Last Updated on March 9, 2024 by CreditFred

With the announced demise of PayPal Key, where for over a year I have taken advantage of it’s great “virtual card” feature to pay rent with no fees while earning points on my monthly rent (it had been an amazing way to earn rewards and hit signup bonuses, with any card of my choice), I was in search for the next best alternative.

Just when I thought the fun was about to end – comes BILT Rewards – the credit card designed specifically for earning rewards on rent payments (and much more).

I’ve been using the card for a couple weeks now and have some thoughts. I also want to preface by saying that I’m mainly intrigued by the product due to the unique transfer partners (namely, Hyatt), and it may not be a good product for everyone. It is also very VERY young product, so things could change rapidly.

[referral] BILT Rewards Credit Card Application Link – feel free to use, the offer is same everywhere, but I will be rewarded with points when enough people use my link. Thank you for your support!

Overview

What is BILT Rewards?

BILT is a new rewards program for renters across the country. You can now pay rent virtually anywhere in the US and earn points without any fees. These points can be redeemed to fund your next vacation, fitness, class, home ownership and other rewards.

It also helps that the ex-Director of Travel Partnerships at The Points Guy and founder of Award Travel 101 Richard Kerr is currently the Director of Travel Rewards at BILT Rewards. Furthermore, The Points Guy (TPG) is also an investor and advisor to BILT, which explains why the reward program almost feels like it was designed for points enthusiasts (more on that later)!

Note that TPG is VERY commercial, so they are definitely not doing this out of “goodwill”, and I’m sure there is money to be made from this product. That being said, it could be a win-win as long as you know how to play the game.

About The Card

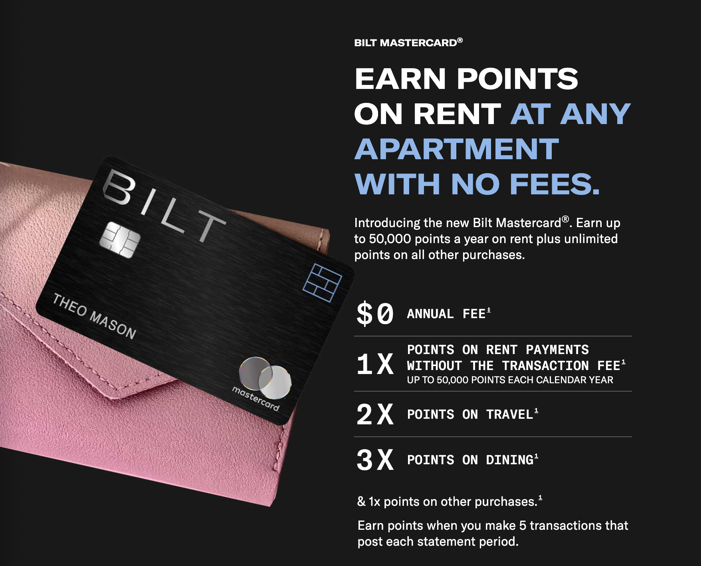

Annual Fee

$0 (there’s no annual fee!)

Signup Bonus

Unfortunately, not much. The offer I got was 2x on all non-bonus/rent spend for the first 30 days (pretty lame…). Some are reporting other offers such as 5x on first 5 days etc.

Point Earnings

3x – Dining*

2x – Select Travel**

1x – Rent Payments Without Transaction Fee (up to 55,000 100,000 pts/calendar year)

1x – Everything Else

Note that the card requires you to make 5 transactions that post each statement period. This means you have to remember to use your card 5 times each cycle to earn points. Given the solid bonus categories, this shouldn’t be too hard, but definitely something to keep in mind!

*What Counts As 3x “Dining”? (based on fine print):

Inclusions:

Eating places and restaurants, drinking places, bakeries or fast food restaurants

Exclusions:

Caterers, grocery stores, and other miscellaneous places that serve food or operate restaurants on their premises are not considered eating places and restaurants.

**What Counts As 2x “Travel”? (based on fine print):

Inclusions:

Airlines, hotels, motels, resorts, cruise lines, and car rental agencies.

Exclusions:

Bus lines, passenger railways/trains, taxicabs and limousines, rideshares, ferries, timeshares, travel agencies, online travel sites, real estate agents, vacation rental platforms (e.g. VRBO, Airbnb), campgrounds, boat lease/rental, motor home/recreational vehicle rental, toll bridges and highways, parking lots, and garages.

Note: I personally found the marketing language very sneaky, as it includes many common expenses that usually are considered travel such as Airbnb, transit, and rideshare. I’ve reached out to BILT regarding this hoping for more transparency, will update if I hear back.

