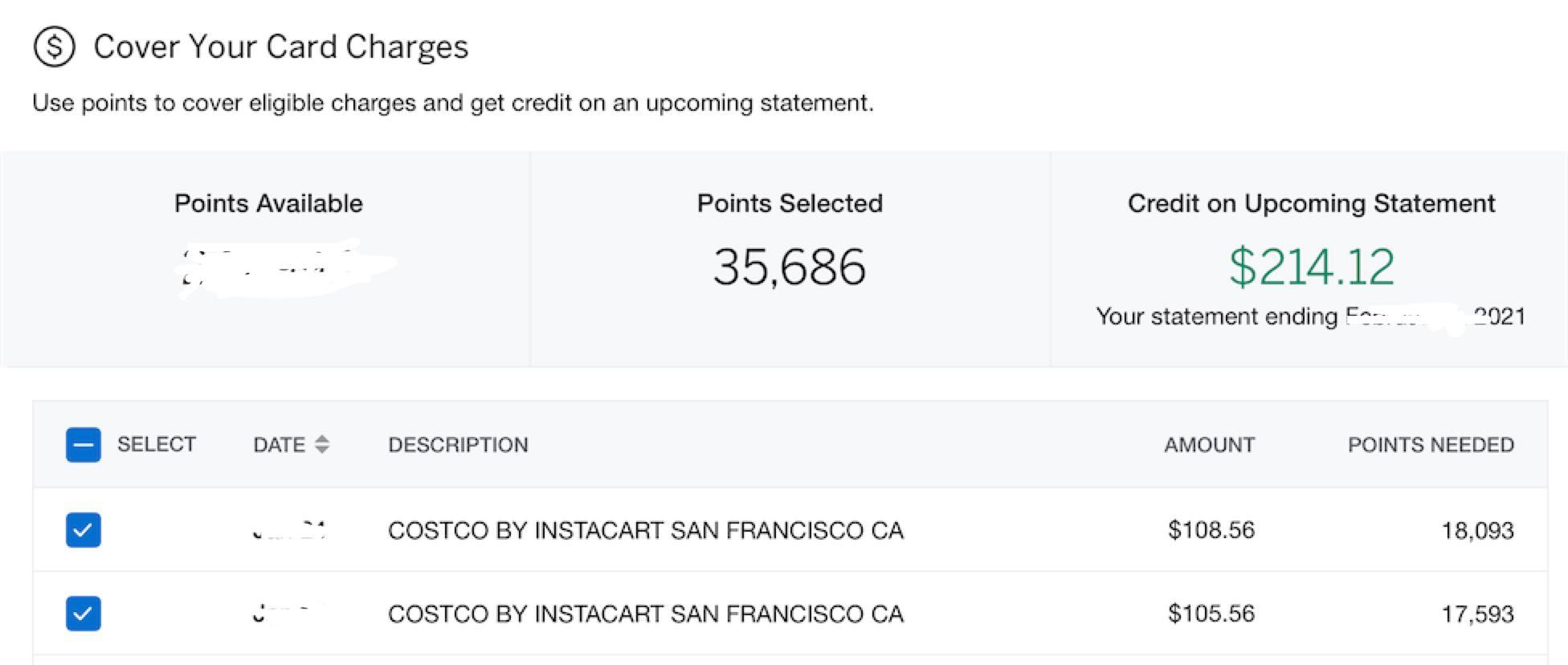

2. Cover your card charges (0.6 cpp)

Only slightly better than the previous option, this is when you use points to cover credit card charges and “wipe” amounts off your statement. Let’s take a look at an example where I can pay off two credit card charges totaling $214.12 for 35,686 MR points:

$214.12 / 35,686 = $0.006 per point

So while this can seem very enticing and easy to do, be aware that you are getting a fraction of the true value of these points.

