Last Updated on March 19, 2024 by CreditFred

Usually when asked which card people should start with, I would reply with, “It depends”. However, the Chase Freedom Flex changed that and has become THE go-to card I recommend to friends & family. Read on to find out why!

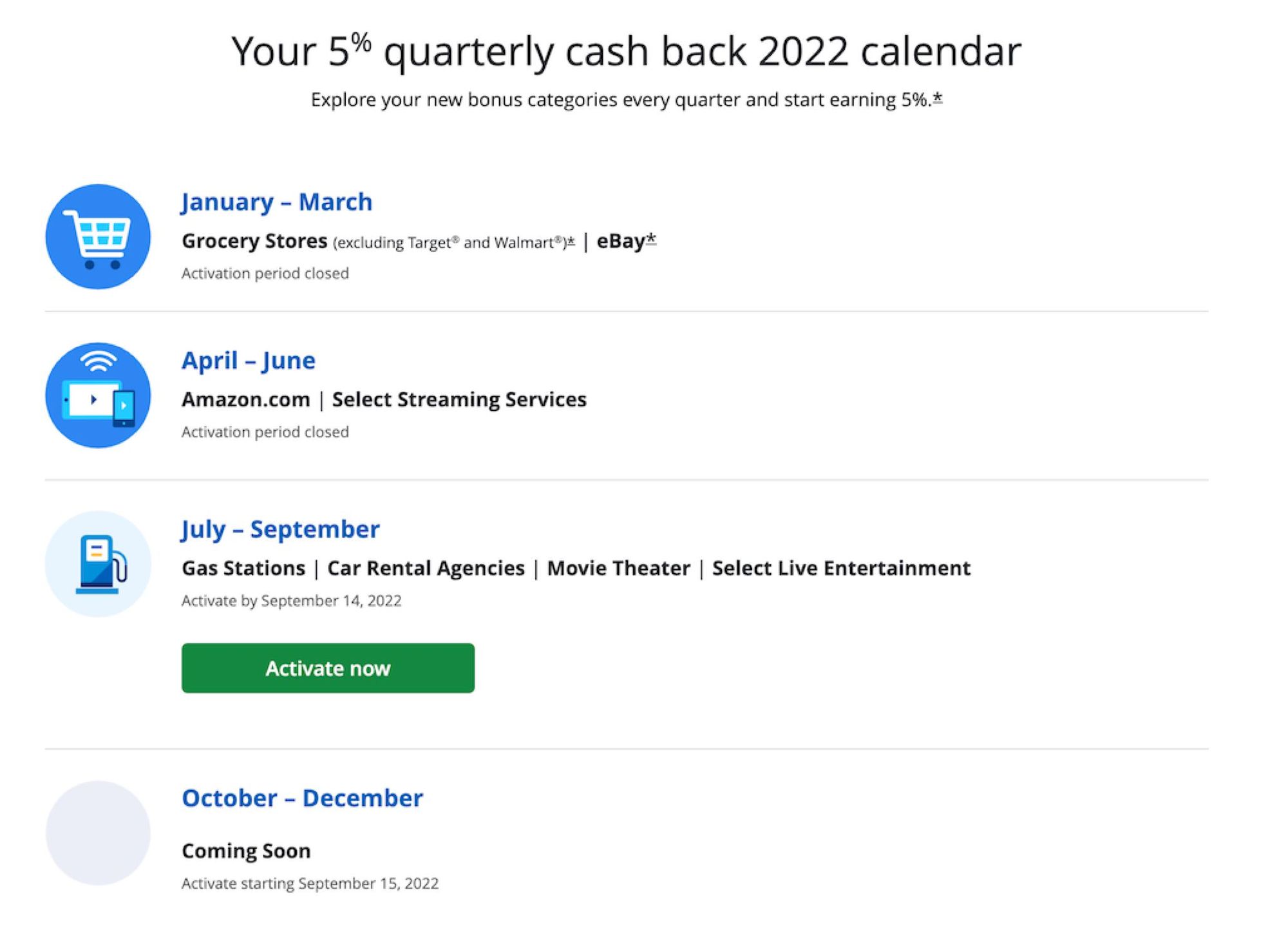

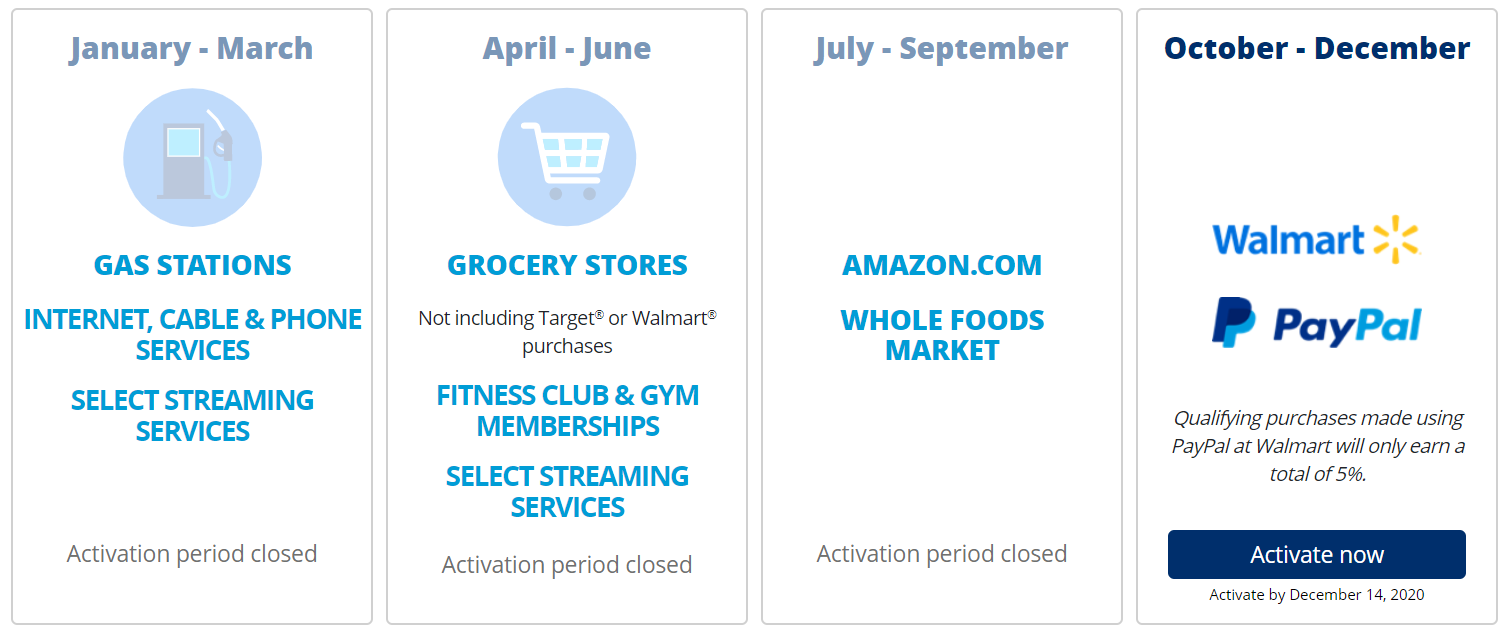

UPDATE: Reminder to activate quarterly 5% categories!

Apply Now: [referral link]

1. NO ANNUAL FEE

Need I say more?

2. 20,000 PTS SIGNUP BONUS

That is at least $200 if you cash it out right after spending $500 within the first 3 months. This is already an incredible 40% return-0n-spend!

If you eventually upgrade or apply for one of Chase’s premium cards such as the Chase Sapphire Reserve (review), it could be redeemed for at least $300 cash or potentially way more (think $1000-2000 worth!!!) if business class flights or 5-star hotels are what you are aiming for. Also, note that even if you already have the old (now discontinued) Chase Freedom or Freedom Unlimited (review) card, the Freedom Flex is considered a new product and you are eligible to earn this bonus.

3. INCREDIBLE EARNINGS

5% on Quarterly Rotating Categories

Categories change every quarter, and vary year-by-year. Some categories are definitely easier than others, but for a no annual fee card, it doesn’t hurt to hold it and use it when there are super useful categories, such as when you can earn 5x back when paying rent via PayPal Key (EXPIRED).

Other Bonus Categories:

9% on Gas (5% in the first year up to $6k spend + 4% Q3 rotating category)

5% on Lyft (until Mar 2025)