How Rent Payments Work

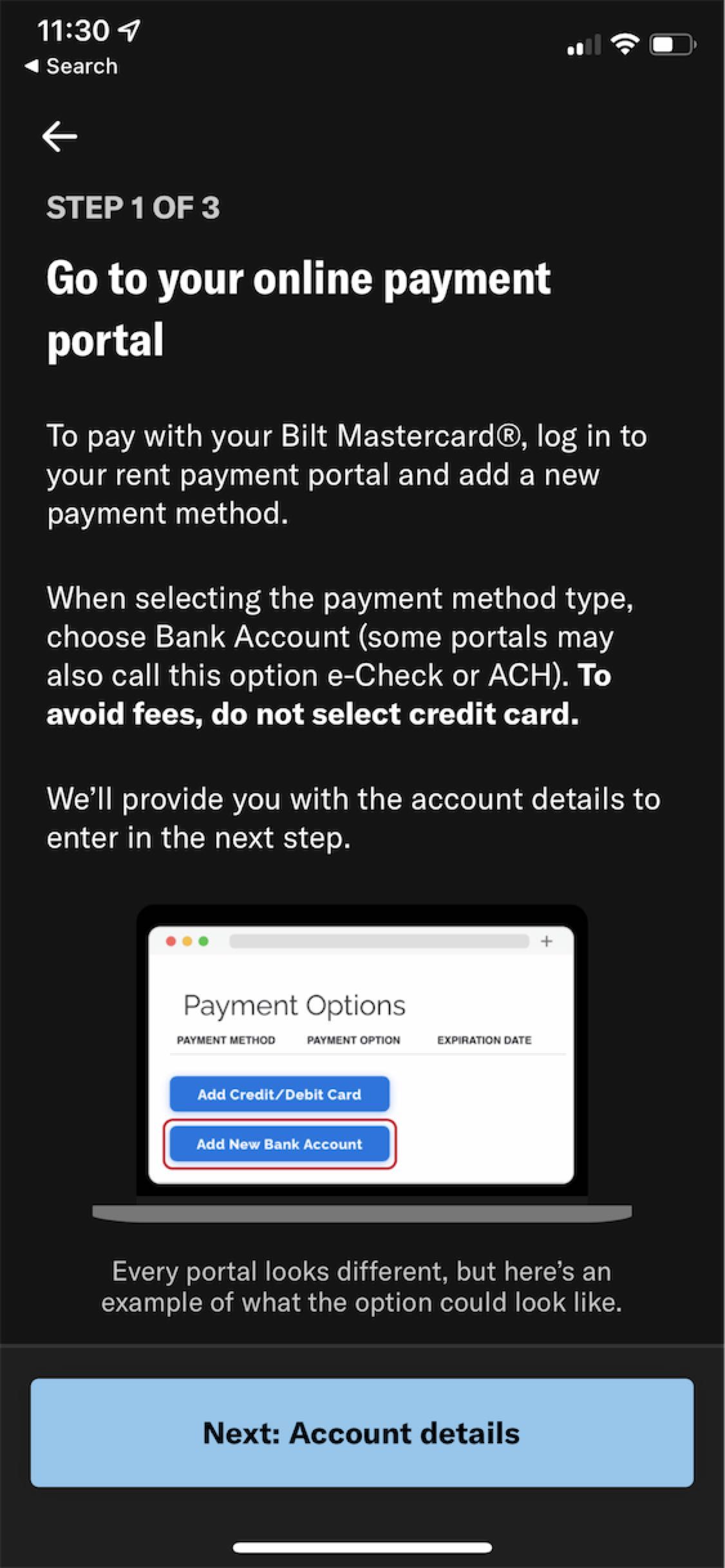

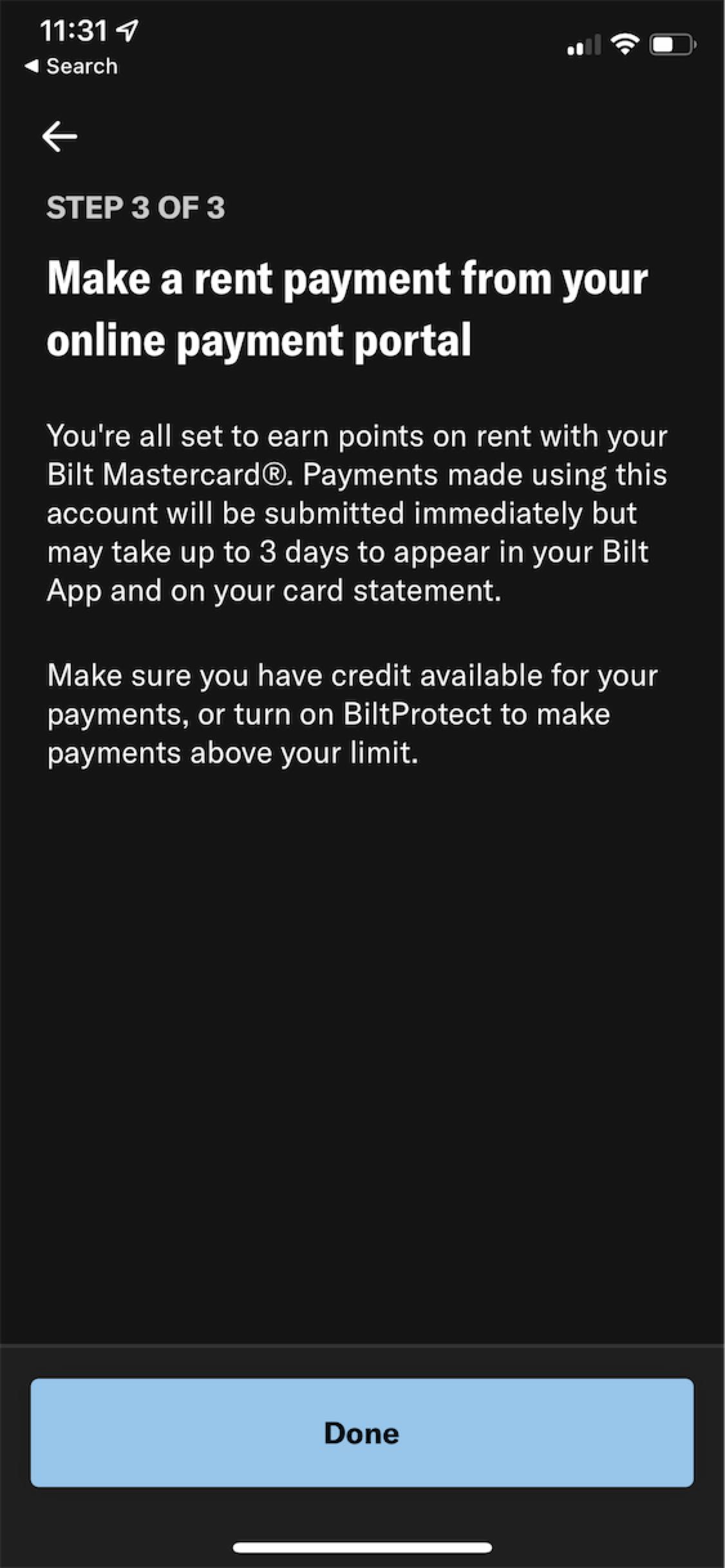

Set up is actually very easy. BILT should work seamlessly anywhere ACH payment (bank transfer) or checks are accepted. For my apartment building, this is how I set it up:

- Open BILT app, click “Pay Rent” tab and the setup instructions will prompt for your address