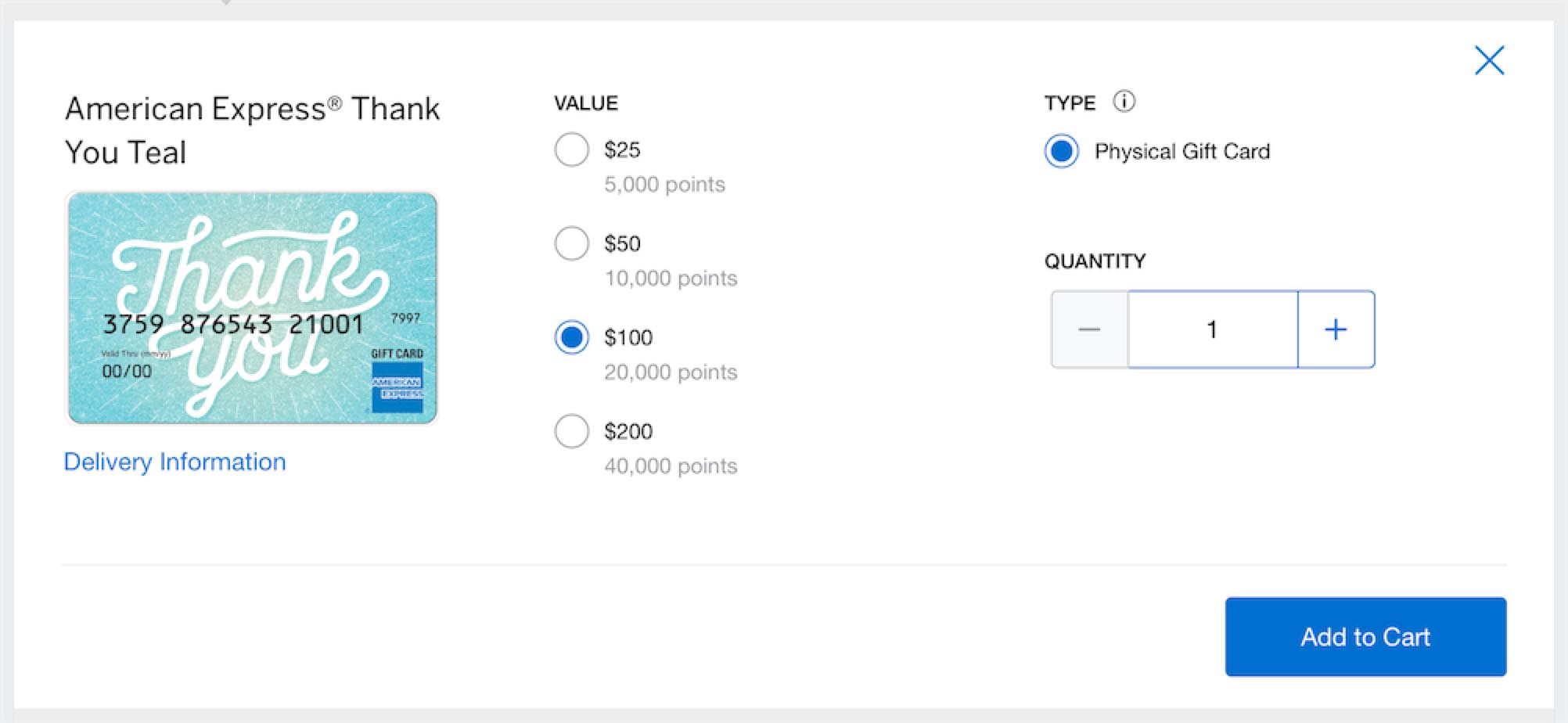

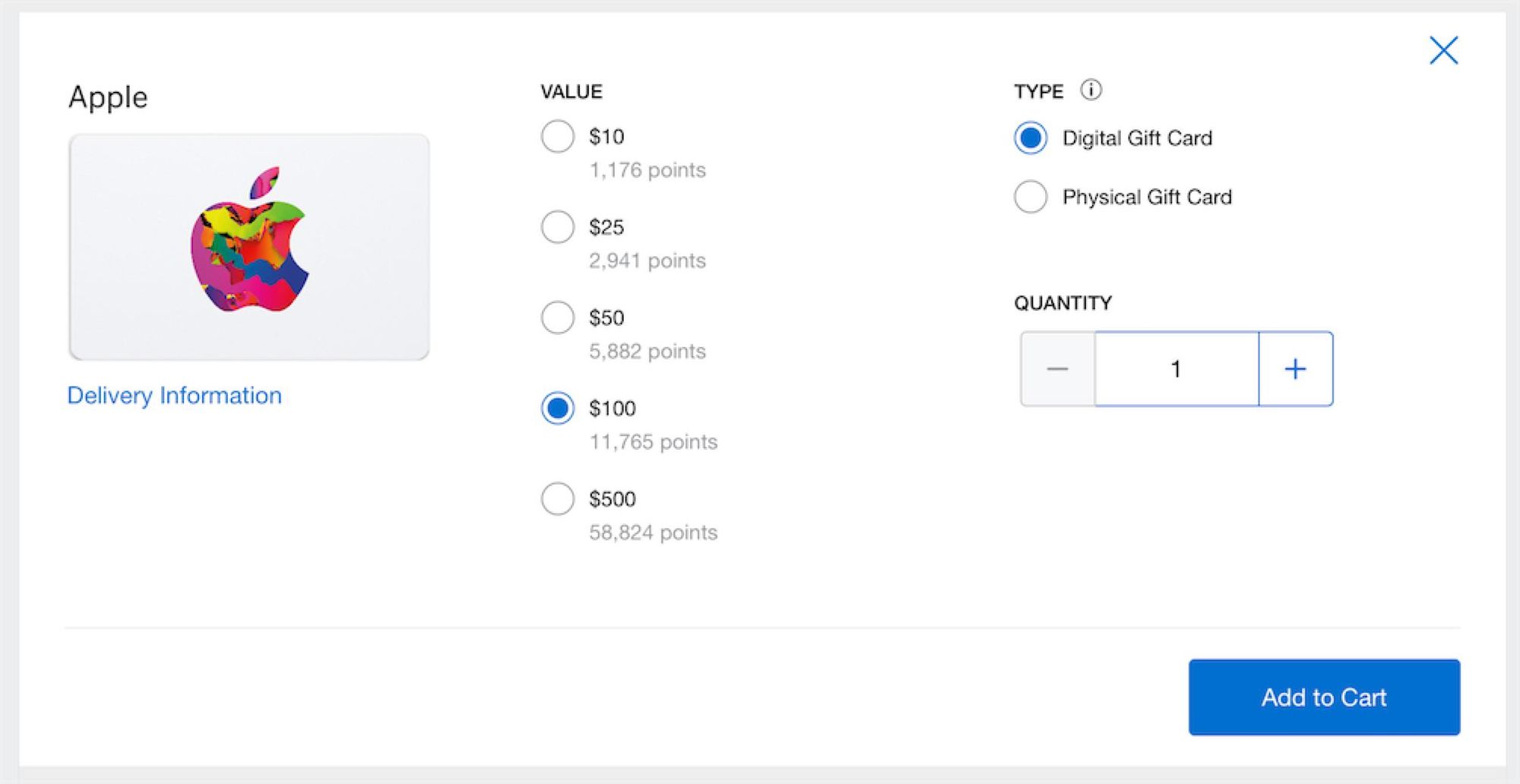

3. Gift Cards (0.5 cpp – 1 cpp)

Redeeming your points for gift cards is also generally not recommended, although the specific valuation depends on the retailer.

In the example below, an Amex gift card provides a value of 0.5cpp:

$100 / 20,000 = $0.005

However, redeeming for an Apple gift card can provide a much better (but still bad) value of 0.85cpp:

$100 / 11765 = $0.0085

By redeeming for gift cards, you also sacrifice the opportunity cost to cover your purchase with free warranty and protection mentioned earlier in this post.