5% on Travel through Chase

3% on Dining

3% on Drugstores

4. AMAZING PROTECTION AND BENEFITS

- Zero Liability Protection – protects you from fraudulent charges

- Purchase Protection – covers many issues including theft, loss, and accidents

- Extended Warranty

- Car Rental Protection

- Trip Cancellation / Interruption Protection

- Cell Phone Protection

- … and many more

5. BEGINNER FRIENDLY

Points from all your Chase Ultimate Rewards cards (including the Sapphire Reserve, Sapphire Preferred, Freedom Unlimited, Freedom, etc.) can be combined together for redemption. You have simple options such as redeeming for cashback, Apple products, or booking travel through Chase. You also have more “advanced” options where you can transfer out your points to airline and hotel partners for crazy redemptions.

Additionally, you can even pool points with others in your household! Learn more here.

6. 5/24

Due to Chase’s infamous “5/24” rule where you will be denied for any new Chase cards if you have opened 5 or more credit cards across ANY BANK over the last 24 months, it is recommended that people start with Chase cards, then move on to other issuers later.

Many beginners may not find this a big deal, but you may be surprised how many people have quickly ramped up and realized they are now restricted by 5/24.

7. CHERRIES ON TOP

3 months of DashPass (DoorDash’s delivery subscription service, which usually costs $9.99/month) FREE, so you can save on delivery fees.

(NEW) 3 months of Instacart+. This works for existing customers too (and extends current subscription if you are already paying for one).