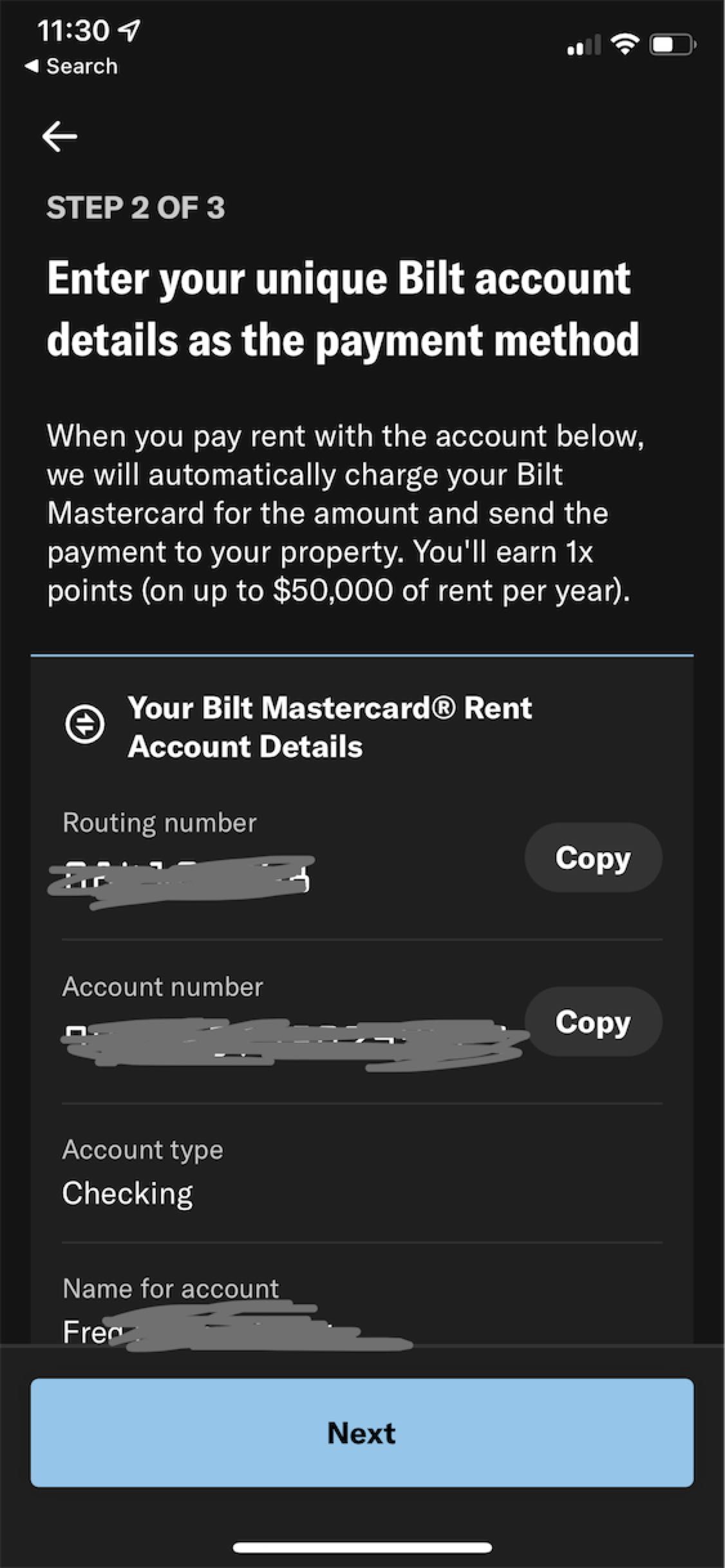

- Your ACH routing and account number will be generated. Enter these in your apartment’s rent payment portal (add as a new bank account)

- Pay your rent using ACH like normal, and the charge will go through to BILT with no fees!

BILT rent payments will work anywhere ACH or Check is accepted

Additionally, there is also a BiltProtect Debit feature, where BILT will let you pay rent without using your credit limit. When turned on, BILT will pull funds directly from a connected bank account, so you can still earn points without worries of high utilization or exceeding your credit limit.

There are also select partners in the BILT Rewards Alliance, where BILT is directly integrated with the apartment community. My apartment complex isn’t included, so I didn’t get to try this integration first-hand.

UPDATE 12/2022: According to a Reddit thread where BILT officially responded, it appears for property owners, HOA fees DO COUNT as “rent” so you can earn 1x on those spend without any fees! This is really promising as it makes the BILT card useful for both renters AND homeowners!

BILT Rewards Tiers

Every cardholder starts out at the “Blue” tier, and gradually move up based on total points accrued that year from purchases and/or points earned.

UPDATE (DEC 2022): BILT just had a major revamp to the elite program, details can be found here. In general, requirements are going up, but they are also adding many valuable benefits to make it potentially worthwhile.