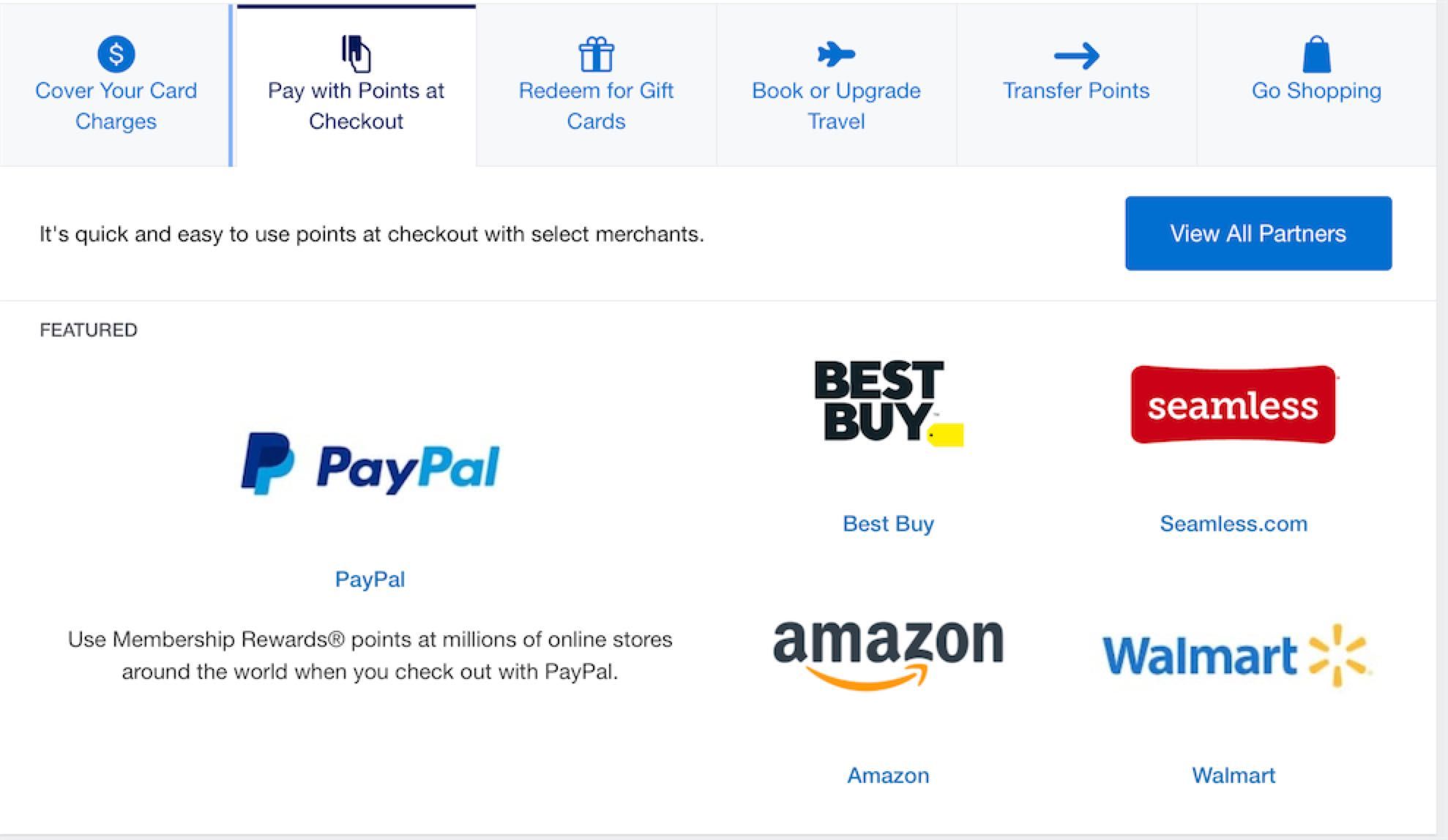

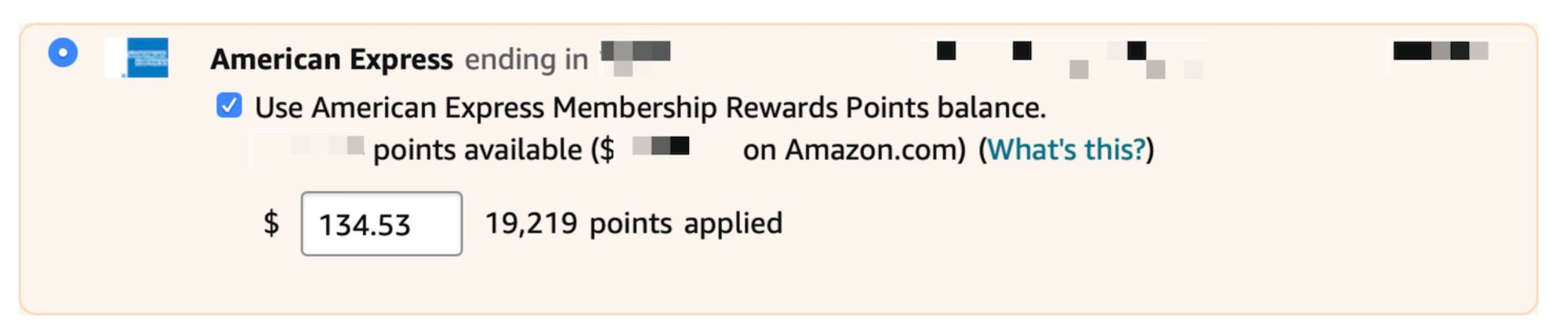

4. Pay with Points at Checkout (~0.7 cpp)

Amex partners with various companies like Amazon and Grubhub to allow point redemptions at checkout. However, these options to easily use your points also provide value far below their worth.

In the example below, I will need the following points to pay for the Amazon purchase:

$134.53 / 19,219 = $0.007 per point

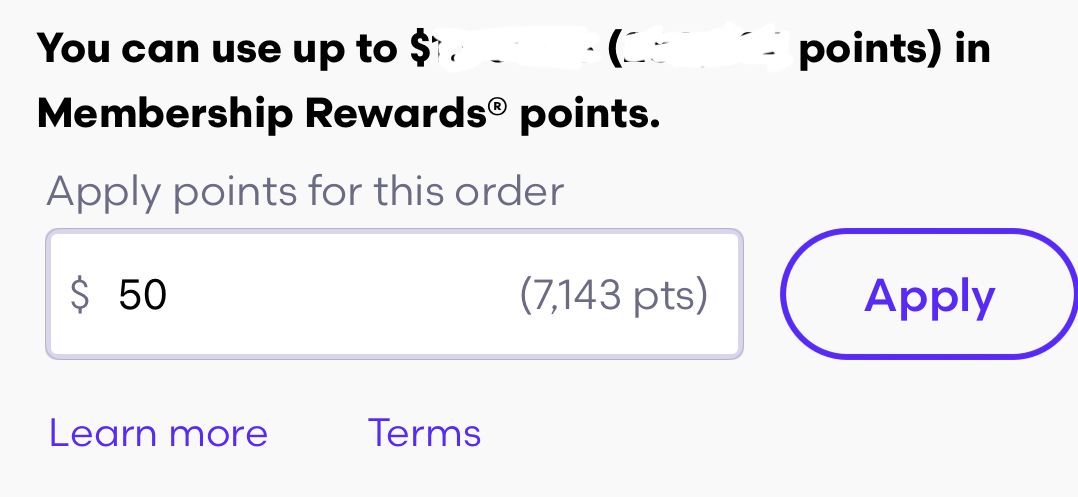

In another example, this time at Grubhub, I will need the following points amount to cover my $50 delivery:

$50 / 7,143 = $0.007 per point

Once again, not a great value. Do note that I have not verified the rate of every merchant, but these are not great redemption options in general. You should always check the math before deciding to redeem your points!

Summary

Amex MR points are best redeemed by transferring points to airline partners for aspirational trips. Avoid using points for paying off your card charges, redeeming for gift cards, or using it at shopping sites like Amazon.

I’ll end with providing an example of the value you would get from 100,000 MR points using the various redemption options discussed:

Travel Partner (2-8+ cpp): $2000 - $8000+

Cashback with Schwab (1.1 cpp): $1100

Travel Portal (1-2 cpp): $1000 - $2000

Go Shopping (0.5 cpp): $500

Cover Your Card Charges (0.6 cpp): $600

Gift Card (0.5 – 1.0 cpp): $500 - $1000

Pay with Points at Checkout (0.7 cpp): $700