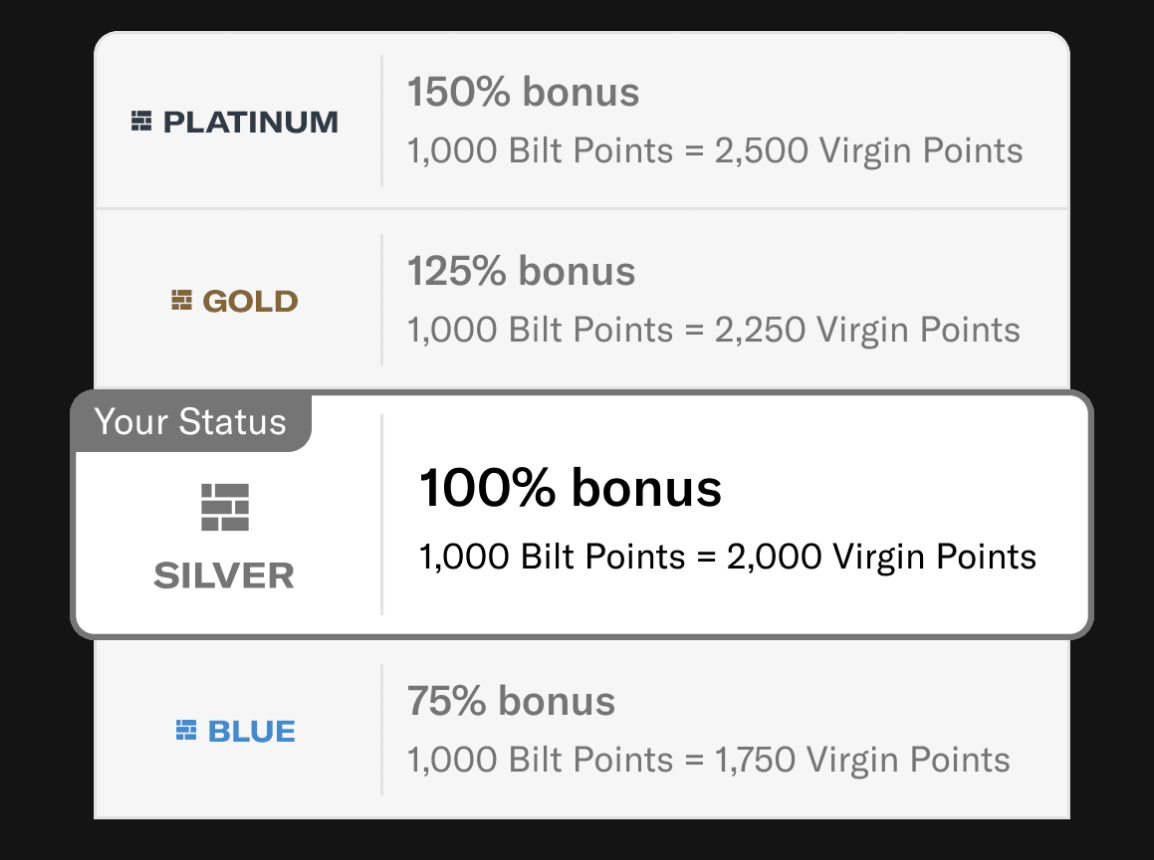

UPDATE (AUG 2023): For the first time ever, BILT status can now potentially improve your transfer bonus rate during special promotions. As part of August 2023 BILT Day promotion, those with Blue can get 75% transfer bonus, Silver with 100%, Gold with 125% and Platinum with 150%! I expect more benefits to come as the product continues to mature.

Perks & Benefits

As a World Elite Mastercard, BILT Rewards cardholders get access to a variety of pretty useful perks. Here are some I think many will find useful, full benefits and terms and conditions here:

- Cell phone protection – pay your monthly cell phone bill with the card and get up to $800 of protection (after $25 deductible) against covered damage or theft. This is really good coverage for a no annual fee card!

- Purchase protection – may be covered for damage or theft up to $10,000 per claim for items purchased within last 90 days.

- Trip cancellation & interruption protection – get up to $5000 in reimbursements if trip is cancelled or interrupted for a covered reason.

- Trip delay reimbursement – get reimbursed for expenses incurred when trip is delayed by more than 6 hours due to covered reason.

- Auto rental collision damage waiver – receive auto coverage for covered damages due to collision or theft for most rental cars (but be sure to check full terms and conditions).

- No foreign transaction fee – very nice for no annual fee card!

- Lyft credits – get $5/month after taking 3 rides in one calendar month.

- DoorDash – get 3-month DashPass membership for new members, and new/existing members get $5 off their first order each month.

Transfer Partners

UPDATE 3/2023: BILT has partnered with point.me to integrate award space search directly into the app. Check out full review here:

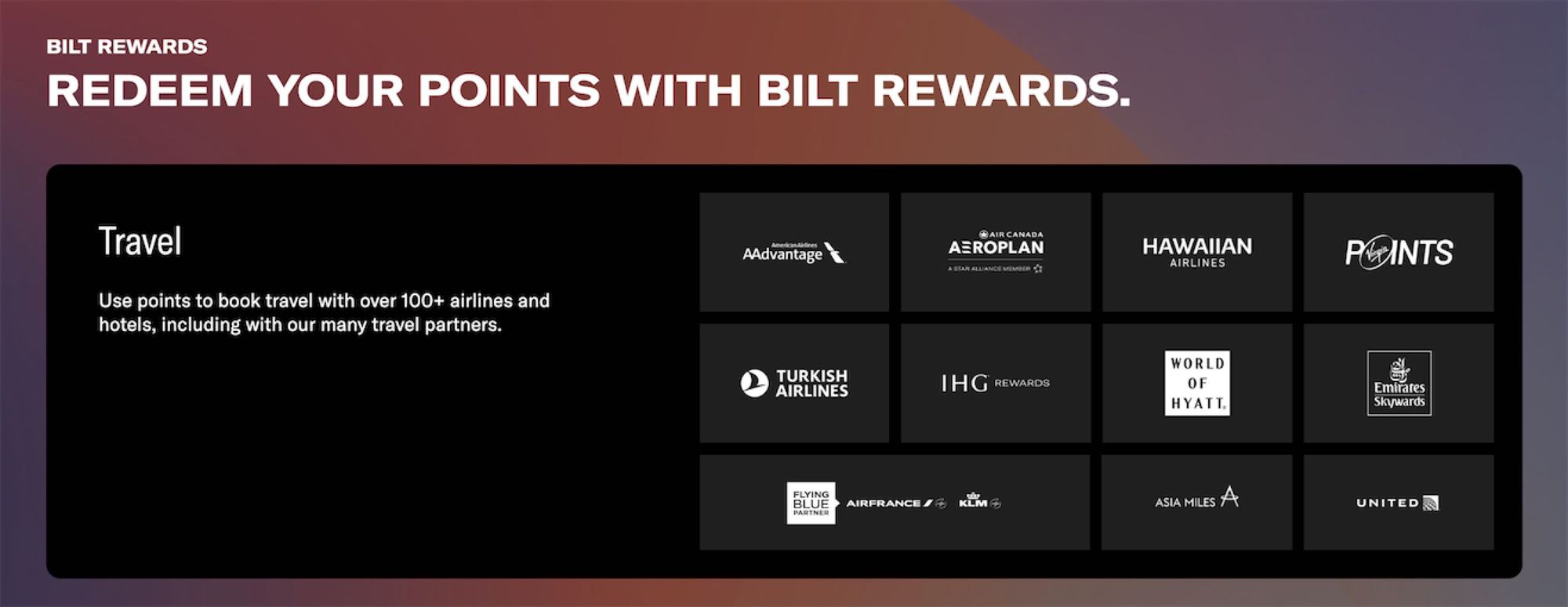

This is probably the highlight of the card, and what attracted me to apply despite no signup bonus. As the new kid on the block, BILT was able to line up some incredibly valuable transfer partners in the airline and hotel space. Notably, Hyatt and American Airlines are the ones I’m super excited about.

Airline Partners:

- ***American Airlines AAdvantage

- ***Air Canada Aeroplan

- United MileagePlus

- Emirates Skywards

- Flying Blue Partner (KLM & Air France)

- Hawaiian Airlines

- ***Turkish Airlines Miles & Smiles

- ***Virgin Points

- Asia Miles

- British Airways Avios

Hotel Partners

- ***Hyatt

- IHG

***my favorites

Some Examples

- 33,000 AAdvantage miles can get you a AA Flagship First class flight worth over $2400

- 15,000 Hyatt points can get you the Hyatt Centric Waikiki Beach in Hawaii worth almost $300/night

- 80,000 United MileagePlus miles can get you EVA Air Business Class flight to Asia worth over $4000

- 12,500 Turkish miles can get you a transcontinental United Polaris Business Class seat

Other Redemptions

BILT launched their own travel portal (very similar to Chase’s) where cardmembers can redeem for travel through the Expedia-powered search engine.

10,000 BILT points = $125 in travel

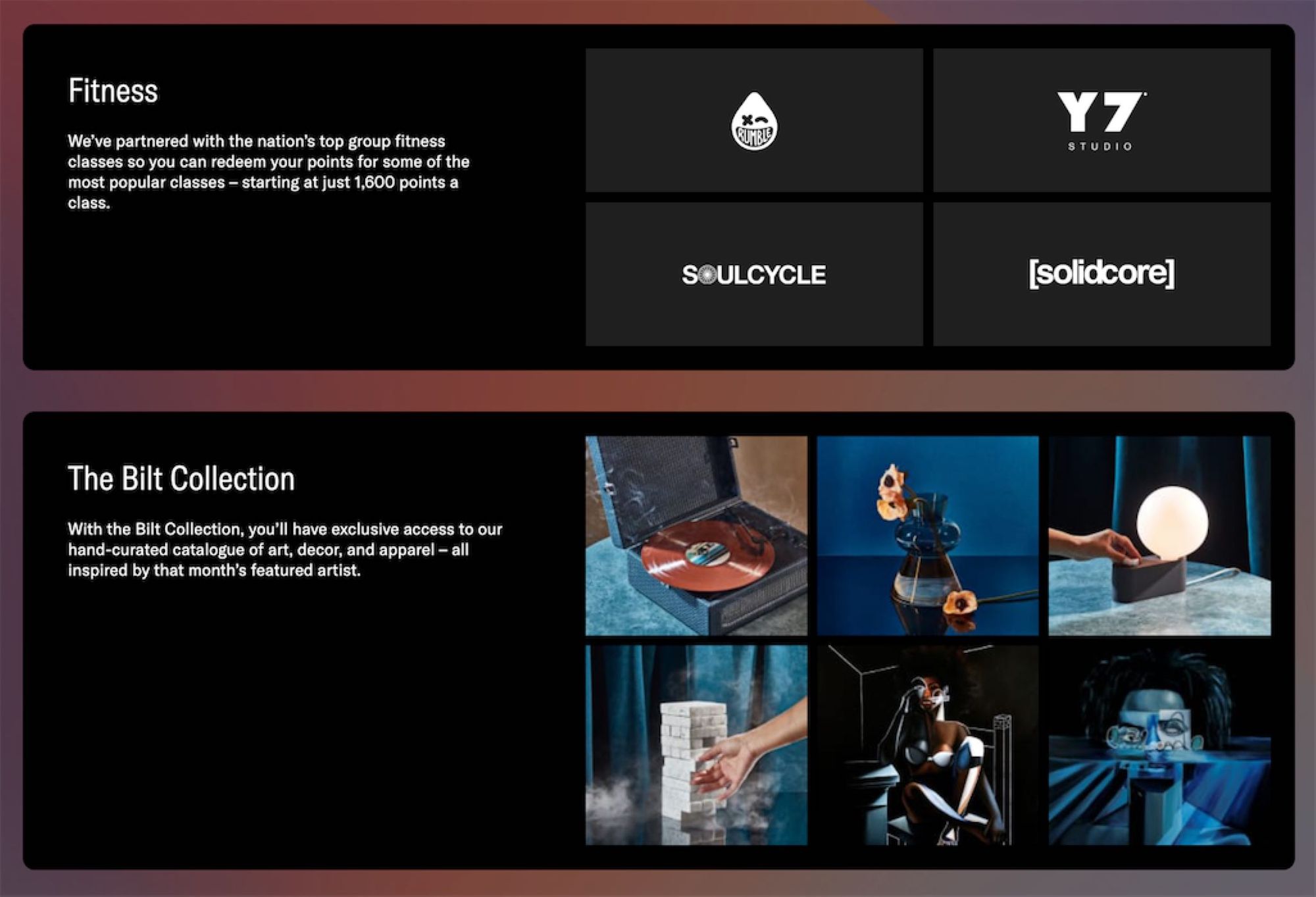

You can also redeem points for limited curated items, fitness classes, reduce your next month rent (bad deal) and even as your mortgage down-payment eventually. I don’t have much detail in this area yet, but will update when I have more info!

I personally find the airline and hotel (Hyatt) transfer partners much more valuable at this point, but understand that is not for everyone.

Application Process and Unboxing

I applied when it was still invite-only, and was instantly approved! The application was simple, fast and I was able to get my card number in the BILT app immediately! You can also add your card to your mobile wallet (e.g. Apple Pay) before even receiving the physical card.

Unfortunately, since BILT exited beta and become available for all consumers, they switched from the previous Coastal Community Bank to Wells Fargo to handle the credit approval process.

Based on data points I have been hearing, the switch to Wells Fargo often results in long approval times and a letter in the mail weeks later asking for “identity verification” via fax.Pretty ridiculous that in 2022 they are still asking people to fax anything. I’ve had my fair share of faxing stuff into archaic banks too in the past (especially with Chase), and have found free faxing services like FaxZero to be a lifesaver! Simply attach your document (PDF, JPG, etc.) and they’ll take care of the rest.

That said, I also have data point from reader who applied after the switch to Wells Fargo and was instantly approved! So your mileage can vary.

In my experience, the physical card arrived 3-5 business days after my application. The packaging is pretty cool, and omits the thick paperwork that usually comes with credit cards.

The card is also metal, and feels just as hefy as the Amex Platinum card. That being said, I think the logo and huge “BILT” text plastered on the front of the card is pretty ugly…

Potential Shortcomings

BILT is a very young company and this is their first (and only?) product. They have shown that they are able to adapt and move fast, and listen to user feedback. This can be good or bad, since what may work now may no longer work a few months down the line. If you want stability, I recommend going with Chase, but if you view BILT as a rapidly changing FinTech product, and set your expectations accordingly, you may still find this product pretty rewarding!

Here’s a few potential shortcomings I’ve found with the card so far:

- No signup bonus

- 5 transactions per cycle requirement: (UPDATE: they’ve added a tracker in the app! YAY!) To earn points, you will need to make 5 or more transactions (of any amount) per statement cycle. This is annoying but could be better if it is on a calendar month cycle instead, or better if the app can reflect the number of transactions you’ve made already this month.

- 5/24 slot: This card adds to Chase 5/24, so if you haven’t gotten your Chase cards yet, you may consider prioritizing those first.

- Limited customer support: I’ve tried their in-app chat and text messaging service, and they did get back to me in a few hours. It’s not the worst but compared to Amex where I can get instant support, this could be improved.

- ‘Travel’ bonus category exclusions: I found they excluded many items for travel, such as transit and rideshare, which make this card a lot less attractive as everyday travel card.

- Risk of devaluation: (UPDATE: The points seem to get even more valuable with really generous transfer bonuses and more partners!) Banks like Chase and Amex have built a reputation over the years, so you can somewhat trust that their currency systems will more or less retain its value. For BILT, it’s hard to say. It’s true they’ve lined up some amazing partners, but I would also be careful as these partnerships can end at any time and you don’t want to be left holding the bag. Overall, terms are subject to change and bigger banks are less likely to make any drastic changes in the short term that will heavily devalue their currency.

- (Potentially) Slow Approval Process – (UPDATE: Wells Fargo is almost instant for most people now!) I went through this before the wide release, therefore my card was issued via a smaller Coastal Community Bank and was able to get immediate approval upon applying. Since the mainstream release, BILT has switched to Wells Fargo for all new issuances, and I have many readers report to me that the approvals process is no longer as smooth. Based on data points I have collected, Wells Fargo has been slow to process new applicants, and in some instances request applicants to ** fax ** (!?!?) their income statements before a decision can be made. For a new “startup” like BILT to partner with such antiquated financial institution is pretty lame, and ruins the entire experience. Hopefully we can see this improved, but for now keep this potential hassle in mind when applying.

- Bad external bank UI / Limited web access: (UPDATE: BILT has really improved the App UI a lot, very happy with it now) Mine is issued via Coastal Community Bank, and I found the bank’s UI to be very limited and clunky. Additionally, BILT’s own web UI is very limited compared to app functionality.

- Young FinTech product: It is a very new product with rapidly evolving changes. If you want tried-and-true and hate changes, go with Chase or Amex.

UPDATE NOV 2022:

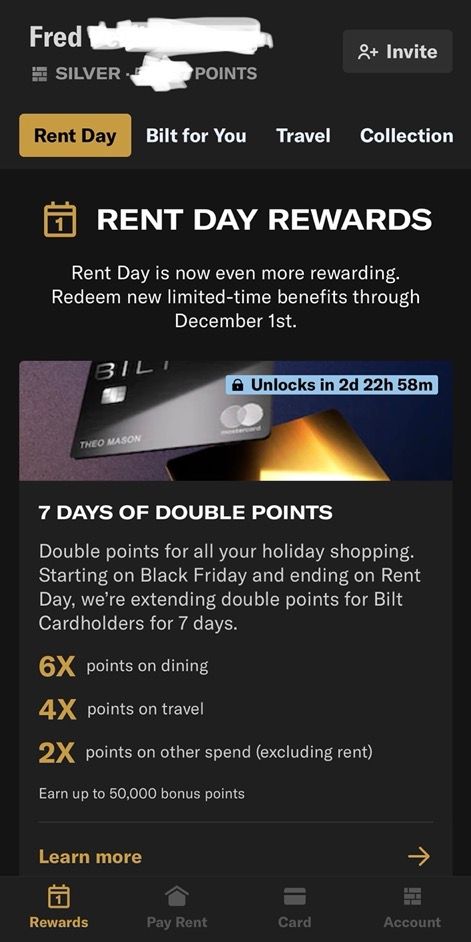

I’ve had a couple more months to use this card and I’ve got to say BILT has made dramatic improvements and rolled out some really really nice features to keep you engaged (and for you to earn more points)! Last month, they gave out free 90-day United Premier Gold status, and this month, you get a whole week where you earn double the reward you usually get (except rent), such as 6x on dining!

Additionally, they run monthly trivia (check the app and/or Instagram) where you get a chance to earn more bonus points (and even potentially get your rent paid)! They’ve also worked out their IT issues and I haven’t run in any other problems since.

UPDATE AUG 2023: Amazing! 100% transfer bonus from Bilt to Virgin Atlantic. This is INSANELY good. BILT just keeps upping their game!

UPDATE JAN 2024: They added additional bonuses. Now that I’ve reached Gold status, I was able to transfer to both Air Canada Aeroplan as well as Air France KLM for a staggering 125% bonus!

Conclusion

This is a very promising card, and can help many quickly rack up points on what is probably their single biggest spend category every month. For a no annual fee, the BILT rewards credit card has very solid Mastercard benefits, such as no foreign transaction fee and cell phone protection. Furthermore, the card has the ability to help renters rack up tens of thousands of points every year in an area where they probably currently don’t even earn any rewards. Finally, for those looking for aspirational travel, the amazing travel partners (e.g. Hyatt) will allow you to redeem these points for a free vacation in paradise! This is a card that I can easily recommend for most people!

That being said, if you are under 5/24, it may be more strategic to prioritize getting Chase cards first. Additionally, if you do not think you can make 5 transactions on this card every statement period, also avoid this card as it will essentially not earn you any points if you fail to meet the requirement.

Finally, know that this is a brand new product, and I am also just getting settled in on trying it out. Make sure it’s the right product for you and you know the risks before diving too deep. I know I’m here for the Hyatt and AAdvantage transfer partners, but just because it has value to me doesn’t mean it will be a good card for you. There has been lots of positive coverage, but also controversial ones like this post by BougieMiles. Things could change rapidly over the next few months (for better/worse), but so far things look promising and will update this post as I find out more!